The Logic That Led To The Student Loan Crisis

If student loans are ripping off and hurting students, why is anyone taking them out? What’s going on in students’ minds?We went to a local college prep high school to find out. These students are very smartjust maybe not when it comes to money.

Their knowledge ranged from having never even heard of FAFSA to believing they could pay off a $40,000 student loan in a year or two.

Heres the transcript from one of our interviews:

Borrowed Future: Do you know where you want to go to school yet?

Student: Columbia University.

Borrowed Future: Very expensive school.

Student: We could work it out with financial aid and stuff.

Borrowed Future: So, I’m looking at the tuition for Columbia University. Do you know how much it costs to go there?

Student: A lot. Like $60,000 a year?

Borrowed Future: You nailed it.

Student: Yeah.

Borrowed Future: And so, have your parents talked to you about this? Did you have a conversation when they’re going, Hey, we can’t afford to send you to a $60,000-a-year school.

Student: We haven’t had that conversation. They never said I can’t go because of financial reasons.

Borrowed Future: Would you take student loans out to go to Columbia?

Student: I would if I felt like it was really, really something I feel like would benefit me in the long run. I feel like it’s a great option for me.

Borrowed Future: Okay, so you’d be willing to take out student loans to go there.

Student: Yes.

Student: This is it.

Borrowed Future: Yeah, what makes it worth it?

Regrets About Student Loans

About three-quarters, or 77 per cent, of Canadian graduates under 40 have some regrets about the money they spent while in school, according to a poll released Tuesday by debt firm BDO Canada.

The report, carried out by Ipsos Poll, found 30 per cent of graduates would have had more frugal budgets, some would have worked more during school , and 25 per cent would have avoided other debt by staying away from credit cards and car loans.

READ MORE: 4 Canadian schools make list of top 100 universities in the world

About 67 per cent of Canadians included in the poll said they had debt when graduating, and were an average of $22,084 in the red. Only about 33 per cent of respondents graduated debt-free.

Sixty-two per cent of those who wrapped up their education with debt are still paying off the loans, the poll said.

WATCH: Canadian consumer debt climbs higher

Public Service Loan Forgiveness Program Could Clear Debt For Thousands Of Americans

Cody Hounanian, the executive director of the Student Debt Crisis Center, a nonprofit organization that advocates for student borrowers, said the sudden notices of discharged debts are a blessing for many applicants who dutifully made the required 120 monthly payments or were on course to and yet were denied because they were inadvertently enrolled in the wrong payment plan or had the wrong type of loan or due to another technicality.

“It’s very emotional,” Hounanian said of the wave of financial assistance. “It’s changing their lives for the better.”

Student borrowers who have benefited in recent days are sharing their shock on social media.

But the latest reversal is also a “double-edged sword” for many borrowers, Hounanian said.

Those hoping to qualify will have until Oct. 31 to submit an application form under a limited-time waiver. Potentially 550,000 borrowers stand to benefit, the federal government said. In addition, student borrowers who may previously have been disqualified because they had a loan through Federal Family Education Loans, a program that ended in 2010, are now eligible. The catch is they will have to make sure such loans are consolidated into a new, federal direct loan.

“Unfortunately, there are some folks who with this news that debt relief is attainable may find the process confusing,” Hounanian said.

But the federal government said it is trying to simplify the steps, with about 22,000 borrowers initially having their debts automatically canceled.

Read Also: Is Pearson Accelerated Pathways Accredited

How Does College Graduation Affect Loan Repayments And Defaults

These personal finance trends reflect the big-picture view of student loan outcomes.

A long-term research project from the federal government tracked borrowers 12 years after starting college in the 2003-04 school year. The results show that borrowers who attain a bachelor’s degree have lower rates of defaulting and deferring their student loans. Conversely, those who didn’t earn their degree have lower rates of having paid off their loans, obtained loan forgiveness, or are currently making payments.

| Student Loan Repayment Status 12 Years After Students Started College | |

| Percent defaulted | |

| 43.3% | 13.8% |

In comparing the outcomes of those who graduated versus those who didn’t, there is a clear trend that favors college graduates. College dropouts are four times as likely to default on their student loans than their counterparts who did graduate. This finding is an increase from an earlier longitudinal study where default rates were three times higher among those who didn’t graduate.

Why Has The Cost Of College Increased So Drastically

At the start of the millennium, the average American who received their Bachelor’s Degree accrued a student loan debt of about $17,297, roughly $13,000 less than the average debt in 2021.

The student debt crisis took hold during the 2008-2009 recession, prompting students to cross the $1trillion threshold in student debt.

Since 2000, the nation has seen a 76 percent growth in student loan debt at the time of graduation.

Forbes reported last year that the tuition for a college education is a contender for the top spot for increasing in cost, only second behind hospital care.

College tuition has increased faster even than the cost of housing, child care, and medical services over the last twenty years.

As more students pursue a college education, the cost comes down to a supply and demand with more students taking out student loans in the hope it will benefit them long term.

Nicole Smith, a chief economist at the Georgetown University Center on Education and the Workforce spoke with CNBC last year to explain the reason for the general uptick in loans.

People who went to school in the 70s and the 60s, they actually paid for college while working. They would take a summer job and they would pay their tuition, she said.

And by the time they graduated, they would be debt-free or just, a couple hundred dollars, a couple thousand dollars to get by, they pay that off in a couple of years and move on with their lives.

Also Check: Dorm Size Bed

Average Number Of Student Loans Per Borrower

Of undergraduate students who borrow federal student loans to pay for a Bachelors degree, more than 95% borrow for at least four years.

On average, 85% of undergraduate students who borrowed a subsidized Federal Direct Stafford loan also borrowed an unsubsidized subsidized Federal Direct Stafford loan, based on data from the 2015-2016 NPSAS. Likewise, 85% of undergraduate students who borrowed an unsubsidized Federal Direct Stafford loan also borrowed a subsidized Federal Direct Stafford loan.

Thus, the typical student who borrows for a Bachelors degree will graduate with 7.5 or more Federal Direct Stafford loans, including both subsidized and unsubsidized loans.

About 11% also borrow institutional or private student loans and about 6% borrow institutional or private student loans without federal student loans. That brings the average number of student loans to 8.2 loans.

Thus, the typical number of student loans at graduation with a Bachelors degree will range from 8 to 12. This does not count Federal Parent PLUS loans.

How Are Student Loans Repaid

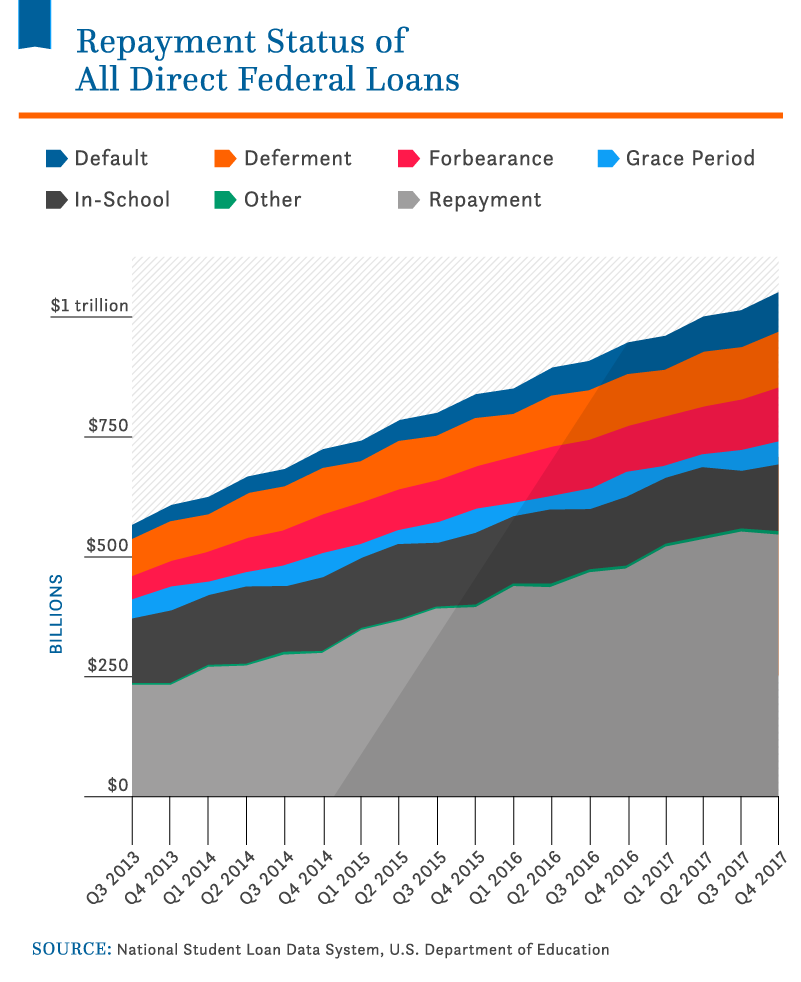

Slowly or in many cases, not at all. A sizable chunk of student loans are in limbo or totally abandoned.

- 3.3 million borrowers are currently deferring their federal student loans. In this instance, deferment means that interest doesnt accrue.

- 2.6 million borrowers currently have federal student loans in forbearance. Interest is still piling up for them.

- An astounding 4.7 million borrowers have their federal student loans in default. That means that 10% of all people with student loans havent made student loan payments on their debt in more than 9 months.

- Students that left college before completing their degree are more than twice as likely to eventually default on their loans compared to students that graduated.

- More than half of all defaulted debts are on loans that amount to less than $10,000.

Also Check: Grammarly Premium For Students Free

Impact Of Number Of Years In College On Amount Of Debt

Some students take more than four years to graduate with a Bachelors degree. This table shows the impact of time to completion on the amount of student debt at graduation for Bachelors degree recipients and the percentage graduating with student loan debt, based on data from the 2015-2016 NPSAS.

|

Average Debt at Graduation |

|

|

$30,043 |

$34,569 |

Thus, even if it takes students at public colleges an extra year to graduate, as compared with students at private non-profit colleges, they still graduate with less debt, on average.

Is It Possible To Go To College Without Student Loans

Anthony ONeal has a firm answer to this question: “Can you go to college debt-free? Yes! Is it going to be easy? No!

Anthony says if everything was easystarting a business or becoming a millionaire, for exampleeveryone would be doing it. He says, Only the successful ones, only the ones who are willing to work, have integrity, have character, and do whatever it takes to become successful are the ones who are actually successful. Successful people do what unsuccessful people are not willing to do.

Then let me say this, Anthony adds, It’s not about a privilege thing. It’s not about a race thing. It’s about people who work. If you put in the work, you’ll get the results. If you want to be lazy, if you just want to have an easy routeyeah, go sign student loan papers and be in debt and bonded for the rest of your life.

Avoid the stupid mistake that I made of borrowing money to go to college, even when I didnt need it. No one gave me another route, like, Hey, Anthony, maybe going off to community college is the best route for you. Or maybe checking out a trade school is the best route for you. Maybe starting off this way is the best route.

People may look at you, and they may laugh at you. They may question you. They may even doubt if you’re ever going to get through, but you have to be so passionate that no matter what, you are not going to give up. You’re not going to borrow one dime to go to school, even if it means you’ve got to move a little bit slower.

You May Like: Apartments Near Cape Fear Community College

Is It Bad To Have Student Loan Debt

Not necessarily while student loan debt can be a financial burden, it could also help you access higher education. Generally, having a college education leads to higher wages and lower rates of unemployment.

For example:

Earning these higher amounts or meeting other personal goals could make student loan debt worth it despite the potential strain on your budget.

Check Out: How to Pay Off Medical School Debt

Student Loan Payments Statistics

Student loan debt statistics will not be what they are if every borrower can make good with their monthly payments. However, borrowers are having a hard time doing so because of the steep interest rate: 5.8% per annum. If you need to know more about interest rates in general, you can read about loan interests and penalties here.

Public Service Loan Forgiveness

Fortunately for borrowers, there is a program called the Public Service Loan Forgiveness. It has a particular set of rules that a borrower has to meet, such as the loan amount, the amount already paid, number of years in employment, and more. If a borrower ticks off every criterion, then they can have their loans discharged.

- At the end of June 2019, there were 110,729 applications for the Public Service Loan Forgiveness program.

- Of those, only 1,216 were approved by the PSLF officer in that period. Others were rejected for not meeting program requirements while there are those that were denied for missing information .

- Only over 1% of PSLF applications have been approved since the programs inception in 2007.

- However, as of March 2020, the U.S. Department of Education approved 3,174 PSLF applications, which translates to an approval rate of 1.8%.

You May Like: Dorm Mattress Size

The Research Process In Hindsight3

- 78% would have researched more scholarships

- 30% would have reached out to the financial aid office to ask for more aid

- 11% would have investigated different student loan options

- 75% would not have chosen a different school

Of course, its easier to see what you could have done differently in your education and how you paid for it. The biggest takeaway? Research more scholarships before going off to school. Its a lot of work upfront but can save you money and reduce your total costs. Learn from other students and speak with your financial aid office to discover the best options for you.

Its important to become familiar with the different costs and implications before signing on the dotted line. For more information on managing the cost of college, or get some techniques for with your family.

The College Ave Student Loans survey was conducted by Barnes & Noble College InsightsTM. The national online survey had 1,033 undergraduate student respondents who attend one of the 772 campuses served by Barnes & Noble College and was fielded in September 2020.

Average Student Loan Debt In America: 2019 Facts & Figures

The average student debt in the United States is $32,731, while the median student loan debt amount is $17,000. With the rising costs of tuition and total student loan debt up around 302% since 2004, we decided to break down the data to get a better understanding of the different levels of student loan debt across different types of borrowers.

Recommended Reading: Goreact Unf

Paying For College Today

The American economy just isnt working as well as it used to for most families. Along with the cost of college, the cost of living has been rising, while family income has been flat since at least the late 1990s.

Which, for many students who want to get an advanced degree, has meant the only option is to borrow more.

The federal government has also been inclined to increase student loan limits rather than grant amounts, and call the problem solved, Kantrowitz said. Even though thats just putting more of the burden on the families.

Take Pell Grants, the biggest source of federal grants for low-income students. In 1975, these grants covered 79% of tuition, fees, room and board at a four-year public college, according to the Center on Budget and Policy Priorities. By 2017, they covered just 29% of those same costs.

We have more and more students of all income brackets taking out loans, said Michelle Asha Cooper of IHEP. As the cost of college has increased over the years, she said, the investment in need-based aid has failed to keep up with that rising cost.

Seth Frotman, executive director of the Student Borrower Protection Center and former student loan ombudsman at the Consumer Financial Protection Bureau, said there is another factor that does not get enough attention in this conversation: the lingering effects of the Great Recession.

At the same time, though, families, like states, were getting hit hard by the financial crisis losing jobs, homes, savings.

Student Loans Vs Credit Cards And Auto Loans

In the past decade, total U.S. student loan debt has surpassed credit card debt and auto loan debt. In the third quarter of 2018, Americans owed $840 billion on their credit cards and $1.21 trillion in auto loans. Currently, U.S. student loan obligations are larger than both, trailing only mortgages in scope and impact.

Don’t Miss: College Freshman Classes To Take

Surprising Facts About Graduate Degree Seekers

Its expensive, but Americans are still pursuing graduate and professional degrees and the majority are doing so as full-time students. Of the 1.84 million students enrolled in public or private not-for-profit graduate programs in fall 2016, 57.4% were registered full time. Graduate students are also now more likely to be women than men.

Federal Student Loan Debt

While 30% of undergraduates borrow money from the federal government, the total amount they borrow accounts for 92.6% of student loan debt.

- 52.8% of federal student loan debt is in Stafford Loans.

- 18.6% of federal debt is in subsidized Stafford loans 34.2% is in unsubsidized Stafford loans

- 35.5% of federal student loan debt is in direct consolidated loans.

- 6.4% of student loan debt is from Parent PLUS loans, borrowed by parents on behalf of their children.

- 5% of student loan debt is from Grad PLUS loans going to graduate or professional students.

- 0.4% of student loan debt is from Perkins loans.

- The federal government loans an annual total of $45.3 billion to 44.4% of all postsecondary students .

- The ED budgets $77 billion for federal direct student loans and $13.3 billion for FFEL loans.

- The ED budgets $90.2 billion for all loan programs, leaving $44.9 billion leftover after distribution to students.

You May Like: Is Ashworth College A Good School

Student Loan Borrowers Who Don’t Graduate College

About 40 percent of undergraduates drop out of college. Hence, the student loan statistics of a college freshman class can paint a different picture than the debt statistics of graduating seniors.

Using the most recent data from the U.S. Department of Education, we’re able to get a clear picture of the student debt problem of college students who don’t graduate. Among students who take out student loans to attend college or university, less than half complete their studies and graduate.

| Students Who Take Out Loans to Attend College | |

| Graduated With Student Debt | |

| 41.31% | 58.69% |

From this analysis, we see that 57 percent of students who take on student debt don’t go on to graduate. This is skewed higher than the 40 percent dropout rate for all students. In other words, students who take on student debt are dropping out of school at higher rates than the entire student body.