Religious And Military Schools

A number of schools also offer free tuition, room, and board in exchange for service, such as Christian and military colleges. If one of these schools offers the kind of program youre looking for and you meet the sometimes highly selective admissions criteria you can graduate debt-free with solid preparation for your future career.

How Much Do In

On average, in-state students at public four-year institutions paid just $3,870 in tuition and fees during the 2019-20 academic year, compared with $14,380 at four-year, private nonprofit universities. This cost, known as average net price, reflects the actual cost of tuition after scholarships, grants, and tax benefits have been taken into consideration.

Financial aid can reduce out-of-pocket costs to attend most universities. A full-time student at a public four-year institution received an average of $6,570 in grant aid and tax benefits during the 2019-20 school year. Grant aid includes federal programs like Pell Grants and veterans benefits, as well as state and institutional grants and scholarships.

Cost Of Language School In Canada

Language schools often provide courses based on a certain number of weeks, rather than a semester approach to study. The cost of tuition at Canadian language schools is established by each school.

Here is some sample costing for language schools in some of Canadas key metropolitan areas :

- Toronto: 12-week English language school = CAD 3,515

- Quebec City: 12-week French language school = CAD 3,570

- Vancouver: 12-week English language school = CAD 4,083

- Calgary: 12-week French language school = CAD 3,446

Recommended Reading: College Book Price

Read Also: What College Has The Best Doctor Program

Private College Tuition Vs Public College Tuition

Private vs. public college timeless war that even Hollywood movies seem to get tangled in nonetheless, whatever your position may be, one thing that is common for both is the increase in the colleges fees and tuition.

The prices of colleges, be they private or public continue to increase. Statistics provided by Education Data, show that on average the private college tuitions are over three times more expensive than the public college tuitions: in 2018/2019, on average private college students had to pay around $35,830 in tuition compared to public college students who paid $10,230.

What Does A Year Of College Really Cost

The average net price of attending college for a year ranges from $14,560 to $33,220, depending on … the type of school.

getty

What does it really cost to go to college? That simple question often defies an easy answer and generates a lot of anxiety because of inconsistencies and confusion in the way college prices are presented to the public. And in some cases, the confusion – or alarm – is stirred by pundits who cite only the sticker price of college even though they know thats a price that the majority of students do not actually pay.

Now, with the release of the College Boards Trends in College Pricing and Student Aid 2020, students and families have a source they can use to determine the average annual costs of attending a two-year college, a four-year public university, or a private, not-for-profit four year institution. Of course, the figures are only averages, sure to vary from college to college, and they suffer the inevitable limitations when national data bases are combined, but they still provide important benchmarks for comparison purposes.

Heres a summary of net costs of attendance for three sectors of higher education.

Public Two-Year Colleges

In 2020-21, the average annual net cost for first-time, full-time, in-district undergraduates at a public two-year college was $14,560, $20 less than the average in 2019-20.

Don’t Miss: College In Terre Haute Indiana

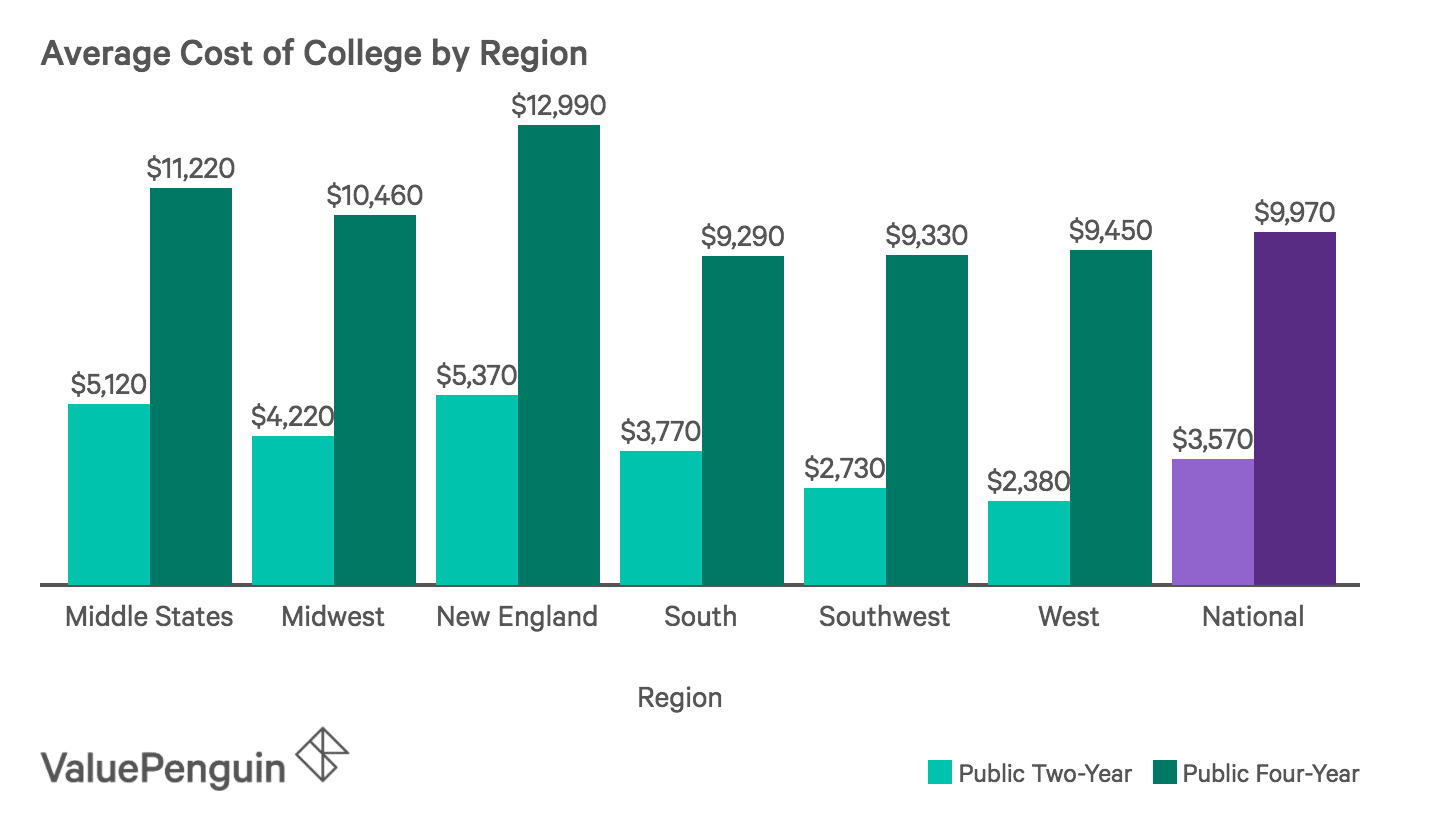

Average Cost Of College By Region

The average tuition cost in each region for two-year and four-year schools in the United States varied minimally. However, New England had both the highest in-district and in-state average tuition costs, not including room and board, for both two-year and four-year public colleges. In contrast, the South had the lowest public four-year tuition at $9,290, while the West had the lowest average tuition for public two-year schools at $2,380.

According to data from the College Board, western states had the highest public two-year and four-year tuition increase over 10 years, increasing 62% and 60%, respectively. Meanwhile, public two-year and four-year colleges in the Midwest only increased by 22% and 21% within the past 10 years. Keep in mind that the West is home to some of the top public schools in the country, namely the University of California system.

Cost Of University In Canada

What could be better than earning a university degree in a beautiful country? Finding a reputable program that you can afford. Many quality universities are found in Canadas smaller cities and towns where the cost of living is lower. At times, Canadas larger cities are more affordable than many cities around the world.

Try our search tool to find your university program and calculate what it will cost you:

You can also compare different schools and cities. Youll see that the costs can vary from city to city and province to province, both for your tuition fees and living expenses. So, if youre on a budget, we recommend searching a wide range of options to find the right university and community for you.

To give you an idea of the costs, we tested our search tool on a number of bachelors degree options across Canada. We found that tuition can range from CAD 1,800 per year to approximately CAD 20,000 per year for an undergraduate degree. The tool will also give you the estimated costs for books and supplies.

Similarly, the cost of accommodation, food and local transportation varies from city to city. Our search tool will give you a good idea of the cost you once you choose your school, however, we found that living expenses for one year averaged around CAD 12,000.

Don’t Miss: Does Trade School Count As College

Tax Deductions And Tax Credits For Students

There are many tax deductions and tax credits available for students. What youre eligible for depends on if youre a part-time or full-time student. Make sure to file your return on time each year to avoid penalties.

A tax deduction reduces your taxable income for the year. For example, as a student you may be eligible for tax deductions for moving expenses and child care expenses, as well as other tax deductions.

A non-refundable tax credit reduces the amount of tax you owe. You may be eligible for non-refundable tax credits for costs that include:

- tuition fees

- public transit

- interest paid on your student loans

Taking advantage of these tax credits and deductions will have a big impact your annual tax return.

Cost Of Graduate Studies In Canada

Your graduate studies are a smart career investment. Canadas masters and PhD programs are recognized around the globe, and our relatively lower cost of living makes the opportunity even more appealing to international students like you. Even Canadas larger cities are more affordable than many cities around the world.

Graduate tuition fees in Canada can vary depending on the program and location you choose. Try our search tool to find your graduate studies program and calculate what it will cost you:

To give you an idea of the costs, we tested our search tool on a number of masters and PhD programs across Canada. We found that tuition can range from CAD 2,500 per year to approximately CAD 18,000 per year for a masters degree program. A PhD might run you approximately CAD 2,500 to CAD 17,000 per year. Be sure to compare programs from different provinces and schools if you are on a budget. The tool will also give you the estimated costs for books and supplies.

The cost of accommodation, food and local transportation varies from city to city. Our search tool will give you a good idea of the cost you once you choose your school, however, we found that living expenses for one year averaged around CAD 12,000.

Recommended Reading: What Colleges Should I Look At

An Investment In Perspective

While public universities continue to provide the most affordable path to a quality higher education and the associated benefits, steep cuts in state funding have pressured public institutions to increase tuition in order to make up some of the loses in state funding. Graduates begin reaping those benefits soon after completing their degrees and they continue to accrue over their lifetime. In fact, median lifetime earnings of bachelors degree recipients are 65 percent higher than those with only a high school diploma.

While public universities continue to provide the most affordable way to receive a quality higher education to help realize these benefits, steep cuts in state funding have pressured public institutions to make up some of their lost funding through tuition increases in recent years. During the six year period of 200607 to 201213, after adjusting for inflation, four-year public universities experienced state funding cuts of $2,370 per student, while tuition and fee revenues increased by only $1,940a net loss of $430 per full-time student.

What Do I Do If I Dont Qualify For Student Aid

Perhaps you dont qualify for student aid but you still think that you would benefit from financial assistance while youre in school, or maybe youve already maxed-out your other student aid options but still have financial needs to be met. If this is the case, you can look into applying for a student line of credit or a personal loan from private institutions, such as your bank or a credit union.

These options can help pay for just about anything from school supplies and tuition to living expenses, which could end up costing more than expected. The amount of money you borrow depends on course load and level of study, and there is typically a cap on the maximum amount that you can receive.

For a student line of credit, you are given a pre-set credit limit, and you only have to pay back what you borrow, plus interest on the amount received. Interest rates on a student line of credit are lower than those offered on Canada student loans, but remember that with a line of credit, youre required to start paying interest as soon as you withdraw any money.

With personal loans, youre required to pay back the full amount, interest and any applicable fees over a specified period of time.

Remember, the most important thing about student aid is to apply. There are plenty of optionsyou have nothing to lose by applying and seeing what you can get, but theres so much to gain.

Also Check: How Many Majors Are There In College

Also Check: How Much Does It Cost To Go To Berkeley College

What Is The Average Cost Of A Bachelors Degree

The average cost of a bachelors degree yearly in 2019-2020 is in total $30,500. However, this price can vary depending on the type of college, whether it is private or public, furthermore, if public whether it is in-state or out-of-state and finally it varies from college to college. The average cost for a bachelors degree from the public in-state institution is $21,950, while from public out-of-state institutions his price is $38,330. For a private non-profit, it is $49,879.

The most affordable bachelors degree is from The Great Basin College, which is one of the most popular colleges for online degrees, with tuition costing only $3,128.

On the other hand, the most expensive bachelors degree is from Franklin and Marshall College a private liberal arts college in Lancaster Pennsylvania with an annual tuition fee of $58,615.

How Can I Cover Expenses

If you dont qualify for enough federal and institutional aid to cover the cost, you might want to consider these options to help pick up the slack:

- Private grants. If you attend a school that cant meet 100% of your financial need, you might qualify for a grant from an institution outside of your school.

- Private scholarships. Students with good grades or special talents might qualify for merit-based scholarships from outside organizations.

- Interest-free loans. Some private organizations offer loans that dont come with interest though usually in smaller amounts than traditional student loans.

- Private student loans. After exhausting all of your federal and free financial aid options, consider applying for a loan from a private lender to cover the rest of your expenses.

You might want to start your search for extra funds with your schools financial aid office. They can likely tell you the scholarships and grants for which you might be a good candidate.

Recommended Reading: College Terre Haute

Average Cost Of College Statistics And Key Findings

- Average Total Cost of Public Colleges: $25,290 $40,940

- Average Total Cost of Private Colleges: $50,900

- More than 19.9 million students are projected to attend American colleges and universities in fall 2018, with around 6.7 million going to two-year institutions and 13.3 million going to four-year institutions.

- The majority of students pay between $6,000 and $15,000 in tuition for both public and private schools in the United States.

- New England has the highest tuition cost for both two-year and four-year public schools, with an average of $5,370 and $12,990, respectively.

Cost Of Books And School Supplies

The average price of books and school supplies for students at both public and private colleges in 2020-2021 is $1,240.

Textbook prices have risen 812 percent since 1978, according to a 2019 report by Follet, an educational products company. Borrowing books from the library or purchasing digital or used textbooks can reduce your costs, but students still find budgeting for textbooks to be a major source of stress, according to a survey of current and former college students by textbook publisher Cengage. Thirty-one percent of the students surveyed said they took fewer classes to save on textbook costs, and 43 percent said they skipped meals or took out loans to pay for course materials.

You May Like: How To Test Out Of College Courses

Tuition At Broward College

Are you worried about the high cost of postsecondary education? Do not stress yourself out-you can pursue higher education without higher costs here at Broward College. With some of the most economical tuition rates, costs, and fees out of all postsecondary institutions in South Florida, we are easily the best option for tight wallets and limited finances. Best of all, we offer countless financial aid and scholarship options for you. The Broward College Scholarship Application allows students to complete ONE application and be matched to numerous scholarships that are available to Broward College students.

The following provides a breakdown of the fees.Fees and charges are subject to change without notice as approved by the Board of Trustees.

Students Living On Campus With A Meal Plan

If youre a student living on campus with a meal plan then all of your major expenses are already covered including food and a roof over your head.

You will still need additional money to cover expenses such as:

- Entertainment

- Transportation to campus

- Entertainment / eating out

The good news is that you can offset some of these expenses by having roommates. Its not uncommon for off-campus apartments to be set up for four roommates or even more.

If you can find three other people to share expenses with you will greatly reduce your overhead. Lets go through all the expenses one at a time assuming you have three roommates.

Rent-this will depend greatly on what area of the country you are going to school in, but plan for at least $300 per month and up to $600 a month.

Utilities this will also depend on where you are going to school. If youre at a college up north, your heat bills can be very high in the winter. You can expect an average of $50 per month.

Food you have a lot more control over your food bill. There are many ways to save money on groceries. You can find some here. So, you should be able to get your food bill down to $35 to $40 per week.

Cleaning Supplies and Misc Expenses About $20 a month should be more than enough to handle cleaning supplies and any small miscellaneous expenses you might have.

Cable and Internet Most cable and internet services run anywhere from $150 to $200 dollars per month. A fourth of that would be $37 to $50 dollars per month.

Also Check: Do Colleges Offer Health Insurance

How Financial Aid Impacts College Cost

An important factor to consider is the potential for financial aid. No matter the circumstances, students should apply for financial aid, which can possibly help them with their college costs.

Understanding the difference between the sticker price and the net priceIn simple terms, net price is what you pay after financial aid is factored in, while the sticker price is the cost before any financial aid comes into the picture. The United States Department of Education Scorecard gives detailed information on the net price of specific schools, allowing prospective students to make more informed decisions.

FAFSA

The FAFSA is a form that college students should always complete to see if theyre eligible for school, state and federal financial aid to cover all or a portion of their college expenses.

Grants

A grant is a state or federal program offered to provide college funding for students. For example, Say Yes Buffalo is a grant program that covers tuition for students who attend Buffalo public schools. Grants are considered free money and typically does not have to be repaid.

Scholarships

A scholarship is a monetary award given to a student to help pay for college. Scholarship is free money and does not need to be repaid

For example, that any student can apply for.