How Much Should You Really Save For College

Jeff Rose, CFP® | September 07, 2021

A major goal for most parents is to see their children graduate from college and receive a good job so that they can live a long and fruitful life. The recent financial fiascos of the United States have put a strain on the ability of government to contribute to the ever increasing costs of college.

Historically college costs have inflated at around 5-8 percent annually, with some long periods of inflation over 8 percent. This could pose a major problem when your average investment return will be in the range of 7% annually based off the historical returns of the S&P 500.; This sounds overwhelming at first, but starting to save early is crucial to your success. From the day your child is born you will have approximately 18 years to be ready for the day your son or daughter is ready for college, but the question is, how much should you save? This whole question become even more apparent in my life as we just welcome our third son into the world.;; Can you say, college tuition x 3 = Big Bucks?..Yikes!; I know many other parents are in that same situation so I thought it would be best to help them figure out how much to really save for college.

There isnt a right answer.; Youll have to figure that out on your own.; What the numbers below will help you figure out is a ballpark figure on how much damage youll be looking at.;; If youre not sitting down yet, maybe you should..

Tips On Saving For College As A Teen

Modified date: Oct. 26, 2020

This article is part of a series;teaching essential personal finance concepts to teenagers. At Money Under 30, we believe that its never too early to become financially responsible;;we hope this series will be a good place to start.

Everyone dreams of that first day of college. The friends you will meet, the experiences youll be exposed to, the school spirit youll develop. But paying for that dream can be a nightmare if you dont have a surefire plan.

However, you can avert all that if you save from early on. A college education is expensive after all. Do you really want to be paying off student loans for most of your 20s or even 30s? There are many ways to save for college without having to borrow at every turn. Here are a few of them.

Every Family Has Different Savings Goals

Our 2K rule of thumb is an easy way to see whether you are on track, especially if your children are still young and you are not sure where they will ultimately choose to go to college, says Andrey Lyalko, a vice president at Fidelity. Because this approach may not apply to all situations, make sure to develop a robust college savings plan and be mindful that college costs are a variable that can dramatically change over time.

So what if your situation differs from the norm? Perhaps you are hoping for a sports scholarship for your aspiring student athlete. Or maybe you are looking to cover 100% of college costs and are not expecting any scholarships or grants. You may also believe that your child will go to a private college, where the costs could be substantially more than the average public university.

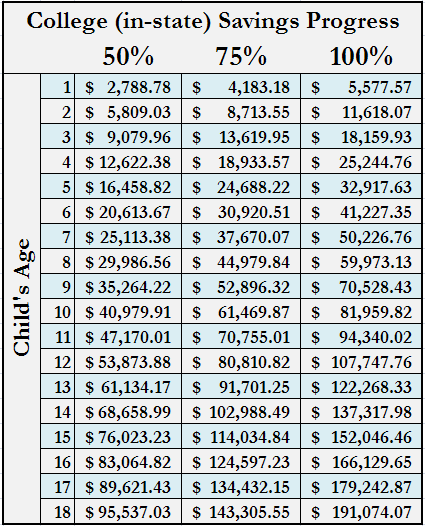

The college savings math can still work for you:

|

|

; |

Recommended Reading: Cape Fear Community College Apartments

Saving More Can Have A Huge Impact

This hypothetical illustration assumes an annual 6% return, as well as a weekly deposit for 18 years, for all examples. This illustration does not represent any particular investment nor does it account for inflation. There may be other material differences between investment products that must be considered prior to investing.

Recommended Expense Coverage Ratio By Age

The below chart is an expense coverage ratio chart that follows someone along a normal path of post college graduation until the typical retirement age of 62-67. I assume a 20-35% consistent after tax savings rate for 40+ years with a 0-2% yearly increase in principal due to inflation.

The other assumption is that the saver never loses money given the FDIC insures singles for $250,000 and couples for $500,000. Once you breach those amounts, its only logical to open up another savings account to get another $250,000-$500,000 FDIC guarantee.

Recommended Reading: Do Native Americans Get Free College

What To Do When You Save Too Much For College

This post may contain affiliate links. Please read my disclosure statement for more info.

Just when you thought filing your taxes was the most complicated thing youd have to figure out financially, along comes a problem like this.

Lets start at the beginning

There are a couple of things you dont know when saving for college:

- Will my children even go to college?

- If so, how much will college cost them?

My wife and I answered these questions many years ago as follows:

- Yes, they will go to college. After all, thats what we did.

- College will cost them a fortune. Well get virtually zero need-based financial aid and even if we get scholarships it will cost a tidy sum.

Saving for College

Given these answers we saved for college in two ways:

- We put in $5,000 each year for several years into a Michigan 529. This also got us the biggest tax break available at the time.

- We gifted my parents money and they put contributions into a Coverdell Education Savings Account.

Over the course of time the savings grew until we ended up with the following:

- $70k in the Michigan 529 for each child $50k of which we contributed and $20k of growth

- $20k in Coverdell ESAs for each child $15k of which we contributed and $5k of growth

In other words, we have $90k for each child, $65k of which is money we contributed and $25k of growth.

We Saved Too Much Based on Reality

The problem is, we answered the two questions above incorrectly:

Getting the College Money Out

Thanks,

She responded:

How Much Money Should I Have Saved By 18 Heres Guidance For Estimating The Amount Of Money Your Teenager Should Have Saved By 18

People graduate high school around the age of 18 . And just beyond that high school diploma, GED, or other slip of paper? Comes big changes and transitions.

Thats why the age 18 is an exciting and sometimes-scary one.

I meanits marked as the end of the pipeline for childhood and the onset of adulthood.

And you know what? Young adulthood can be quite expensive.

Think about it theres generally a need for a place to live, there might be college/vocational/other education, transportation needs, etc.

There are so many different paths that your teenager can take at around this age that how much you should have in savings by 18 really boils down to what their next phase in life is going to look like.

Not only what its going to look like, but what their personal money responsibilities are going to be. Meaning, this is partly a conversation between parents and teenagers.

You and your teenager have to answer questions like:

- Are you going straight to college?

- Are you getting an apartment, and is that first apartment with or without a roommate?

- Are you living at home, and will you be responsible for paying rent or any other costs?

- Are you going to college, and is there on-campus housing or will you be making other arrangements?

The answer to any one of those questions can vastly change someones savings needs .

Lets dive into this subject so that you and your teenager walk away with an estimate savings goal based on how much theyll need for their next phase of life.

Also Check: Colleges With Best Dorms

When Does It Ever Stop

How much you need to save depends on when and how you want to retire. To sustain your quality of life, you’ll likely need between eight and 11 times your annual pay by retirement, not counting Social Security.

Some estimates suggest that people may need between $1 million and $2 million dollars by old age â though again, it will depend on your lifestyle.

If you learn to live on less, you may need less. But if you want to be in true ship-shape, keep in mind estimated goals for your age group. The estimates really do range â so don’t get too hung up on dollar amounts â but do understand the rules of thumb enough to stay on track.

Remember: Saving is more achievable than you may realize; the sooner you start, the easier it will be. You might even get to retire early.

How Much Money To Have Saved By Age 40

Your 40s are when your finances start to get a lot more complicated, which is why it’s also the age where it’s increasingly helpful to consider paying a professional to help you make a plan and stay on track.

On the flip side, if you’ve been hitting the goals so far, by now you’ve built up pretty consistent savings habits, which means you might not have to depart too much from what you’re already doing.

A common benchmark for age 40, according to Fidelity, is to try and save three times your current annual salary, which could mean about $150,000.

Recommended Reading: What College Has The Best Dorms

How Much Of The Bill Do Parents Plan To Pay

Findings from Fidelity Investments’ 2020 College Savings Indicator Study5 also reveal that although many parents plan to pay the total cost of college and are increasingly on track, they need to start saving earlier: Fewer parents are starting to save before their child reaches the age of 233%, down from 37% in 2018but are on track to meet 33% of their college funding goals. The good news: This important college savings indicator is up from 28% in 2018.

Weve seen the percentage of costs parents intend to cover grow over the past several years, even as college costs continue to climb. Parents want to help minimize the burden of potential student loans, explains Rita Assaf, vice president, Retirement and College Leadership at Fidelity Investments. Despite these good intentions, fewer families today can realistically reach these lofty savings goals.

Any way you look at it, parents are on the hook to pay the lions share of college expenses. To keep things simple, our 2K rule of thumb methodology assumes that parents, on average, are expecting to cover 50% of college costs from savings. Thats the starting point for our college savings calculator. Your own situation might vary, so weve added the flexibility to let you input the percentage of college expenses that you expect to pay from savings.

Recommended Savings By Age Chart: Pre And Post

Below is my command savings chart by age. It shows how much you should have saved in your pre-tax retirement accounts and your post-tax investment accounts.

I recommend everybody start off with 10% and raise their savings amount by 1% each month until it hurts. If youve ever had braces, you get the idea. Keep that savings rate constant until it no longer hurts, and start raising the rate by 1% a month again. If you make more than $200,000, certainly shoot to save more if you can.;You can theoretically achieve a 35%+ savings rate in two short years with this method!

Please note that I am making 401K and IRA contributions a priority over post-tax savings. The reasons are: 1) we have a tendency to raid our post tax savings, 2) tax free growth, 3) untouchable assets in case of litigation or bankruptcy, and 4) company match.

Obviously you need some post-tax savings to account for true emergencies. Ideally, my goal for everyone is to contribute as much in their pre-tax savings plans as possible and then save another 10-35% after tax.

The maximum 401k contribution for 2020 is $19,500. The maximum pre-tax contribution will probably increase by $500 every two years or so if history is any guidance.

Recommended Reading: What College Is In Terre Haute Indiana

What If You Save Too Much

Because 529 contributions can only be used for qualified educational expenses, you might wonder what would happen if you dont need that money, or all of it, to pay the bills. Say the student gets a free ride and ends up paying zero tuition, or decides not to attend college at all.

Having too much money saved for college is a problem that few families will ever face. But if it happens, there are ways to deal with it. For one thing, the owner of the account can change the beneficiary to another qualifying family member, such as a sibling, a niece, a grandchild, or even the person who opened the account. In addition, under the SECURE Act, passed and signed into law in Dec. 2019, a beneficiary can take out a lifetime maximum of $10,000 from a 529 to pay student debt.

If all else fails, its possible to simply withdraw the money, although the account owner will owe income taxes on the earnings plus a 10% tax penalty. There are exceptions to the penalty, so be sure to check with your tax accountant before withdrawing funds.

Take Advanced Placement Courses

John Marotta of Marotta Wealth Management also recommends that you take advanced placement courses, which help prepare you for college-level coursework. You can save a good amount of money on books and tuition through doing these classes.

According to the Huffington Post, 90 percent of colleges and universities in the U.S. offer credits for some AP courses. Getting a head start on your college education could help you reach the finish line quicker.

Recommended Reading: How Much Does One College Class Cost

Bottom Line: Save As Much As You Can

When it comes down to it, you’ll need to reconcile your numbers with what you can truly afford. Saving for college is important, but it needs to work with your other priorities, like saving for retirement or building an emergency fund.

Be sure you’re doing all you can, though. Cutting expenses to save an additional $25 a week could have a huge impact in the long runand make it less likely that you’ll struggle financially when it’s time for college.

Study: How Much Money Do Students Have In Their Bank Accounts

OneClass;is an education service that uses technology to help you study more efficiently and improve your grades. In our;blog, we intend to provide helpful resources and inform you about important trends and events happening at your school and in the education sector at large.

With the average cost of attendance for private colleges being over $50,000 in 2019, it’s common knowledge that students don’t necessarily have plenty of cash lying around.

Everyone knows that being a student is expensive but how does it really affect their bank accounts?

To figure this out, we surveyed 399 students across 82 schools and asked them a simple question:

“How much money is in your bank account right now?”

We analyzed the results first on an overall basis, then dove a little deeper to look at what the results were specific to students’ majors and years.

Here’s what we found.

*Numbers include amounts in both chequing and savings accounts

Don’t Miss: How To Introduce Yourself In An Essay For College

Start Saving When Your Child Is Born

This figure seems scary, but you have to consider the fact your wages will also likely increase at a constant rate to differ some of the excess costs. If you were to start saving the day your child was born, and were planning on paying the $201,108 with an 8% average return on your investments you would need to save $418.90/ month to be able to pay for your childs total college expense. If you were to only receive a 6% return on your investments, you would need to save $519.19/ month for the next 18 years to pay for your childs total college expense.

More 529 Plan Assumptions:

- College tuition and expenses will increase by an average of 3% a year, even though the value of college is declining. It is very hard to stop momentum, especially due to growing international demand.

- Some of the 529 plan may be used to pay for grade school tuition and expenses. As of 2020, $10,000 a year can be used from a 529 plan per student per year for private, public or religious;elementary, middle, and high;school tuition.

- Financial support for education stops at 25. Age 25 is old enough for a child to have started and finished a Masters degree. It is also old enough for the adult child to get on the path to financial independence. You plan to spend down 100% of the 529 plan after 25 years.

- Contributing too much is an inefficient use of funds because the money could also be spent on living a better life.

Now that we have these assumptions in place, lets look at the recommended 529 plan amount by age.

Recommended Reading: Terre Haute Indiana Colleges And Universities