The Student Aid Report

After your information is processed, youll receive a SAR that contains the data you entered on the FAFSA. If you entered an email address on the FAFSA, youll receive an email letting you know your SAR is ready to review on studentaid.gov. If you didnt enter an email on the FAFSA, youll receive a SAR via postal mail. You can also find it online at studentaid.gov.

Review the SAR carefully for errors . Follow directions for making and submitting corrections. Submit corrections promptly so your colleges have the most up-to-date information.

How To Find Fellowships And Research Scholarships

During your undergraduate years, you likely navigated the financial aid experience with ease. Fill in your forms and the school will take care of the rest. However, you will quickly notice that medical school is a different beast. You will be expected to find your own sources of funding before diving into your studies. Here are some tips that can help you find fellowships or research scholarships on your own.

Choose The Correct Year

This is slightly tricky and a common mistake when students fill out the FAFSA! You are applying for financial aid for NEXT school year, so make sure to select the following year, not the current one. For example, if you are filling out the FAFSA in the Fall of 2021 and you are a senior in the Class of 2022, you will fill out the 2022-23 FAFSA .

On October 1st, the following years application opens.

Read Also: Where Is Sam Houston College

Where To Find Help In Completing The Fafsa

Most errors on the FAFSA are made because students and/or parents fail to read the instructions or don’t fully understand the instructions. Please read ALL of the FAFSA instructions carefully.

If you need help:

- Attend a workshop where a presenter helps families complete the FAFSA and learn about how to pay for college. Check for locations here: www.mafaa.org or at Minnesota Goes to College.

How To Fill Out The Fafsa

Whether youre a student filling out a FAFSA, or a parent of a student, the steps below will help you fill out the FAFSA the right way and qualify for maximum benefits. Remember, you must complete a FAFSA form for each school year.

Now that you understand how your FAFSA form can affect your future, well walk you through the process step by step.

Find this infographic helpful? You can download a hi-res version to print or use in your office here:

You May Like: Do Community Colleges Offer 4 Year Degrees

A Crash Course On College Financial Aid Paperwork

Your child got into collegenow, how do you pay for it?

If youve been diligently saving money in a 529 plan, you still might not have enough to cover all college-related expenses. Items such as food and study materials arent always considered eligible under 529 rules, which means youll be saddled with extra costs.

College financial aid could significantly offset the amount youre responsible for, freeing up more of your own resources to cover the items not eligible for 529 funds or other financial aid.

After Filling Out The Fafsa Consider Completing The Css Profile

- If you are applying to these schools you should complete the CSS Profile. Prior to filling out the CSS Profile, gather all of the documents needed in order to make the process run smoothly.

- Since the CSS Profile gives each school an opportunity to ask additional questions, be prepared to provide information on other financial items, such as vehicles owned or amount owned on vehicles, second mortgages, and home equity loans.

- There is also a Special Circumstances section that enables families to explain any extenuating circumstances that may impact their financial situation.

You May Like: Can You Test Out Of College Courses And Get Credit

Types Of Student Loans

Student loans are from the federal government or from private sources, such as a bank, credit union, state agency, or school. Learn the differences between federal and private loans before considering a loan.

Federal Student Loans

If you need to borrow money to pay for college or career school, start with federal student loans. Theyre more affordable than private loans.

Types of Federal Student Loan Programs – The William D. Ford Federal Direct Loan Program offers four types of Direct Loans:

- Direct Subsidized Loans are made to eligible undergraduate students based on financial need.

- Direct Unsubsidized Loans are made to eligible undergraduate, graduate, and professional students, and are not based on financial need.

- Direct PLUS Loans are made to graduate or professional students and parents of dependent undergraduate students.

- Direct Consolidation Loans allow you to combine all of your eligible federal student loans into a single loan with a single loan servicer.

Eligibility – You must be enrolled at a school that participates in the school loan program, and meet the general eligibility requirements.

How to apply – Complete the Free Application for Federal Student Aid or FAFSA.

Private Student Loans

Before taking a private loan, make sure you need it. These loans generally are not as affordable as federal student loans and offer little repayment flexibility. Read these tips before getting a private loan.

How Does Student Loan Repayment Work

Each loan specifies its own repayment terms and timeline, such as fixed payment amounts over a period of 10 years. Students with multiple loans may consolidate them into a single Direct Consolidation Loan. This offers the convenience of making a single payment instead of several payments to multiple lenders each month.

Many federal loans offer loan forgiveness programs for qualifying graduates, including those who become teachers or work for a government agency. Some students may pursue deferment — a temporary postponement of repayment — for special circumstances, like unemployment or economic hardship.

DISCLAIMER: The information provided on this website does not, and is not intended to, constitute professional financial advice instead, all information, content, and materials available on this site are for general informational purposes only. Readers of this website should contact a professional advisor before making decisions about financial issues.

Recommended Reading: What College Has The Best Law School

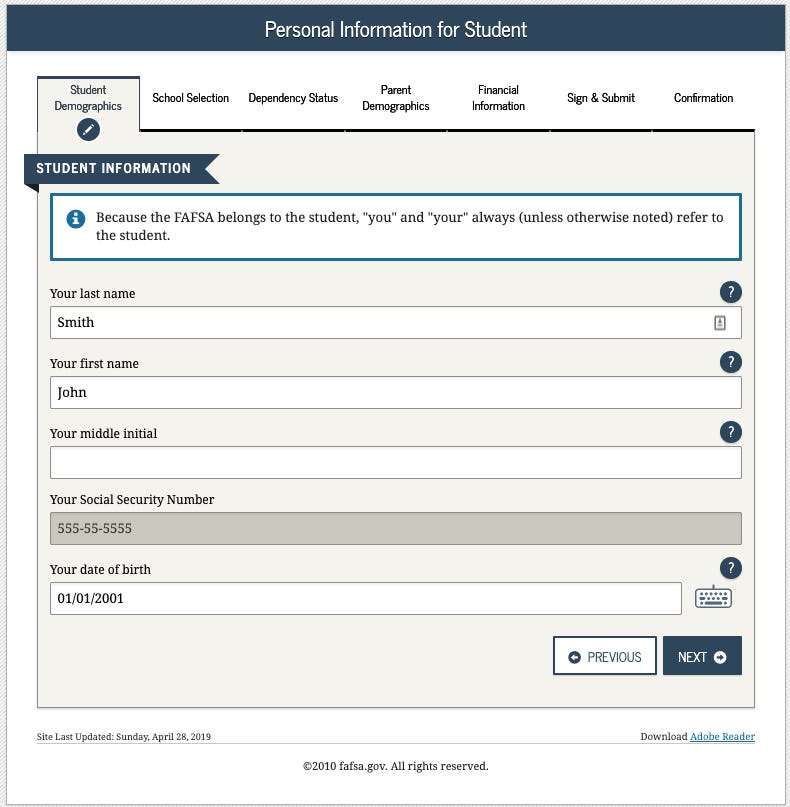

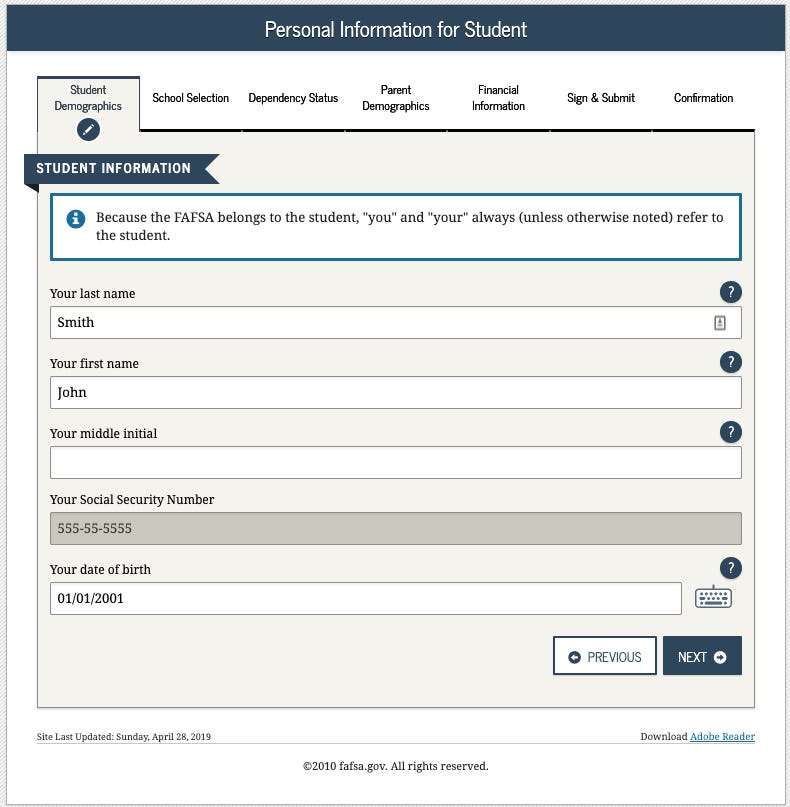

Fill Out Your Student Demographics Section

This is your full name, date of birth, social security number, and other personal information. If you are renewing your FAFSA, your information will be carried forward from the last application, saving you time. Enter your name exactly as it appears on your social security card.

If you are a parent entering information on a students FAFSA form, remember that the questions are for the student. If you are unsure, check the banner on the left side to see whether youre on the student or parent page.

The FAFSA form asks you a set of questions that will determine whether you are a dependent student or independent student for federal student aid purposes.

If you qualify as a dependent student, you are required to report parent information in addition to your own information on your application.

Find out here to see whether you qualify as a dependent student.

Determine If You Will Provide Parent Information

For most high school and college students the answer here is YES. The system in the United States is based on parents paying for college even if the student is over 18 and most students are dependent, which means they will provide parent information. You will need to do this even if your parents will not be paying for college. Their income will still determine your eligibility for different types of financial aid.

You are an independent student if any of the following apply to you:

- You are 24 years old or older

- You are active duty in the military or are a veteran

Read more on the US Department of Educations website about the fine print of the criteria for being an independent student. You can also check out this video which covers the same information about dependency.

Keep in mind that if you are under 24 and any of these situations apply to you, colleges will ask for documentation that proves that situation applies to you, so make sure to gather those documents now so you are ready to provide them when asked . You will not be able to receive financial aid without providing this documentation.

You May Like: What Is The Best Financial Aid For College

Talk To Your Professor

Publish or die is a saying thats commonly heard on college campuses. As such, professors are constantly looking for new avenues to research and, therefore, students to act as research assistants. Reach out and see if you can lend a hand. Many such fellowships are sponsored by medical research companies or universities and can help you pay your way through medical school.

Additionally, many professors at medical schools often practice what they preach by serving at local hospitals. See if there are any local positions you may apply for. Doing so will not only help you financially but also put you in a position to get noticed by the admittance committee when it is time to apply for your residency.

Ownership Of An Asset

In some cases the ownership of an asset is divided or contested, which can affect how the student reports the asset.

Part ownership of asset

If the parent or student has only part ownership of an asset, the student should report only the owned part. Generally the value of an asset and debts against it should be divided equally by the number of people who share ownership unless the share of the asset is determined by the amount invested or the terms of the arrangement specify some other means of division.

Contested ownership

Assets shouldnt be reported if the ownership is being contested. For instance, if the parents are separated and cant sell or borrow against jointly owned property because its being contested, the parent reporting FAFSA information would not list any net worth for the property. However, if the ownership of the property is not being contested, the parent would report the property as an asset. If ownership of an asset is resolved after the initial application is filed, the student cant update this information.

Lien against, and imminent foreclosure of, an asset

Untaxed income . These questions total the untaxed income, some of which is reported on the tax form even though it isnt taxed. A student who hasnt filed a return will have to estimate these amounts, and students or parents may need to separate information from a joint return.

c. Child support received for all children.

Income and benefits NOT to be included:

Read Also: When To Begin Applying For College

When And How To Fill Out The Fafsa

The federal deadline for the FAFSA is June 30th, but you should apply much earlier than that.

In order to receive the highest amount of aid, you should submit your Free Application for Federal Student Aid as soon as possible as of October 1st of the year before you will be attending college. This is because most colleges award some kinds of aid on a first-come, first-served basis. Colleges can and will check to see when you submitted your FAFSA and will award aid accordingly. In the past, many college applicants put off filling out the FAFSA until their families had completed their taxes since the form asks for tax information. However, this is not necessary because of the changes made to the FAFSA in 2016.

You can now use your prior-prior year tax return when filling out the FAFSA. For example, if you’re planning to enter college in the fall of 2020, you can fill out your FAFSA beginning October 1st of 2019 using your 2018 tax return.

Before you sit down to fill out the application, make sure you have gathered all the documents you’ll need to answer all the FAFSA questions. This will make the process much more efficient and less frustrating.

It is important to note that colleges that offer institutional aid often will require you to submit different forms in addition to the FAFSA. For example, many schools require the CSS Profile. Be sure to check with your school’s financial aid office to know exactly what kinds of aid are available and what you can do to receive them.

Create Your Federal Student Aid Id And Save Key

Youll have to fill out the application online at studentaid.gov, as the mobile app has been discontinued.

Before you can start the FAFSA application process, you must set up an account with a Federal Student Aid ID, which requires a students Social Security number or alien registration number. It takes one to three days to confirm your account, so start this process several days beforehand.Your FSA ID is a username and password for your account. It also acts as your electronic signature when you submit the FAFSA online. This video will guide you on setting it up.

One parent also needs to set up a separate FSA ID if youre a dependent student. The parents FSA ID is solely to sign electronically, and it requires their Social Security number, a separate email address, and a separate phone number from the student’s. If your parent doesnt have a Social Security number, they cant get an FSA ID. They should instead insert zeros in place of their Social Security number and print the signature page at the end to sign and snail mail.

Youll use the same FSA ID every year you fill out the FAFSA. It can be reset if you forget your password or username, but the FAFSA locks you out after three attempts to sign on so reset before that third try. Returning users can log in and hit FAFSA renewal to populate the personal information from last years form.

You May Like: How To Apply For Financial Aid For College

Css Profile Questions That May Be Difficult To Answer

Some items on the application may confuse first-time users. Here are a few situations to be ready for:

- If your parents are divorced: Your noncustodial parent might be required to fill out the CSS Profile application. If you dont have contact with your noncustodial parent, you may be able to submit a waiver to colleges requesting that their information not be included. Be aware that some colleges might deny your request and require both parents income.

- If youre an international student: You can submit financial information in your home countrys currency, and the College Board will do the currency conversion for you.

- If schools pose supplemental questions: Some colleges ask supplemental questions. Make sure youve answered every question from each individual school, as your answers on these will only be visible to the specific college asking for that information.

Enter Your Personal And School Information

The first two sections in the meat of the application focus on the student’s personal information and school selection. In the student demographics section, you’ll need to enter your name, address, email address, phone number, driver’s license number, marital status, citizenship status, Selective Service status, and education history.

On the School Selection tab, you will enter information about your high school and college. If you have your college’s Federal School Code, you can enter it here. Or you can look it up with a search system. Once you pick your school and enter your planned housing status, you can move on to information about the household and parents.

You May Like: How Do I Find Out My College Credits

My Responsibility: The Search For Fit

The goal of this process is to find the post-secondary pathway that is the best fit for you. Maybe thats going to college to study architecture, or maybe its taking a gap year, or maybe its taking a shot at starting your own business. Careful research will help you find the pathway to best match your goals.

To find the best fit, you need to thoughtfully consider what you want and reflect, realistically, of what you are capable of. You also need to know what options are available to you out there in the world. Thats where research comes in. EFC limitations should play a major role in guiding initial school search. High EFC affords more options. Low EFC requires more detailed research into the schools admission and aid award policies.

How to Use the Common Data Set for Understanding College Fit

Section B

This section breaks down general enrollment by categories such as cohort, gender, and racial/ethinic identity. If diversity is important to your college experience, this will be a useful section for you!

Section G

Reminder: Section G outlines the COA for the university. Understanding how and where the money goes is an important part of your research.

Section H

Lets review: From this Common Data Set, we can gather the following details about the school:

Average need-based aid package to international students is $64,000 USD.

Total institutional aid awarded to international students is approximately $38,000,000 USD.

Gather All Required Materials

To fill out the FAFSA, you’ll need your driver’s license and your Social Security number .

The Office of Federal Student Aid requires financial documents such as your most recent W-2s and federal tax returns. You must also provide current bank statements investment records for stocks, bonds, and real estate and any information on farm or business assets.

Additionally, you may need to supply untaxed income records for things like child support, veteran noneducation benefits, and interest income.

If you’re a dependent, note that your parent or guardian must submit all these materials as well.

Recommended Reading: How To Transfer To Another College