Nacac Application Fee Waiver

To help make college more accessible for all, the National Association for College Admission Counseling offers a college application fee waiver, as well.

The NACAC waiver has the same eligibility requirements as the waivers from College Board and Common App. However, NACAC requires you to send the application directly to your school of choice.

NACAC recommends using its fee waiver to apply to up to four schools.

Working For Chipotle At&t And Other Companies

You may work for someone who will pay you with money that you may use to pay for your college education. However, it is also possible for you to work for someone who will pay for your college diploma itself.

Its all about the so-called tuition reimbursement that some employers offer.

Also called tuition assistance, it is a type of employee benefit where the employer pays a predetermined amount of college coursework or continuing education credits to be applied towards earning a degree.

Tuition reimbursement tends to vary from one employer to the other. However, most of the time, an employer will reimburse your tuition costs.

This means that you will get a reimbursement of your tuition after you have completed your course credits or earned your college degree.

It is rare for an employer to pay for your school out of pocket before you successfully complete it. However, most employers will be willing to shoulder the costs of course-related books.

Here are some companies that are known to offer tuition reimbursement as an employee benefit:

- AT&T

- UPS

- Verizon

Just because your employer is providing tuition reimbursement, that doesnt mean right away that you can go to college and expect to be reimbursed after graduating.

There are predetermined guidelines that you will have to meet to qualify or remain qualified for tuition reimbursement. Some of them are:

In addition to maintaining a certain GPA, the reimbursement that the company offers could change based on your actual GPA.

Scan Apartment Listings Specifically For College Students

Renting an off-campus apartment that isnt directly affiliated with your school is often the priciest strategy, but it doesnt have to be. Many schools, including the University of Arizona and the University of Oregon, team with Off Campus Partners to provide lower-priced listings.

If your school doesnt have an Off Campus Partners website, ask if it offers an alternative. Places4Students.com, for example, works with 59 schools in the U.S.

Property managers who post listings on these sites are open to student applicants. Thats a plus because some landlords might be hesitant to rent to college students.

Theres no shortage of non-school-specific websites, such as Apartment Finder. Be sure to compare rent quotes before scheduling visits to rooms and apartments that fit your budget.

Keep in mind that an apartments lease might span a longer period than a dorm room for an academic year. Dont sign on for a 12-month lease if you plan to return home for the summer. Youll also likely be on the hook for a security deposit equal to a months rent.

You May Like: What College Is In Terre Haute Indiana

Public Service Loan Forgiveness For Military

The Public Service Loan Forgiveness program is a little-known benefit that can help you pay off your student loans. You can have your federal student loans forgiven after 120 qualifying payments and there are no limits on the amount that can be forgiven.

Military service qualifies under the qualifying employment guidelines.

How to Apply for Public Service Loan Forgiveness:

You can fill out the employment certification formor access our free assessment to see if you qualify.

Reduce Your Tuition Costs

Consider choosing a college with lower tuition rates. In-state schools are generally cheaper than out-of-state or private schools. Some schools offer discounts based on how close you live to the campus.

You might qualify for discounts if you’re a “legacy” because one or both of your parents went to school there.

Of course, school costs include more than just tuition, but you can save in other areas as well. Buy used rather than new textbooks. Check your college bookstore to find out what’s available. A lot of students sell their used books back to these stores when they graduate. Some will even rent textbooks, and online booksellers often offer used copies as well.;

You May Like: Can You Apply To Multiple Colleges

Pay For It On Your Own

Remember how I mentioned that paying for college is a giant jigsaw puzzle? Its also a subtraction problem.

Take the total cost and subtract small bits at a time to get your out-of-pocket cost at the end. It could look like this. :;

Total cost: $60,000

Outside scholarships: $10,000

New out-of-pocket cost: $20,500

See how we subtracted, subtracted, subtracted from that total cost to arrive at an out-of-pocket cost?

Check out the next part to see how you can further take that $20,500 and break it down.

Explore College 529 Savings Plans

Another great way to save for college is a 529 Savings Plan, also called a 529 Plan. State-sponsored and offered by nearly all U.S. States, 529 Plans are specialized savings and investment accounts that do not tax on interest accrued. In almost all cases, you keep everything you earn to put towards a college education.

There are two primary types of 529 Savings Plans: College Savings Plans and Prepaid Tuition Plans. College Savings Plans work like retirement funds in that they invest deposited money into mutual funds or other options . Prepaid Tuition Plans allow plan owners to pre-pay all or some of the cost of an in-state public college education.

Interested in learning more about 529 Savings Plans and comparing them state-by-state? Check out this USNews article for more information.;

You May Like: Berkeley College New York Tuition

How To Pay For College

With the data now clearly laid out, its easy to see that there are several ways that students and their families have paid for college. For some, families provide the money. For many others, this simply isnt possible. In cases where family money wont get you across the finish line, there are several routes you can take to successfully fund the next step. Below, weve compiled 7 of the best ways to pay for college.

Get An Easy Side Gig To Earn Rent Money

College life is busy. Thats why the best side gigs are ones that dont require massive time commitments.;

Side gigs such as driving for Uber will require you to put in the hours in order to earn enough money for rent. However, there are better student gigs that will pay for the things youre already doing.;

In our guide to hacking college debt, we rounded up some of the best gigs for making money with minimal time investment. For example, some apps will pay you for tracking your steps, making it an easy way to monetize your fitness habit. You can also get paid to play video games with apps like Twitch.;

You can also get paid to go to class. As a OneClass Official Notetaker, students earn an average of $470 per course for something theyre already doing — taking class notes. Class notes can be either typed or neatly written, and the majority of notetakers find that their own grades improve after becoming a paid notetaker.;

Read Also: Harrison College Terre Haute Indiana

Apply For Scholarships And Grants

Scholarships are not just for high school students. There are thousands of scholarships specifically for adult learners and you should looks into them. Heres where to look for scholarships.

Aside from scholarships there are grants. Grants are most commonly awarded by the government and are money you can use for college that you dont need to pay back.

Dont make the assumption that you wont qualify without first checking. You can see if you qualify for grants by filling out the FAFSA online or meeting with your schools financial aid office.

Here are some of the most awarded grants for going back to school:

Federal Pell Grant This is the most popular type of grant awarded by the federal government. The maximum payout is $5,815 for the 2016-2017 school year. The amount youre awarded relies upon your financial need, the cost of your schooling and whether youre a part-time or full-time student.

FSEOG Awarded to students of financial need who qualified for the Pell Grant and havent obtained a bachelors. You can receive $100-$4,000 per year through this grant.

TEACH Grant This grant is for students who plan on becoming teachers and are willing to sign a contract to work in high-need areas for a specified period of time. You can receive up to $4,000 per year through this grant.

There are also a number of state based grants including:

- Financial Needs Based

- High Need Fields of Study

- Students with Disabilities

Choose An Affordable School

Paying for college will be exponentially easier if you choose a school thats reasonably priced for you. To avoid straining your bank account, consider starting at a community college or technical school.

If you opt for a traditional four-year university, look for one that is generous with aid. Focus on the net price of each school or the cost to you after grants and scholarships. Use each schools net price calculator to estimate the amount youll have to pay out of pocket or borrow.

Just because one schools sticker price is lower doesnt mean it will be more affordable for you, says Phil Trout, a college counselor at Minnetonka High School in Minnetonka, Minnesota, and former president of the National Association for College Admission Counseling. For example, if a $28,000-a-year school doesnt offer you any aid, and a $60,000-a-year college offers you $40,000 in aid, the school with the higher sticker price is actually more affordable for you.

» MORE:How to use a net price calculator

Don’t Miss: Terre Haute Indiana Colleges And Universities

Learn How To Pay For College At Oct 9 Program

Learn about financial aid and how to pay for college at ECC at “Financial Aid 101,” a free, virtual event hosted by Elgin Community College on Saturday, Oct. 9.

The event will take place from 9 to 11 a.m. via Zoom. Register at elgin.edu/financialliteracy.

All are invited to attend this informative event.

A presentation on paying for college at ECC begins at 9 a.m. and ends at 9:45 a.m.

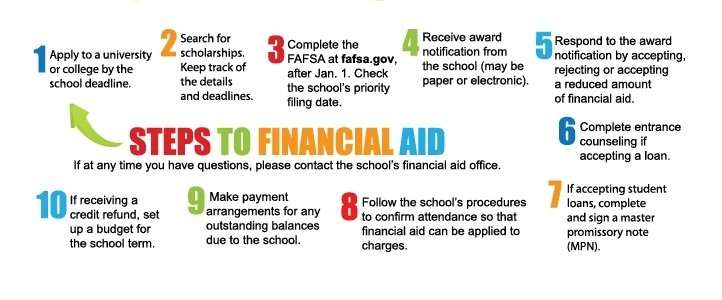

Parents and current and future students can learn about the differences between grants, loans, and scholarships — including detailed information about ECC’s Foundation and Board of Trustees scholarships and how you can search for private scholarships.

In addition to the presentation, you can speak with financial aid representatives about your Free Application for Federal Financial Aid . Support will be available after the presentation until 11 a.m., and it is first-come, first-served.

Work On Lowering Your Living Expenses

Carefully;monitor your college spending;and your living expenses, so you don’t need as much money.;You might look into how much it would cost you to;live off-campus as opposed to on campus.;Get a roommate and share off-campus housing, or live at home to save on costs.;

Avoid contractual obligations like gym memberships and cable bills. Look for;affordable options that allow you to cancel at any time.;

And make sure you have your student ID tucked into your wallet at all times. Whip it out whenever you shop or visit a place that’s going to cost you moneyeven that coffee shop down the street. Many commercial establishments offer discounts to students.;

A strict budget can make a huge difference in the amount that you need to borrow.;

Also Check: Average College Dorm Size

Publix Will Pay Up To $12800 In Tuition Reimbursement After Six Months

Any employee with six months of continuous service who also works an average of 10 hours a week as well as full-time employees are eligible to participate in Publixs tuition reimbursement program.

Classes that directly affect your ability to perform the current job and occupational or technical programs to help prepare you for a future role within the company are covered.

Employees enrolled in a four-year college or university may be reimbursed up to $3,200 annually, with a lifetime limit of $12,800.

Employees enrolled in undergraduate courses at a two-year community college, technical program, or individual course program may be reimbursed up to $1,700 annually, with a lifetime limit of $3,400.

What Are Typical Work

Typical on-campus work-study jobs include working in the library or bookstore, serving in the dining hall, and assisting with college events. Off-campus work-study usually benefits the public in some way and relates to your course of study whenever possible. No matter what kind of job you get, be realistic when working out your schedule and allow yourself time not only for study but also for recreational and leisure activities.

Read Also: What You Need To Get Into College

Do I Need To Be Enrolled Full

Every grant;differs in its eligibility requirements. As more and more students dont fit in the traditional mode, by definition many require scheduling flexibility that goes beyond the usual 15-credit semester. Look for grants;that expressly state part-time or part-time basis. In some cases, the amount of such grants;may not be much less than for an equivalent grant;for full-time students.

For example: The Government Finance Professional Development Scholarship to support the studies of part-time students with a career interest in state and local government finance. There is an equivalent award;for full-time students, but both the part-time and full-time awards;are $8,000 each in 2016.

How To Pay For College Using Multiple Strategies

You might have asked teachers, counselors and admissions officers about how to pay for college only to get a different answer each time. Thats partly because there are a lot of different answers.

And chances are, with the rising cost of college, youll need to use more than one tactic to pay for school. Many students fund their undergraduate education by attending low-cost schools and finding scholarships, federal and private student loans and part-time work.

Ensure you make the right school choice, tap savings and seek out gift aid before all else. Then try to cut expenses and ramp up income before you resort to borrowing. Work your way down our list of 16 strategies, ensuring that you combine the best of each of them before taking on debt.

Andrew Pentis and Christina Majaski contributed to this report.

You May Like: College Terre Haute

Google Will Match Student Loan Payments Up To $2500/year And Help With Tuition

As of 2021, to help reduce the amount of student loan debt their employees are carrying, by matching employees student loan payments up to $2,500/year.

Thats on top of Googles existing tuition reimbursement benefits, which include up to $12,000/year for employee-students who earn grades of A or B.

Become A House Sitter Or Pet Sitter

House sitting or pet sitting is a great option for free to low-cost housing. However, you will need to remain somewhat nomadic as you schedule a series of gigs throughout the semester.

Your academic circles can lead you to house sitting opportunities. Professors could take sabbaticals and grad students may take research fellowships.;

Additional house sitting options could come from snowbirds or people who have multiple homes. For example, when retired people are spending their winters in Florida or Arizona, their vacant property could become your affordable housing.

Recommended Reading: Can You Go To College For Free If Your Native American

Take Advantage Of Federal Student Aid

In many cases, its difficult to cover all of your college expenses with savings and scholarships, even if you choose a low-cost school. This is where federal student aid comes in.

When you fill out the FAFSA, your information is used to determine what types of government aid you qualify for when paying for college. You might even be able to receive grant money to help you pay for school.

Federal work-study is another program that can help you with expenses. With this program, youre guaranteed access to a job usually on campus that can help you keep up with college costs.

Even if you arent eligible for government grants or federal work-study, you can still get help in the form of loans. With federal student loans, you dont have to worry about a credit check or getting a cosigner. For those with greater need, the government might even pay your interest while you attend college.

Federal student loans also come with repayment options that can cap your monthly bill at a percentage of your discretionary income.

When youre trying to decide how to pay for college, federal student aid can be a big help. Your school will send you a letter with information about whats available to you after getting a copy of your FAFSA.

Look Into Grants And Scholarships

Getting paid to go to school is only one of many options out there for those looking to go to college for free. There are also numerous grants and scholarships available for students in need. You are best off searching and applying for as many as you can. They generally dont cost anything to apply, and the more times you try, the better your chances are!

Its important to note that once you are already enrolled in a college program its generally easier to apply for grants and scholarships. Many businesses and philanthropists have made donations to colleges in order to offer more scholarships for minorities, low-income workers and single parents. A scholarship is an incredible gift that allows deserving students to go to college for free.

You May Like: How To Get College Discount On Apple Music

How To Get Paid For Car Advertising Stickers

If you are someone who spends a significant part of your day driving in a car, be it going to work or visiting your friends, car wrapping is a feasible option that provides you with extra passive income that will help you cover your fuel and car maintenance costs.;

The job just needs you to get an advertising sticker on your car and run for your daily errands. If you are looking forward to considering this as your side income, heres how you can get started.;