How Long Does It Take To Pay Off College Debt

The average student borrower takes 20 years to pay off their student loan debt. Some professional graduates take over 45 years to repay student loans. 21% Of borrowers see their total student loan debt balance increase in the first 5 years of their loan.

How Long Does It Take To Pay Off 100k In Student Loans? Between 15 and 20 years. The more youre able to contribute to your debt per month, the sooner you can pay off the balance and the less youll pay in total. It could realistically take between 15 and 20 years to pay off a $100,000 student loan balance, or longer if you require lower monthly payments.

What Is The Fastest Way To Get Rid Of College Debt? 8 Ways to pay off your student loans fast. Make additional payments.. Establish a college repayment fund.. Start early with a part-time job in college.. Stick to a budget.. Consider refinancing.. Apply for loan forgiveness.. Lower your interest rate through discounts.. Take advantage of tax deductions.

How Long Does It Take To Pay Back University Debt? Any outstanding student debt is written off after 30 years, even if nothing has been paid back during that time . In fact, studies have estimated that over 70% of graduates wont have paid their full loan back after 30 years.

Q Is College Worth The Money Even If One Has To Borrow For It Or Is Borrowing For College A Mistake

A. It depends. On average, an associate degree or a bachelors degree pays off handsomely in the job market borrowing to earn a degree can make economic sense. Over the course of a career, the typical worker with a bachelors degree earns nearly $1 million more than an otherwise similar worker with just a high school diploma if both work fulltime, year-round from age 25. A similar worker with an associate degree earns $360,000 more than a high school grad. And individuals with college degrees experience lower unemployment rates and increased odds of moving up the economic ladder. The payoff is not so great for students who borrow and dont get a degree or those who pay a lot for a certificate or degree that employers dont value, a problem that has been particularly acute among for-profit schools. Indeed, the variation in outcomes across colleges and across individual academic programs within a college can be enormousso students should choose carefully.

Getting A Forbearance To Temporarily Stop Paying Off Student Loan Debt

With loan forbearance, your loan holder gives you permission to stop making payments for a set amount of time or permits you to temporarily make reduced payments. Common reasons supporting a forbearance include poor health, unforeseen personal problems, your inability to pay the loan within ten years , or monthly loan payments that are more than 20% of your income.

Also Check: Can I Sell My College Books

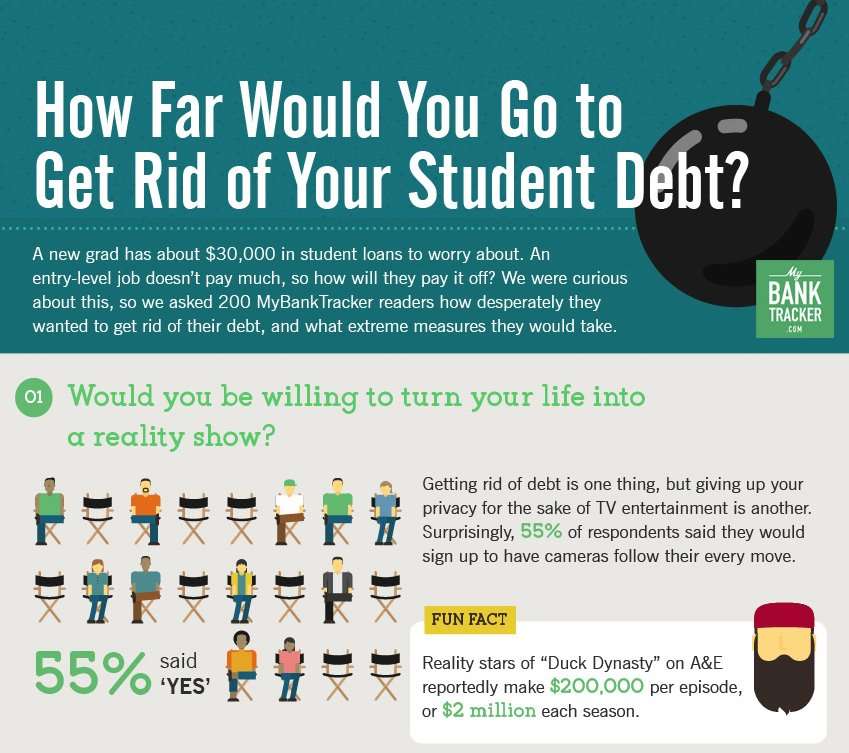

Our Story Of Student Loan Debt Is Not Unique

In 2016, 70% of college graduates exited school with student debt totaling 43 million student loan borrowers in the United States. All of this debt in the U.S. totals $1.4 trillion dollars in loans, and it is growing at a rate of about $3,000 per second! Want some perspective on that? In the time that it took you to read this article so far , another $360,000 of student loan debt was added to that massive total

The average 2017 graduate will leave school with over $37,000 in debt and an average payment of almost $400 per month! Of the students that graduate with secondary or professional degrees , more than half have over $100,000 in student loan debt and more than 30% have over $200,000 in debt. Year-after-year, these statistics continue to skyrocket, making a frightening situation for most young professionals trying to start their careers.

Consider Refinancing Your Student Loans

Effectiveness: High

Student loan refinancing is an increasingly popular option for borrowers with good or excellent credit and relatively high interest rates.

When you refinance, you essentially consolidate your student loans into one by taking out a new loan with a private lender and use it to pay off your original loan. This allows many borrowers to secure lower interest rates because theyre more financially stable than when they took out the loan in the first place.

Keep in mind that if you refinance your federal loans, youll no longer have access to federal programs like income-driven repayment or student loan forgiveness. But if you think refinancing could be a good fit for you, use this student loan refinancing calculator to estimate how much you could save.

You May Like: Central Texas College Culinary Arts Program

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Find State Assistance For Your Student Loans

Many states also offer various student loan forgiveness programs for your student loans. 46 out of 50 states offer at least one program, with some states offering many different programs to cover a wide variety of loan types, employment, and more. In fact, Kansas offers student loan forgiveness of up to $15,000 for just living in certain parts of the state.

Before you give up on not qualifying for Federal loan forgiveness programs, check your state and see if they offer any incentives or assistance: Student Loan Forgiveness by State.

You May Like: Can Single Moms Get Paid To Go To College

Addressing Racial Disparities And Predatory Practices In Our Higher Education System

In addition to canceling existing student debt, we must take steps to improve college affordability and curb the growth of student loan debt in the future. I have already called for new laws making public college and technical school tuition-free, supporting HBCUs and Minority-Serving Institutions and working to close the racial gaps in access to higher education and college completion, and ending for-profit collegesâ access to federal student aid. Iâll urge Congress to adopt these proposals, but I will also use all the existing authorities at my disposal to fight racial disparities in higher education, encourage investments in public higher education that improve affordability and limit indebtedness, exclude predatory for-profit colleges from accessing federal aid, and crack down on predatory lending products.

Addressing Racial Disparities in Higher Education through Civil Rights Law

Our nationâs civil rights laws are clear: discrimination in the provision of student loans is illegal. Title VI of the Civil Rights Act prohibits discrimination in the provision of federal financial assistance, and the Equal Credit Opportunity Act prohibits discrimination in the provision of credit products, including federal student loans.

Consolidate Your Federal Student Loans

The next option to try to help you eliminate your student loan debt is to consolidate your Federal student loans. Now, while consolidation by itself won’t help you lower your payments or your student loan balance, what it will allow you to do is to be financially organized.

When you start college before your Freshman year, you’ve likely already signed up for your first student loan. Then, you sign up and receive a new student loan each year. And if your Federal student loan doesn’t cover the full balance of your tuition, you likely have private loans as well . That means you could have four or more different loans and payments. How confusing!

To make matters worse, each of these loans could have a different payment amount and due date. If you mess up one payment, you could harm your .

Recommended Reading: What Is An Undergraduate College

Personal Debt Forgiveness: Escape Their College Loans These Products Makes It Possible To Get Rid Of Student Loans

Personal Debt Forgiveness: Escape Their College Loans. These products makes it possible to get rid of student loans

Just how can group beat their unique student loan debtand, particularly, when are financing forgiveness an option? We do not require another statistic to share with you just how strong in education loan loans U.S. college students become. Full financial obligation and average debt figures you shouldnt suggest much, except to state that if the sums you borrowed from help you stay up at night, you are in close providers. What truly does matter try discovering a solution.

Make Public Colleges Universities And Trade Schools Free For All

Attending some of the best public colleges and universities was essentially free for students 50 years ago. Now, students are forced to pay upwards of $21,000 each year to attend those same schools.

Every young person, regardless of their family income, the color of their skin, disability, or immigration status should have the opportunity to attend college.

When Bernie is in the White House, he will:

- Pass the College for All Act to provide at least $48 billion per year to eliminate tuition and fees at four-year public colleges and universities, tribal colleges, community colleges, trade schools, and apprenticeship programs. Everyone deserves the right to a good higher education if they choose to pursue it, no matter their income.

Recommended Reading: Is Ashworth College Accredited

Most People Can’t Eliminate Student Loan Debtbut Many Can Get Better Payment Plans

By Kathleen Michon, Attorney

Student Loan Relief Due to the COVID-19 Crisis

Most federal student loan payments are on hold, and interest is waived,during the COVID-19 national emergency. Collection actions, wage garnishments, and Treasury offsets, like tax refund offsets and Social Security intercepts, for defaulted federal student loans are also paused during this time.

Also, the American Rescue Plan Act of 2021, which President Joe Biden signed into law on March 11, 2021, includes a provision exempting all student loan forgiveness after December 31, 2020, and before January 1, 2026, from federal taxation. Federal laws generally treat any forgiven student loan debt as a taxable event for the borrower unless they were forgiven for specific reasons, like the death or disability of the borrower . The American Rescue Plan Act makes student debt forgiveness tax-free until January 1, 2026. The tax exemption under this law applies to direct federal student loans, Federal Family Education Loans , and private student loans.

Of the millions of Americans who struggle to pay their federal student loans, many want to know: Can I reduce or eliminate my student loan debt? In very limited circumstances, it’s possible to get rid of student loan debt. But most people won’t be able to wipe out some or all of their loans.

Below is an overview of your options if you’re struggling to pay your student loans.

Use Your Credit Card Wisely

Look for a credit card with the best interest rate.

If you can, find ones that have a zero interest rate option and minimum payments that fit your budget.

You can also look at refinancing higher interest cards so you could get a lower interest rate.

It also makes sense for you to pay off your credit card with the highest interest rate first. These cards cost you more money in the end, so make sure to deal with it first.

Recommended Reading: How Much Does 4 Years Of College Cost On Average

Apply Every Raise And Tax Refund Toward Paying Off Your Student Loans

What do most people do when they get a raise? They blow through it like its nothing. And then they wonder why it felt like they didnt get a raise.

As you keep growing in your career and getting promotions as you go, put your extra income toward paying off those student loans. Dont move to a bigger house. Dont buy a new car. Dont buy any designer threads. And dont upgrade your smartphone. You were living without that extra money before, and you can keep living without it a little while longer. Now is not the time to upgrade your lifestyle. You can do that later when you dont have a payment in the world! Use your income boost to make major progress in your fight against student loan debt.

The same goes for your tax refund. How many people do you know who take that free money and burn it all on new furniture, clothes or a 55-inch flat-screen TV? One extra deposit into the bank account, and suddenly a little voice in your head yells, Treat yourself!

Heres a not-so-fun fact: Your tax refund isnt free money from the government. Theyre just giving you back your own money because you paid them too much. They were just holding onto your money all year long with zero percent interest earned! If you really want to treat yourself, take that refund and put it directly toward paying off a big chunk of your student loans!

For 15 Million Borrowers A Slate Wiped Clean

More than a third of federal borrowers could see their balances fall to zero with $10,000 in debt cancelation. Among those, 7.9 million owe less than $5,000 in student loans and 7.4 million owe between $5,000 and $10,000, according to federal data.

» MORE:How many Americans have student loan debt?

These are also the borrowers most likely to default on their loans. Over half of those who default have less than $10,000 of federal undergraduate debt, according to an analysis of federal data by The Institute for College Access and Success, or TICAS.

Thats because those with lower debt amounts often have not completed their schooling, so they dont reap the benefits of a degree that leads to a better paying job. Among those who default, 49% did not complete their program of study, TICAS found.

Default has severe consequences: It can sabotage credit scores and trigger collection efforts that can include seizure of tax refunds and Social Security payments.

Many of these borrowers are current on their payments. For them, forgiveness could help, but it might not be much of a boon to the overall economy, says Betsy Mayotte, president and founder of The Institute of Student Loan Advisors.

If you owe $10,000 and your payment is $120 and thats a lot of money to a lot of people but you all of a sudden dont have to pay $120 a month, I dont see that $120 being put toward something that will stimulate the economy, Mayotte says.

Recommended Reading: Good Colleges That Accept Low Gpa

Consequences When You Stop Paying Student Loan Debt

Once you are in default your lender has many aggressive options to get you to pay your balance. Here are some of the things that happen:

- You lose eligibility for forgiveness, forbearance, deferment, and changing repayment plans.

- You lose eligibility for financial aid.

- The lender can garnish your wages, tax returns, social security, and other government payments.

- Your lender can sue you.

- The lender may put a lien on any property you own.

If Youre Failing Classes

If youre failing one class, you might need a tutor. If youre failing every class, it may be tempting to drop out altogether.

But if the transition from high school to a four-year college was more difficult than anticipated, consider transferring to a community college also known as a reverse transfer.

Why bother transferring instead of dropping out? By continuing your education as a full-time or at least half-time student, lenders will typically allow you to defer your student loans.

You could save $224 per credit hour by going to a community college instead of a four-year school, according to a Penny Hoarder analysis of National Center for Education statistics.

Thats important because during deferment, you dont need to start paying back your student loans right away and if you have subsidized federal student loans, the U.S. Department of Education will cover the accruing interest during deferment.

Recommended Reading: Is Atlanta Technical College Nursing Program Accredited

How Can I Get Out Of Paying My Sallie Mae Student Loans

Luckily, Sallie Mae offers deferments, meaning you can reduce or postpone your payments if youre returning to college, going to graduate school or entering an internship or residency. You can receive a deferment for up to 48 months. When you defer your loans, interest continues to accrue on the balance.

Find Help Along The Way

If youre drowning in debtor if youre just sick and tired of working so hard and watching your money go to a lot of debt paymentsyou might feel lonely. But hear this. You. Arent. Alone. And you dont have to figure it out alone! Get help along the way. Its not a sign of weakness. Its a sign of maturity!

You can learn the step-by-step plan for how to get rid of debt and save money for the future in Financial Peace Universityavailable only in Ramsey+. This plan actually worksto the tune of the average household paying off $5,300 in the first 90 days of working it. And you can give it a test-drive with a Ramsey+ free trial.

Recommended Reading: Is College Ave Student Loans Legit

Ways To Eliminate Your Student Loan Debt

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

Every story I hear about student loans is similar: I have this debt, and I want it gone. Of course you do! I want it gone for you! But where do you start?

Ways To Pay Down Or Eliminate Your Student Loan Debt