A Breakdown Of The Average Costs Of College

To give you a quick overview of the costs for a full year of college at a four-year public and private nonprofit college, we’ve included a breakdown of all costs associated with going to college. This includes the average college tuition cost, room and board, books and supplies, transportation and other expenses.

| Public two-year | |

|---|---|

| $40,940 | $50,900 |

Community colleges are primarily two-year public institutions but some schools also award four-year degrees and there are private community colleges. According to Community College Review, the average cost of community college is $4,864 and $8,622 per year for public community colleges. For private community colleges, the average tuition is around $15,460 per year.

Should I Bring My Books To College

Your institutions library Even so, restrict yourself to only a few of books to bring along with you on your new adventure. As a freshman, youll be so busy that youll have little time for leisure reading. Also, keep in mind that youll have limited room. Choose the books that are most meaningful to you and leave the others to be waiting for you when you return to your hometown.

Average Cost Of Books & Supplies

Some programs require more expensive materials than others, so the cost of books and supplies varies widely.

- At public 4-year institutions, students pay an average of $1,334 annually on books and supplies.

- Books and supplies at private, non-profit institutions average $1,308 at private, for-profit institutions, the average cost is $1,194.

- At public 2-year institutions, students pay an average of $1,585 each year for books and supplies.

- At private, nonprofit institutions, books and supplies average $1,061 at private, for-profit 2-year colleges, the average cost is $1,393.

Read Also: Is Study.com Accredited

How One Application Can Cost As Much As $4688

Factor in test prep, taking the SAT and ACT multiple times, rushing score reports and tutoring and you can end up with a nearly $5,000 bill for that first college application. Heres how it breaks down:

| Concept | |

|---|---|

| Grand total | $4,687.50 |

Want even more tutoring, AP exams and subject tests? Apply to more than one school? You might have to pay even more.

Equipment Rental And Refundable Deposit

Students that have to pay a refundable deposit for loaning/renting equipment specific to their programs will be refunded the full amount of their deposit, if the equipment is returned is good condition subject to normal wear and tear. An proportionate amount will be deducted from their deposit if the equipment is not returned in good condition which will be equivalent to having the equipment repaired and maintained as before.

*Students may apply for an exemption from this fee if they have comparable coverage. Please contact the Student Association Benefits Office at 416-415-5000, ext. 2443 for the opt-out deadline, as no applications receive after the deadline will be accepted. Part-time students are not eligible for insurance coverage.

** If choosing to opt-out, please log into STU-VIEW and select Financial Services > View Fees to submit your opt-out choice. If you have any questions, please visit any of the Student Association Offices for assistance. No refunds will be issued after the opt-out deadline.

Also Check: Mortician Colleges

The Cost Of College In The Future

If youve spent a few nights worrying about how to pay for college youre not alone. The cost of college is a major concern for most families with good reason as it is increasing at a faster rate than inflation. According to the College Board, between 2011-12 and 2021-22, published in-state tuition and fees at public four-year institutions increased by 9%, in inflation-adjusted dollars.

Why Is College So Expensive

There are a many of causes for this, including increased demand, more financial assistance, decreased state support, the expanding expense of administrators, and inflated student amenity packages. The most costly institutions Columbia, Vassar, and Duke will cost you well over $50,000 a year just for tuition and room and board alone.

Read Also: Uei High School Diploma Program

The Lifetime Earnings Gap

As you can see, this gap is further widened by the fact that the lower your degree, the more likely you are to be unemployed. Given higher unemployment rates and annual salary, it’s no surprise that these numbers can add up to significant differences in the long run. In fact, not going to college could cost you dearly, to the tune of $1 million in lifetime wages, according to a Georgetown University study.

Sorting Out Grants And Loans

One of the key things for students and their families to determine is the breakdown of scholarships and grants vs. student loans in the aid offer.

Grants don’t have to be repaid. They come from colleges themselves in the form of merit- or need-based scholarship aid. Some are for one academic year only, while others cover as many as four.

Grants also come from private sources such as local organizations and foundations. The federal government awards grants as well, primarily in the form of Pell Grants.

One of the key things for students and their families to determine is the breakdown of grants vs. loans in the aid offer.

Loans are a different matter. They do, of course, have to be repaid, and all have varying terms.

Federal loans are either subsidized or unsubsidized. If you have financial need, you can get subsidized loans, which come with low interest rates and the option to defer payments interest-free until after you graduate.

You don’t have to demonstrate financial need to get unsubsidized loans, which have a slightly higher interest rate. And while you can defer payments with unsubsidized loans, too, you must pay interest along the way.

In addition, your parents can take out a federal Direct Plus Loan.

Finally, you can get a private loan from a bank or other financial institution. Rates vary considerably and tend to be higher than federal loans. Your college also might offer loans as part of its aid package. Some private loans allow deferment.

Don’t Miss: Ashworth University Accreditation

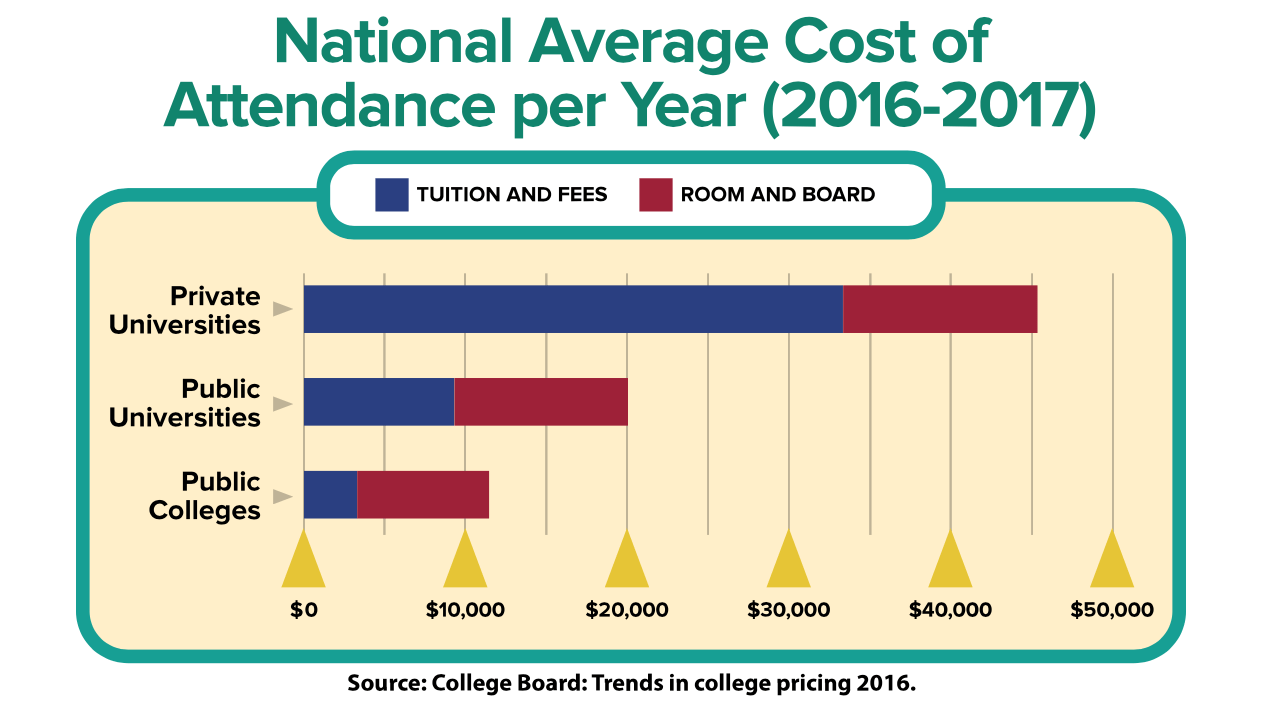

How Much Does College Cost Per Year

College can cost anywhere from $18,000 to over $50,000 a year depending on where you go to school, if youre an in-state or out-of-state resident and if you attend a public or private university. Aside from tuition and fees, your schools cost of attendance usually also includes room and board, books, transportation and other personal expenses.

Here was the average cost of college for a full-time undergraduate student living on or near campus for the 20192020 academic year, according to a 2019 College Board study.

-

Average cost of college in 201920

Cost $26,590 $18,420

As these numbers show, tuition isnt the only number you should look at. Room and board is also a significant part of the cost of attendance.

It was a quarter of the cost of attending a private school or a public school as an out-of-state student during the 20192020 academic year. And it was around 45% of the cost of public schools for in-state students and public two-year programs.

How Much Does College Cost

Spread the Knowledge. Share:

When thinking about the price of college, people often focus on college tuition costs. But the total price tag can include additional expenses ranging from housing and transportation to school supplies. Let’s take a look at the average costs behind a year of college.

In its 2021 report, Trends in College Pricing and Student Aid, the College Board reports that a moderate college budget for an in-state student attending a four-year public college in 2021-2022 averages $27,330. For out-of-state students at public colleges, the average budget comes to $44,150, and for students attending private colleges, the average budget is $54,800.

Source: College Board, Trends in College Pricing and Student Aid, 2021.

Recommended Reading: Ashworth College Fafsa

How Can You Calculate Your Own Costs Of Studying In The Us

In recent years, its become easier for individual students to calculate how much they could expect studying in the US to cost. All US universities are now legally required to include a fees and financial aid calculator on their websites, allowing students to get a rough idea of how much their intended course of study would cost and what aid they may be eligible for. These net price calculators can be accessed via the governments College Affordability and Transparency Center, which also provides details of the US universities with the highest and lowest tuition fees and net costs.

This article was originally published in February 2012. It was most recently updated in May 2019.

Want more content like this? Register for free site membership to get regular updates and your own personal content feed.

This article was originally published in May 2019.It was last updated in May 2021

Want more content like this Register for free site membership to get regular updates and your own personal content feed.

What Is The Average Cost Of A Bachelors Degree

The average cost of a bachelors degree yearly in 2019-2020 is in total $30,500. However, this price can vary depending on the type of college, whether it is private or public, furthermore, if public whether it is in-state or out-of-state and finally it varies from college to college. The average cost for a bachelors degree from a public in-state institution is $21,950, while from public out-of-state institutions his price is $38,330. For a private non-profit, it is $49,879.

The most affordable bachelors degree is from The Great Basin College, which is one of the most popular colleges for online degrees, with tuition costing only $3,128.

On the other hand, the most expensive bachelors degree is from Franklin and Marshall College a private liberal arts college in Lancaster Pennsylvania with an annual tuition fee of $58,615.

Also Check: Grammarly Premium Free For Students

What Does College Really Cost

While college education has become more expensive, the costs that are often reported in the financial media don’t tell the whole story. For instance, because they are based on national published averages, they do not reflect regional differences or the fact that the net price many students pay to attend college is often significantly lower than the published price.

Each year, the College Board publishes a detailed analysis of the cost of attending college, based on an annual survey of nearly 4,000 US schools.

For the 2020-2021 academic year, the average cost at a private, nonprofit 4-year college was $54,880 .2 While that amount is high enough to cause sticker shock among even relatively affluent families, a closer look reveals that many students do not pay the full sticker price. For example, the average total published price for tuition and fees, not including room and board, was $37,650 in 2020-2021, but the estimated average net price was only $15,990a difference of $21,660.2

Students who attend public colleges typically pay less than those at private colleges, provided they qualify for in-state tuition rates. The average cost per year for a public 4-year in-state college was $26,820 in 2020-2021.2 Keep in mind that all of the College Board’s numbers are based on national averages, so depending on where you live, the cost of attending a public college could be higher or lower.

Average Cost Of College By Region

The average tuition cost in each region for two-year and four-year schools in the United States varied minimally. However, New England had both the highest in-district and in-state average tuition costs, not including room and board, for both two-year and four-year public colleges. In contrast, the South had the lowest public four-year tuition at $9,290, while the West had the lowest average tuition for public two-year schools at $2,380.

According to data from the College Board, western states had the highest public two-year and four-year tuition increase over 10 years, increasing 62% and 60%, respectively. Meanwhile, public two-year and four-year colleges in the Midwest only increased by 22% and 21% within the past 10 years. Keep in mind that the West is home to some of the top public schools in the country, namely the University of California system.

Recommended Reading: Arielle Nachmani Father

Average Cost Of College By Flagship University

University of Wyoming had the lowest in-state tuition while University of South Dakota had the lowest out-of-state tuition, which lines up with the state rankings. Unlike the state rankings, Pennsylvania State University had the highest in-state tuition at $18,436, with the University of New Hampshire ranking as a close second. And the University of Michigan had the most expensive out-of-state tuition out of all the flagship universities.

| Flagship university |

|---|

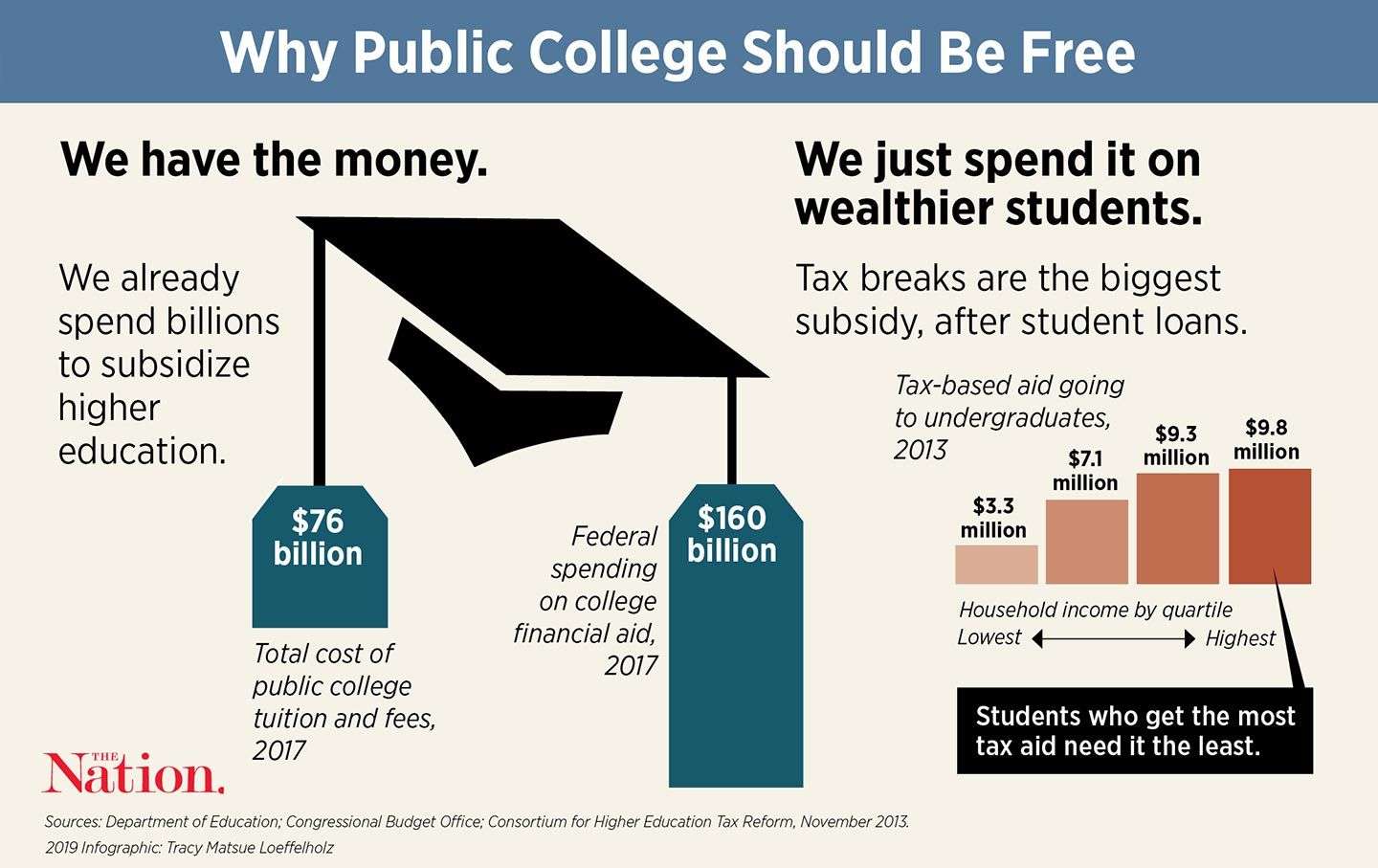

Cost Of College To Taxpayers

Most public institutions receive funding from state and local governments. Colleges also receive federal funding through financial aid to students.

- In 2017, local and state governments spent approximately 10% or $297 billion on higher education compared to 1977, when these expenditures were closer to $105 billion .

- 98% of state funding for higher education funding and 78% of federal higher education funding went to public institutions.

- For most states, this was the third-largest expenditure, behind elementary/secondary education and public welfare.

- 88% of this spending went towards operational costs, and 12% went towards capital outlays .

- In 2017, 85% of higher education spending occurred at the state level.

- The number of FTE students increased by 45% from 2000 to 2012.

- Revenue per FTE student from federal sources increased by 32% compared to a decline in state revenue of 37%.

- Total federal revenue increased from $43 billion to $83 billion .

- Federal loans increased by 375% between 1990 and 2013 compared to 60% enrollment growth.

- As many as 50% of students at 2-year institutions received enough financial aid and grant money to cover tuition and fees.

- Full-time students enrolled at 2-year institutions receive an average of $4,050 in financial aid and grant money.

Analysis: College Cost Variations

Note: North Dakota participates in both the Midwest Student Exchange AND the Western Undergraduate Exchange.

Analysis: Why is College So Expensive?

Don’t Miss: Test Out Of Classes

College Tuition : Everything You Need To Know About The Cost Of College

Your major, learning environment, class size, distance from home, sports teams, and a decent pizza joint. So much goes into selecting a place to further your education. But probably nothing resonates than the total cost of college.

One just has to scan the news to know that college costs are at an all-time high, anda paper by CBPP shows that the US has hit rock-bottom in state funding of public universities and colleges. So that, in turn, means these public institutions have to charge more for tuition. Its simple math, and simply frustrating to face these days.

In fact, given their reliance on state funding, public colleges and universities have seen a greater increase in their tuition price as compared to private institutions during the last two decades. As the price of both public and private institutions have increased, more and more students are making their choice based on the total cost of attendance.

But determining what that total cost means is critical to making an informed decision about your next phase of learning. So lets look a little deeper.

Some background from HSBCsThe Value of Education, a recent survey of US parents and students:

- Total spending to complete a degree averages almost $100k

- 85% of all students work while attending college

- On average, about 62% of parents reduce their leisure activities to support their childs education

Safeguarding Your Information And Online Transactions Strong Technologies And Technical Controls

We use the following methods to help keep your online transactions and personal information safe and secure.

Username and password requirements

To help prevent unauthorized access, we prompt you to create a unique username and password when you first access your account. A password is a string of characters used to access information or a computer. Passwords help prevent unauthorized people from accessing files, programs, and other resources. When you create a password you should make it strong, which means it should be difficult to guess or crack. See below for hints in creating a password that would be difficult to crack.

A Strong Password

- Minimum of eight characters long

- Includes numbers, symbols, upper-case and lower-case letters

- Does not contain your username, real name or company name

- Does not contain a dictionary word

- Is significantly different from the previous passwords

Image verification during login

Before you enter your online password, we ask that you verify your personalized security image. This image would be one that you selected during the creation of your web account. Once the image you have selected is displayed, you can be confident that you are accessing our website, as opposed to a fake site that may be attempting to “phish” for your personal information. If you ever log in and do not see the image you’ve selected or the image is incorrect, STOP, do not input your password. Please immediately report this to your plan’s customer service team.

Firewalls

Read Also: Fsaid Ed Gov Legit

Higher Education In The Us

50 years ago, only 10% of the population attended college, mainly because it was generally reserved for a privileged few, and high school education was sufficient to enter the job market and build a comfortable career. Due to many different factors, this is no longer the case today, and the percentage of the population that has a college education has risen to more than 65%. In this period of time, the cost of tuition skyrocketed and continues to do so. In recent years, college tuition has risen almost six percent above the rate of inflation and increases at a rate of roughly 100% each decade. In the U.S., total student loan debt is twice the amount of total credit card debt.

On average, students that graduate with college degrees earn significantly more throughout their lifetime and are more likely to hold a job than those with only a high school degree. In addition, jobs that require at least a bachelor’s degree tend to have benefits such as healthcare, retirement investment accounts, and other perks. There are many other benefits that come with higher education college graduates have lower smoking rates , show fewer symptoms of depression, and participate in exercise more regularly than people who do not graduate from college. While the debt of student loans can be burdensome, it should be weighed against the benefits that come with higher education.