Nys 529 College Savings Program : New York

- Minimum Opening Balance: $0

- Maximum Cumulative Contribution: $520,000 per beneficiary

- Fees and Expenses: Investment fees top out at 0.13% for all portfolio types

- Tax Benefits for In-State Participants: Up to $5,000 state income tax deduction per individual taxpayer per year up to $10,000 per married couple per year

NYs 529 College Savings Program Direct Plan has a lot going for it: nonexistent account minimums, high lifetime contribution limits, and incredibly low investment fees, regardless of portfolio type. The tax benefits arent half bad, either, topping out at $10,000 in state income tax deductions per married couple per year.

The Direct Plan has a manageable if not vast lineup of investment options. Do-it-yourself investors can mix and match from 13 prebuilt portfolios to create fully customized investment vehicles. And those whod just as soon leave things to the professionals can choose from age-based portfolios suitable for three general levels of risk tolerance: aggressive , balanced , and conservative .

How Do I Open A 529 Plan

You can work with a financial advisor to open a 529 plan, or you can choose a direct-sold plan by yourself. Plans sold by financial advisors tend to be more expensive due to higher fees. Don’t forget that some professionals may not look out for your best interests, encouraging you to select investments that give them a higher commission. If you go the financial advisor route, make sure to do your research asking for 529 account recommendations from trusted friends and family members is a great starting point.

Opening a 529 plan yourself simply requires that you visit the plan’s website and fill out an enrollment form. Information you’ll need includes your full name, Social Security number and the same for your beneficiary. Then, select your investments and fund the account.

How Do Taxes Work With A 529 Plan

Tax advantages are one of the biggest benefits of 529 plans, and savers can benefit in several ways.

In the last several years, a 529 plan has become an attractive vehicle due to its tax advantages, says Adam Holt, CFP and CEO of Asset-Map, a company that helps savers track their financial plan. 529 plans are inspiring people to actually save, especially for education/college expenses. The 529 plan tax advantages are a good incentive.

First, a 529 plan allows you to grow your contributions on a tax-deferred basis, so you wont pay any taxes on your earnings each year, as long as you hold the money in the account.

Second, when you take out money for qualified educational expenses, you wont have to pay any taxes on the money you withdraw. So you save taxes on your capital gains.

Next, some states offer you a tax deduction for contributions that you make to a 529 plan. So youll be able to write off a portion of your taxes for doing something smart anyway.

Utilizing a program that gives you a tax incentive is probably the single most appealing aspect of a 529 plan, says Holt.

Don’t Miss: Ashworth College Reviews 2018

What Happens If My Child Doesnt Go To College

The future is always uncertain, and some parents worry about losing the money they saved in a 529 plan if their child doesnt go to college or gets a scholarship. Generally, you will pay income tax and a penalty on the earnings portion of a non-qualified withdrawal, but there are some exceptions. The penalty is waived if:

- The beneficiary receives a tax-free scholarship

- The beneficiary attends a U.S. Military Academy

- The beneficiary dies or becomes disabled

However, the earnings portion of the withdrawal will be subject to federal income tax, and sometimes state income tax.

What Are The Tax Benefits

The money in a 529 education savings account grows tax-free. So when your child withdraws the money to pay for qualified education expenses, no federal income taxes or in many cases, state income tax will be due.

The same thing goes for a 529 prepaid tuition plan. You fund the account with after-tax contributions, and no federal income tax or state income tax is owed when your child withdraws the money to pay for college.

But, unfortunately, contributing to either type of 529 plan may not help you save much money on taxes next April. You cant deduct contributions from your federal income taxes, but you might be able to earn a state tax deduction, depending on your state.

You May Like: Who Buys College Books Back

The Vanguard 529 Plan: Nevada

- Minimum Opening Balance: $3,000

- Minimum Additional Contribution: $50

- Maximum Cumulative Contribution: $500,000 per beneficiary

- Fees and Expenses: 0.14% investment expense ratio for target enrollment portfolios 0.12% to 0.42% for individual portfolios

- Tax Benefits for In-State Participants: None

The Vanguard 529 Plan is one of the best state 529 plans available to American savers today.

Thats a bit ironic, considering Nevada is one of the handful of states that dont levy state income tax. As such, the Vanguard 529 Plan doesnt offer direct state tax benefits to Nevada residents.

The plan more than makes up for this modest shortcoming elsewhere. In keeping with Vanguards famous commitment to low investment management fees, the Vanguard 529 Plan has some of the lightest expenses of any 529 scheme: just 0.14% of assets under management per year for target enrollment portfolios, passively managed accounts that automatically reduce risk as the beneficiarys expected college enrollment date approaches.

Expenses arent much higher for the plans individual portfolios, which mix and match Vanguard mutual funds to create custom investment mixes finely tuned to account holders risk tolerance and investing objectives.

And as one of the United States largest 529 plan managers , the legendary investment house brings a wealth of experience to bear for its plan participants.

Best For Customized Investments: My529

my529

Why We Chose It: We chose my529 as the 529 plan best for customized investments because, in addition to offering a variety of age-based and static investment options, my529 also offers two customizable investment options.

-

Gold analyst rating from Morningstar

-

Maximum contribution limit of $510,000

-

FDIC-insured investment options available

-

No operating expense ratio fee for FDIC-insured accounts

-

Phone assistance unavailable on weekends

-

Carries an operating expense fee and an administrative fee

The Utah-based my529 offers education savings 529 plans to people throughout the United States so they can save up to $510,000 for a student to pay for college in the future. Not only can you choose from four age-based and seven static investment options , but my529 also offers two customizable investment options, making it our choice for best for customized investments.

Youll pay two sets of fees with my529, an operating expense ratio fee for your investment ranging from 0% to 0.330% and an annual administrative fee ranging from 0.10% to 0.15%. When we checked, the historical average annualized returns since inception on the my529 investment plans ranged from 0.77% to 16.68%.

My529 has a top-tier Gold analyst rating from Morningstar. You can sign up for a 529 plan, manage your account, and contribute online with my529.

If you need help, you can reach the my529 customer service team by phone at 1-800-418-2551 from 7:00 a.m. to 6:00 p.m. Monday through Friday.

Also Check: Can Single Moms Get Paid To Go To College

Best 529 Plans Of 2021

Already have an account? Log in

To help you narrow the field, we analyze plans across the country each quarter and identify the best performing 529 plans for you. Whether you’re looking for the lowest-fee 529 plans, the top-rated plans, or plans with high returns, these 529 plan rankings are a great place to start.

Wondering how your state’s 529 plan compares to other top plans? Select up to three plans for a side-by-side comparison.

Safeguarding Your Own Information: Account Owner Security Checklist

While we strive to keep your information and transactions safe, there are actions you can take to contribute to your own security. The following are some best practices to follow.

Protect your account

- Do not use your Social Security number , in full or in part, for a password or PIN.

- Review your credit reports frequently . Verify the information listed about you is up to date and accurate and that it includes only those accounts and activities you’ve authorized. Work with the credit reporting agencies to have any inaccurate information removed.

- Store your Social Security card, other identification cards, checks and accounts statements in a safe and secure location.

- Do not carry your Social Security card, passport or birth certificate with you unless absolutely needed.

- Do not share your personal or financial information over the phone or in person unless the information is absolutely necessary and you can confirm that the individual and company are legitimate.

- Frequently monitor your financial accounts and report any suspected fraudulent transaction immediately.

- Retrieve and review your mail promptly.

- Shred financial documents no longer needed, pre-approved credit offers, receipts, and other documents that may contain financial and personal information.

Protect your computers, cell phone and other mobile devices

Keep your information secure

Practice safe web browsing

Create a strong password

Stay informed on the latest fraud threats

Read Also: Ashworth College Accredited

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Recommended Reading: College Hill Episodes

Minnesota College Savings Plan

Here’s another big surprise from my research. This plan does not get the credit it deserves for out-of-state investors. Good funds, low expenses, straightforward website. As for state income tax, earnings are tax-deferred until they’re withdrawn, and distributions for higher education expenses are free. I wouldn’t be surprised to see people considering this one a top-tier plan soon.

Withdrawals From A 529 Plan Account

Take advantage of professional money management experience from Fidelity

Withdrawals from a 529 plan account can be taken at any time, for any reason. But, if the money is not used for qualified education expenses, federal income taxes may be due on any earnings withdrawn. A 10% federal penalty tax and possibly state or local tax can also be added.There are exceptions to the 10% penaltyfor instance, if the beneficiary receives a scholarship or attends a US military academy. Any earnings would still be subject to federal income tax and any state and local taxes.

Also Check: Can I Sell My College Books

Ohios 529 Plan Collegeadvantage

Ohios plan offers savers a diversity of investment plans three based on age and five based on your risk tolerance, as well as other investment options, including FDIC-backed accounts. The plan uses Vanguard funds, a leader in low-cost funds, and DFA funds. The plan is available for both in-state and out-of-state savers, and it offers up $4,000 in state tax deductions per beneficiary for Ohio residents.

Withdraw Funds Only For Qualified Expenses

You can use funds from a 529 account for a wide range of education-related expenses. That includes tuition, fees, books, supplies, and computers.

The money can also go toward expenses for room and board, as long as the student is enrolled in school at least half-time. Dorm expenses are always covered, but if your child is living off campus, check the colleges cost of attendance figures to find out the amount thats considered qualified for off-campus housing.

But not all college-related bills are valid for 529 funds. Expenses such as transportation and insurance, for example, are not covered. If youre unsure whether an expense qualifies, check with your plan provider.

Keep in mind that you have to spend the money you take out of a 529 account in the same calendar year as the withdrawal and that you should keep your receipts.

The 529 provider may not require proof of the withdrawal, but the IRS could have questions, says Young Boozer, former Alabama state treasurer and current chairman of the National 529 Campaign, a coalition of more than two dozen states working to raise awareness about 529 plans.

Also Check: Good Colleges That Accept Low Gpa

How Much Does The Texas 529 Plan Cost

Each investment portfolio in the Texas 529 College Savings Plan charges a total annual asset-based fee, which currently stretches from 0.5997% to 0.9887%. When compared to portfolio options in plans other states sponsor, the Lone Star States fees range from low to moderately high.

The total annual-asset based fee depends on the portfolio option you choose and its not charged directly. Instead, its indirectly factored out your account.

For example, lets say you invest $10,000 in one of the higher-fee options with a total annual asset-based fee of 0.9426%. Your fees would amount to $96 in one year. This estimation assumes a 5% annual rate of return and a constant fee level for that length of time.

Im New To Investing Is This Complicated Quite The Opposite

We believe that investing shouldnt be intimidating. Thats why the Oregon College Savings Plan has chosen Sumday Administration, LLC, to be our plan manager. Their intuitive platform and simple interface makes it easy to open an account, add or withdraw money, and keep an eye on things over time. Any questions you might have should be covered in our FAQs, but if you still have others, dont hesitate toreach out to our customer service team.

Also Check: Grammarly Free For Students

What Are The Fees Lower Than You Think

There is a low annual fee of 0.25% of your total savings in order to keep your account running and an annual investment fee based on the investment portfolio youve selected. There are no other recurring fees when you choose to manage your account online and receive statements and withdrawals electronically. If you choose to manage things offline or require printed materials, there are some additional fees. Learn more about account fees.

Stanley G Tate Florida Prepaid College Plan

The Stanley G. Tate Florida Prepaid College Plan is the name of Florida’s Prepaid Tuition Plan. This plan allows residents to prepay for the cost of tuition and specified fees for the plan purchased. It also has an optional university dorm housing plan that may be purchased to pay for university housing.

The plan gets the most value by using it for in-Florida colleges. However, the plan may be applied toward the costs at any eligible education institution nationwide. Benefits are paid out at the current rates paid to public colleges or universities in Florida at time of usage, per actual plan purchased.

It’s important to note that you must purchase a plan by the time the beneficiary is in the 11th grade. Also, the plan benefits must be used within 10 years after the expected date of college enrollment , unless an extension is requested.

Fees:

Enrollment fee of $50.

Who Should Use It:

This is a solid plan for someone who is planning to attend college in Florida. However, given that Florida’s tuition prices have been relatively flat, it could also be a wash versus simply saving in a 529 plan.

Don’t Miss: Ways To Graduate Early

Are There Any Contribution Limits Or Income Limits

Regardless of how much money you make, the federal government doesnt place any income restrictions on who can open a 529 college savings plan.

Theres also no defined contribution limit. Just keep in mind that if you invest more than your child needs to pay for qualified education expenses, your child might have to pay income taxes on any withdrawals that arent used to pay for college.

What Is The Best Way To Save For College 529 Plans

There are several ways to save for college, including 529 college savings plans, prepaid tuition plans and Coverdell education savings accounts. Of these, 529 plans are the best way to save for college.

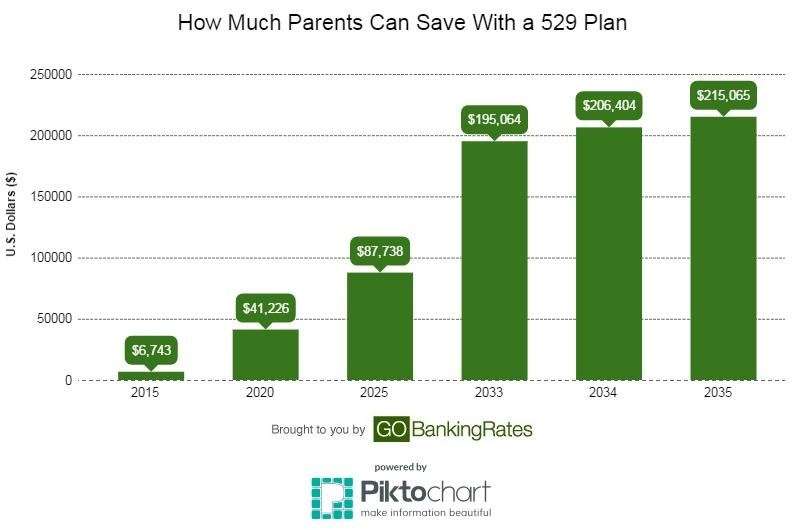

Start saving for college when the child is young. Aim to save about one third of future college costs. Set up an automatic monthly transfer from your bank account to the 529 plan.

Choose a direct-sold 529 plan with low fees, ideally one with a state income tax break on contributions. Use an age-based or enrollment-date asset allocation within the 529 plan to balance risk and return.

529 plans are the best way to save for college.

getty

Don’t Miss: Can I Sell My College Books