Heres What We Could Have If We Slashed The Military Budget

The US military budget sucks up an enormous amount of resources without making the world more peaceful or democratic. Here are a few ways we could better spend that $717 billion.

Chairman of the Joint Chiefs of Staff Gen. Joseph Dunford speaks during a press briefing at the Pentagon August 28, 2018 in Arlington, Virginia. Zach Gibson / Getty

Our fall issue is out in print and online this month. and start reading today.

The Pentagon is set to receive $717 billion in 2019 more than half of the roughly trillion-dollar annual budget. That level of Pentagon funding is immense by any standard. Next years budget will be roughly twice the size of military appropriations in the mid-1990s, before George W. Bush and his twin wars in Iraq and Afghanistan. And it will be higher than the peak of Pentagon spending during the Vietnam War.

None of this is necessary. The Pentagon is the least accountable part of the federal government, wasting billions of dollars on needless bureaucracy, pouring billions more into dangerous nuclear weapons, and cozying up to contractors who siphon off roughly half of the Pentagons budget each year. Even worse, the never-ending US wars in Iraq and Afghanistan have made the world more dangerous, and American imperialism continues to undermine the autonomy of other nations and peoples.

Who Is Eligible For The Gi Bill Kicker

Each branch of service administers its own version of the kicker and has its own requirements. In general they may be similar but the details will vary depending on the branch of service, whether the applicant is Active Duty, Guard, or Reserve, etc.

The U.S. Navys requirements for the kicker are a good example of what you might expect regardless of branch of servicethe specific job titles and requirements will vary.

Heres a look at the Navys rules, which include a reminder that many recruits may technically be eligible to receive a kicker but there are budget constraints. Not all who qualify will be awarded the incentive. Consider the Navys GI Bill kicker program to be first-come, first-served for those who do meet the criteria:

- Qualify for training in a selected Navy rating as a non-prior service enlistee.

- Enter active duty on or after November 21, 1989.

- Agree to serve on active duty for an additional time

- Must be a high school graduate, no H.S. equivalency is accepted.

- Achieve an AFQT score of 50 or higher.

- Be 17-35 years old.

- Enroll in the MGIB Program and agree to pay the required $1,200 pay reduction.

- Receive an Honorable Character of Service. This does not include General Under Honorable Conditions.

Compare that with the Army National Guard requirements for the same benefit. For non-prior service enlistees:

I Sure Wish My Family Opened A 529 College Savings Plan For Me When I Was A Kid

When I graduated from college in 2010, I owed more than $60,000 in student loans, which took me the better part of a decade to repay.

These days, getting an education is even more expensive. According to the College Board, the average cost to attend an in-state public college including room and board for four years is more than $85,000. For a private college education, youre looking at an average of nearly $200,000.

I cant imagine how expensive college will be when todays little kids head off to pursue a higher education.

The good news is you can do something about it. But if you want to help your children pay for college, you should try to start saving sooner rather than later.

Lets take a look one of the great options for a college savings plan the 529.

Don’t Miss: Cheapest College In Chicago

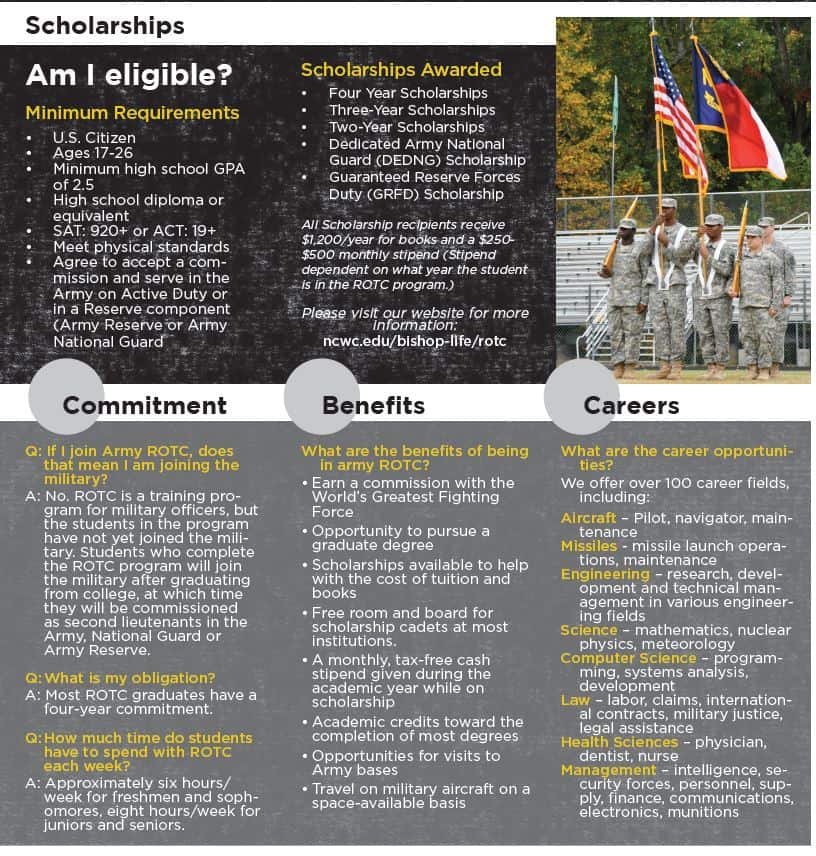

Earn Your Degree Through Rotc

If you are interested in joining the Army as an Officer and you do not already have a college degree, then the Reserve Officers’ Training Corps is for you.

ROTC is a scholarship program that allows you to complete all of the requirements of Army Officer training while attending college. In return for a service commitment after you graduate, the Army will pay for your college tuition, books, and other expenses.

ROTC programs are available at more than 1,100 colleges and universities across the United States. You can join the ROTC after graduating high school or at any point during your first two years of college.

Eligibility For The Post

To be eligible for the program, you must have served a total of at least 90 days on active duty, after 9/11. If you have a total of six months or more of post-9/11 active duty service, time does not have to be continuous. Active duty service, for the purpose of this new bill, doesn’t count active duty time spent in initial entry training , meaning time in basic training, initial job training, service academies, OCS/OTS, and ROTC.

Under the previous Montgomery GI Bill , officers who received their commission through a service academy or an ROTC scholarship were ineligible. There are no such restrictions under the Post-9/11 GI Bill program. Any officer who was previously ineligible will be eligible for this program, assuming they have at least 90 days of post-9/11 active duty service. Similarly, military members who previously declined the MGIB are eligible for the Post-9/11 GI Bill program.

Don’t Miss: Listen To College World Series Live

Apply For Scholarships From The Armed Forces Themselves

Each of the armed forces offers scholarships for children of parents who served their country. The goal of these scholarships is to help students who experienced the stress of growing up with a parent who was active in the military. From moving around to multiple bases to worrying about parents serving in the Middle East, children of military parents often have to grow up faster and take on more responsibilities than their parents would like. Each of the armed forces have scholarships to reward students for their dedication, along with their parents.

Each scholarship varies by military branch. The Air Force Society awards $2,000 grants for students, while the Marine Corps Scholarship Foundation divides more than $6 million among eligible students depending on need. Each organization has specific regulations for the students age, GPA, and monetary requirements. Most applicants will have to complete the FAFSA® to determine their benefits.

Gi Bill Kicker Basics

Each branch of military service has its own procedures, requirements, and guidelines for offering GI Bill Kickers and how they may be claimed. Some may not offer the program at all depending on current budget, legislation, and other issues. Others may offer it only to Guard/Reserve members. The availability of the kicker program will vary based on any number of variables.

The Kicker is not a program which can be used independently of the GI Bill. You must qualify for either the Montgomery GI Bill or the Post 9/11 GI Bill in order to use your kicker. If you were offered this benefit at enlistment time, you will need to provide the paperwork when you apply for your GI Bill benefits.

Recommended Reading: Colleges Still Accepting Applications For Fall 2020

College Level Examination Program

Through independent study, distance learning, and credit-by-examination programs, you can earn college credit without stepping into a classroom.

Exams administered by the College Board allow you to receive credit for job experience or completing military training. This allows you to test out of many college prerequisites and earn college credit for your transcripts.

How The Gi Bill Kicker Is Paid

For those using the Montgomery GI Bill, the kicker may be paid as a portion of your usual monthly payment, but under the Post 9/11 GI Bill program that may come as part of your monthly housing allowance.

The length of your payments is identical to your GI Bill deposits and is divided over the entire 36 month entitlement period for full-time attendees. Students attending part-time will have their monthly payment prorated but the total amount paid over the entire course of the program is the same.

You May Like: Is Ashworth College Real

Education Benefits Available To College Graduates

If you have already graduated from college and have outstanding student loan debt, there are programs that can help repay or cancel your loans. Additionally, you may qualify for financial scholarships offered to college graduates who wish to pursue a post-graduate degree in areas such as law and medicine.

Coast Guard Tuition Assistance

Coast Guard Tuition Assistance covers up to 100% of tuition and fees with the following limitations: $250 per semester credit hour or $166 per quarter hour. The maximum fiscal year benefit is $4,500. The TA covers tuition and lab fees. Active Duty, Selective Reserve and Civilian Employees are eligible.

Recommended Reading: Ashworth College Master’s Degree

Eligibility Requirements And Documents Required

Veterans who began active duty for the first time after June 30, 1985. Servicepersons who participate in chapter 30 pay $1,200 towards their chapter 30 benefit. The $1,200 is withheld from their pay during their first 12 months of service and it’s non-refundable.

- Entitlement: 36 months. May extend to end of term if benefit monies expire during term. Note: If there is a “kicker” this will not extend to end of term.

- Chapter 30 “Buy-up”: Servicepersons may pay up to $600 more towards Chapter 30. A maximum $600 contribution increases the full-time Chapter 30 benefit by $150/mo.

- Chapter 30 Kickers: A “kicker” is part of the enlistment contract. It’s often referred to as the Army College Fund, Navy Sea College Fund, or whatever the newest recruitment ad calls it.

Documentation Required

- Application for Benefits VA Form 22-1990

- Member – 4 copy of DD214.

- Have with you the Account No. and Routing No. of your bank or bring with you a voided check so that Direct Deposit can be set up at the time of application.

- If you made the additional $600 contribution to your VA education benefits prior to discharge, documentation needs to be provided – LES’s – Leave & Earning Statements, or a signed contract that contribution was made, or a reference on DD214 showing a total of $1,800 – was contributed to VA education benefits.

When Should I Start A College Fund For My Child

When it comes to saving for your childs college education, the sooner you start, the better. Not only does starting early give your college fund more time to grow, but it also can allow you to reap the benefits of compound interest.

Vanguard provides an excellent example of how compound interest makes an early start valuable. According to the financial services company, if you start saving for college when your child is born and invest $25 per week at 6% annual interest for the next nine years before stopping a total investment of $11,700 your fund will total about $26,750 when your childs ready to go to college at 18. But if you wait nine years before beginning to save, and all other factors remain the same, youll have a fund of only about $15,800 by the time your child is 18. The stark difference is due to compound interest.

You May Like: Brandon Charnas

Research Dependents Education Assistance Program

Along with the GI Bill, the Dependents Education Assistance Program offers 45 months of educational benefits for the children of certain veterans. This might come in the form of a technical school, certification, or apprenticeship. There are more limits to this type of funding, and it might not be approved for traditional two-year and four-year colleges.

The DEA Program also limits funding for the types of veterans whose children can apply. The grant is made to support children of permanently disabled veterans, deceased veterans, or soldiers who are currently MIA. These soldiers are unable to support their families through their military income or through civilian work, so the military provides education credits to help children further their job prospects.

Before your child applies for any of these grants, make sure they understand the limits of each option. If they accept a smaller grant from one organization, they may be disqualified from receiving a larger grant that could make paying for college easier. However, fully knowing their options can help them get the most grant funding possible to cover their education and help them graduate debt-free.

Earn Your College Degree Through The Green To Gold Program

The Green to Gold Program identifies enlisted Soldiers with leadership potential and helps them pay for college and earn the degree needed to become an Officer. Through ROTC, candidates will attend college or graduate school, complete Army Officer Commissioning requirements, and compete for Officer assignments.

You May Like: Sell My Old College Textbooks

Federal Perkins Loan Cancellation Program

If you have already been to college and you are currently serving on active duty, you may qualify for a cancellation of your student loans.

The Federal Perkins Loan Cancellation Program gives Soldiers who have served in combat situations the chance to cancel up to 100 percent of their Federal Perkins Loans or National Direct Student Loans. This benefit does not apply to Stafford loans or PLUS loans.

Active-duty Soldiers in hostile fire or imminent danger pay areas for at least one year are eligible for cancellation of their Federal Perkins Loan Program student loans.

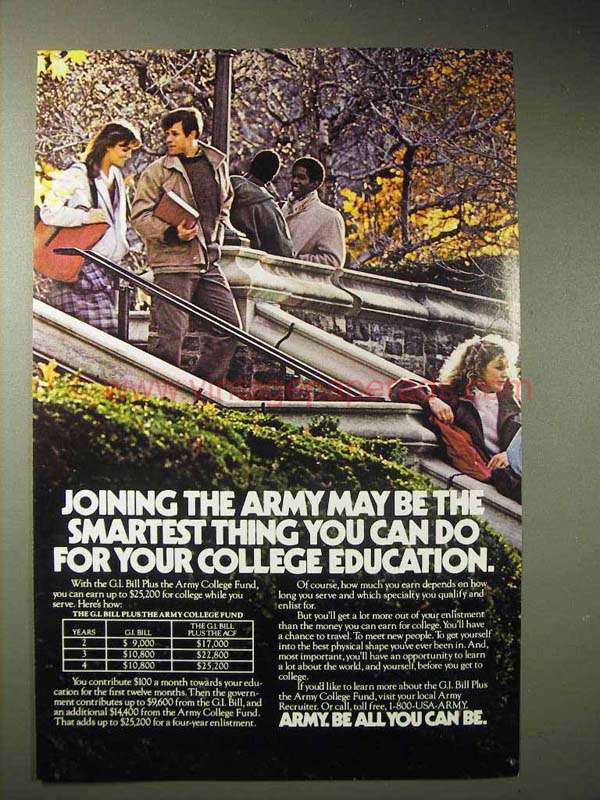

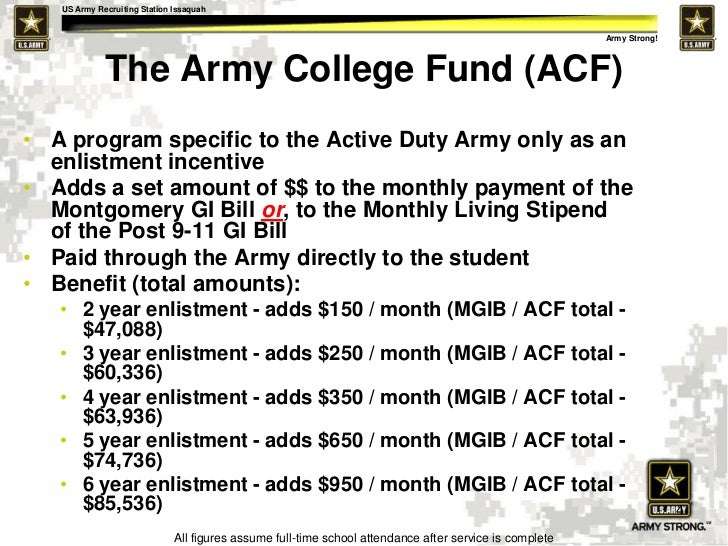

The Army College Fund

The Army College Fund is an enlistment incentive option designed to aid in the recruitment of highly qualified Soldiers for critical or shortage Military Occupational Specialties . The ACF supplements the basic Montgomery GI Bill entitlement.

To receive specific eligibility requirements, application deadlines, criteria, and further details, please visit the provider’s website.Below are some of some of the categories: Regular Army: Active DutyRegular Army: RetiredArmy National Guard: Federal Active DutyArmy National Guard: State Active DutyArmy National Guard: DrillingArmy National Guard: RetiredArmy Reserve: Active DutyArmy Reserve: DrillingArmy Reserve: Retired

Don’t Miss: Is Fsaid.ed.gov Legit

Guaranteed First Duty Assignment

The Army and the Navy are the only active duty services which can offer a guaranteed first duty assignment. However, since the invasion of Iraq, the Army rarely offers this incentive anymore. When authorized, under the Army Program, you can get a written guarantee in your enlistment contract for your first duty assignment following basic training and job training . This option is only available for certain, hard-to-fill Army Jobs. Additionally, the guarantee is only good for 12 months. After that, the Army can move you anywhere it wants.

The Navy program is a “sort of” guaranteed first duty station. Under the Navy program, you can be guaranteed a first assignment in a designated geographical area. In other words, while the Navy can’t guarantee that you would be assigned to a particular base, they can, for example, guarantee an assignment on the West Coast. However, under the Navy program, there is a catch — the program is not available to those who sign up with a guaranteed rating . It’s only available for those who enlist under the GENDET program. Under the GENDET enlistment program, applicants pick a “general field,” such as “aviation,” rather than a specific rating. Then, following basic training, they spend a year or so at a Navy Base, doing general duties as an “undesignated seaman” before they get to choose their rating and go to job-school.

Are There Any Contribution Limits Or Income Limits

Regardless of how much money you make, the federal government doesnt place any income restrictions on who can open a 529 college savings plan.

Theres also no defined contribution limit. Just keep in mind that if you invest more than your child needs to pay for qualified education expenses, your child might have to pay income taxes on any withdrawals that arent used to pay for college.

Don’t Miss: College Hill Season 3

Army Green To Gold: Scholarship Option

This Green to Gold Option provides financial aid for enlisted soldiers on active duty who want to finish their education and become officers after graduating. There are two-, three-, and four-year scholarships available, depending on how much undergraduate education the soldier has already completed. Those accepted to master’s degree programs may be eligible for two-year scholarships. Upon acceptance into the program, soldiers leave active duty and enroll as ROTC cadets. Following graduation, soldiers commission as a second lieutenants and serve on active duty, in the Reserve or in the National Guard.

- Eligibility: Applicants must be U.S. citizens in good standing who will be under 31 years of age at the time of commissioning and who have no more than three dependents. Applicants must have completed two years of active duty or received a waiver approved by Human Resources Command in Fort Knox, but they cannot have served more than 10 years on active duty. Applicants must attend an institution that offers an Army ROTC program.

- Four-year scholarship recipients must have a high school GPA of at least 2.5 and have a minimum SAT score of 920 or ACT score of 19. For the 20182019 school year and those that follow, the minimum SAT score accepted is 1000.

- Two- and three-year scholarship recipients must have a cumulative GPA of at least 2.5 on all previously completed college work.

The Navy Marine And Army Corps Funds For College

GI Bill Kicker is prominently referred to as the Navy, Army or Marine Corps College Funds, and is presented via the service branch of the DoD as a part of the reenlistment or the enlistment contract and for various other reasons.

The Corps College Fund refers to a supplementary amount of monetary benefit that raises the basic benefit received per month by an individual and this is covered in the GI Bill disbursement which is released by VA. The service branch has the provisions to determine which individual receives the funds and the sum received by them. To ensure the accuracy of the funds being offered under the College Fund scheme, it is vital for the individual to submit a copy of the bill to VA.

These added benefits can boost the GI Bill disbursement amount to $950 per month. This implies that the benefit value of GI Bill can actually receive a significant boost. The amount received by a person is dependent on several factors which include the service joined, the location of service, the job chosen, enlistment date and the tenure of the enlistment contract.

Recommended Reading: Umaine Book Buyback