Examples Of Financial Goals For College Students

You may find it helpful to use some of these examples of financial goals to help guide you in the beginning.

Your objective to start with is to select 3 financial goals that are your main priority for the next 12 months.

Some of these may be to actually spend money as well, but make this intentional.

One of your objectives at college is obviously to make new friends and have some fun. You can allocate part of your income to do this, but work it into your plan.

Starting to pay down your college loans is another super smart financial goal for a college student. Putting as much as you can afford against your student loans will give you a fantastic start to your life, and remove a lot of pressure and worry for you as well.

Allocate an amount that is comfortable for you and work it into your 12-month financial plan.

Here is a suggested list of financial goals you may like to set as a college student:

Short term goals:

- Buy a small car

- Commit to paying $20 a week towards student loans

- Purchase a laptop in 3 months time

- Reduce your living expenses and set a barebones budget

Longer-term goals:

- Get rid of any car loans or credit card debt $1,000+

- Start investing/saving for a home deposit

- Save for a decent holiday to celebrate graduating

- Pay off all student loans in 5 years

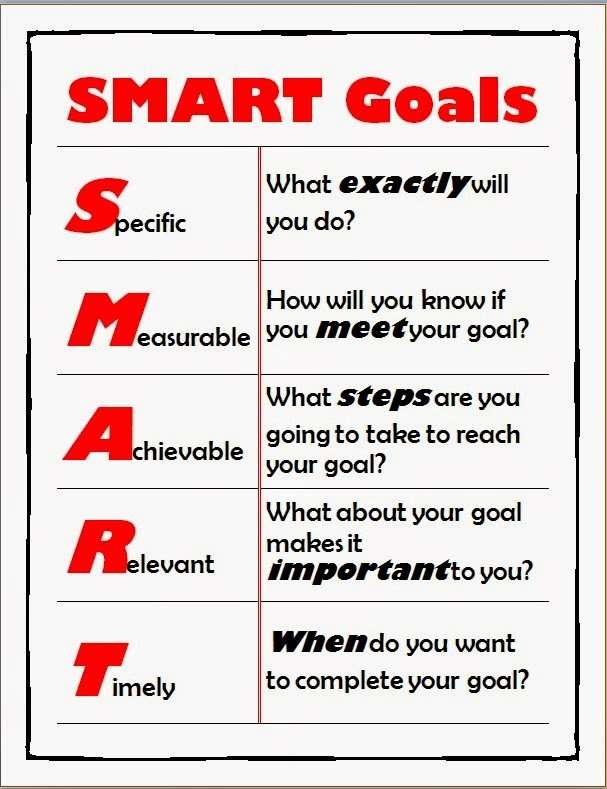

Next, we need to make sure these financial goals are set up smartly, to give you the maximum chance of achieving them.

Being An Ideal Student

Read A Little Every Day

Does reading make you smarter? Yes, regardless of content, reading increases your intelligence. A paper by Anne E. Cunningham claims that children who read turn into smart adults. Interestingly, Cunningham suggests that the actual reading material plays little role in the result. Instead, the act of reading produces increased intelligence.

Reading creates an atmosphere for reflection and analytical thought. You pause and consider what you read. The practice of reading demands attention. Simply by concentrating, you stimulate your mind and increase your brainpower.

Of course, as an adult, you benefit more by absorbing interesting or challenging material. Pushing yourself to digest harder texts puts a healthy strain on your mind. Books covering topical or socially relevant subjects force you to think critically.

Meanwhile, fiction increases your capacity for understanding the human condition and boosts your emotional intelligence. Reading also jam-packs your brain with tons of knowledge and vocabulary.

Try to pick up a good book and read on a daily basis. Its fun, relaxing, informative, and exercises your brain.

Read Also: Is Atlanta Technical College Nursing Program Accredited

Take An Extra Challenging Course

Look for courses that interest you outside your degree program or current area of focus, and try to challenge yourself to move out of your comfort zone. While there may not be time to do this every session, you can calculate how many elective credits you need to take and then set aside a certain number of these for challenging, unfamiliar courses. Pushing yourself to try something new can be a great way to keep yourself intellectually engaged, especially during sessions where your coursework is otherwise focused on general education credits or basic introductory classes in your degree program.1,2

Start Studying For Tests At Least One To Two Weeks In Advance

Cramming for tests is always a bad idea. It wont enable you to achieve long-term success at school.

I recommend that you set a reminder on your phone one to two weeks before every scheduled test, so that youll start preparing for the test.

For big exams, I recommend that you start studying four weeks in advance or more.

This study tip is a vital one for students to implement.

Read Also: Arlando College Hill

Give Shopping For Groceries Online A Try

A lot of big supermarkets now offer home deliveries or curbside pickup and its not just a massive timesaver but also a great help if youre looking at how to save money in college. First, its way easier to fill your virtual shopping cart with items you need without wandering off to other aisles and seeing enticing deals for stuff you werent planning to buy. Second, seeing the total worth of the items in your cart displayed at all times will make it harder to keep adding things you dont need without giving it a second thought!

Dont Go Wandering The Aisles

Have you ever noticed how the items people tend to buy the most often are always placed at opposing corners of the shop? Its done that way on purpose: by making you walk around the entire store, the salespeople boost the chances of you seeing more grocery deals and getting more items into your cart on the way. If youre saving on food, try to stick to the things you need and skip the sections you had no intention of buying anything from.

Read Also: Where Can I Sell My Old College Books

Know What Insurance You Need

Theres insurance available for practically everything under the sun. As a college student its important to know what types of insurance you need.

If youre not married and dont have any children then you probably dont need life insurance quite yet. However, you do need health insurance, auto insurance, and renters or homeowners insurance. Its important to set these things in place so that youre protected.

Confused? Check out these resources:

Break Big Tasks Into Smaller Ones

Big tasks seem complicated and overwhelming, which is why many students procrastinate.

Break every big task down into smaller tasks. For instance, instead of deciding to work on your history paper, you might break the task down into the following smaller tasks:

- Read Chapter 3

- Do online research

- Develop thesis statement

- Write conclusion

- Proofread and edit

When you work on the history paper, focus on completing one task at a time. This will make it less likely that youll procrastinate.

Don’t Miss: How To Transfer Colleges Cuny

Study Smart Before Exams

Many college students feel stressed and overwhelmed when a test or exam is approaching. Following our study plan and time-management tips should help you feel more prepared in the lead-up to an exam. When it comes time to study, there are many common study methods that can help enhance your exam prep, and reduce your stress. Below is a detailed list of common study methods college students use to prepare for exams.

Get Rid Of Distractions Before They Become Distractions

The biggest obstacle to doing well in school is distractions.

To overcome distractions, you cant only depend on willpower. Few of us have the willpower necessary to fight off all the distractions that surround us in this digital era.

Here are some ways to eliminate distractions before they become distractions:

- Turn off notifications on your phone/tablet

- Delete all the apps that distract you

- Put your phone/tablet in another room before you start work

- Set a really, really long password to unlock your phone/tablet

- Restrict your Internet access

- Have only one tab open in your browser at any one time

- Find an accountability partner as you make these changes

Also Check: College Hill Season 1 Full Episodes

Choose A Course You Like

When you are short listing the course that you’d like to pursue in college make sure that you are genuinely interested in the field. Do not base your decisions on factors like which course leads to the best salary packages and such. Remember that unless and until you have a good academic background and sufficient skill set no matter what course you take up you won’t find a high paying job. On the other hand if you go for a course that you enjoy, your work would not be a burden for you, you’d enjoy it. And you would be more driven and passionate towards giving your best. Thus, leading to good and positive results at work. Constant excellent work results would lead to promotion and better salary packages. Always remember be the best at whatever you do.

Keep Track Of Important Dates Deadlines Etc

This is related to Tip #3, but its more specific.

Ive worked with many students who try to keep track of important dates by storing them in their brains.

Needless to say, these students occasionally forget about upcoming tests or deadlines. This results in panic and low-quality work too.

Use Google Calendar or Google Keep to keep track of important dates, and youll become a more effective student.

Also Check: How Long Are College Credits Good

Monitor Your Credit Score

Three major companies provide free annual credit reports: Experian, Equifax, and TransUnion. Get a credit report from all three companies at least once a year to check for errors or identity theft and to get as thorough a review as possible. Free sites like CreditKarma and FreeCreditReport.com give users access to just one of these reports, leaving room for error.

Note: its a myth that checking your credit score will lower itthats only the case when lenders or credit card issuers inquire about your score, for example when applying for many credit cards at the same time.

Broad Goal I Want To Improve My Listening In English:

- Specific I will subscribe to an English podcast

- Measurable I aim to listen to one podcast a week

- Achievable I will download them to my phone so I can listen on the way to school

- Relevant I will choose a topic that interests me to keep me engaged

- Timely I will listen to one podcast a week for 6 weeks and then reassess

SMART goal: I will listen to a different English podcast once a week, for six weeks, on my phone. I will listen to a range of topics that interests me, and I will listen on my way to work to build the habit.

Read Also: Where Should I Go To College Buzzfeed

Hang Out With People Who Are Motivated And Focused

No matter how much wed like to think that were immune to peer pressure, were most definitely not.

Peer pressure affects people of all ages. This means that we must be intentional about the people we surround ourselves with.

Do you hang out with people who are pessimistic?

Are they always complaining?

Do they pursue excellence, or do they try to find shortcuts?

Spend time with people who are positive, motivated, focused, kind, generous and hardworking. Youll find yourself developing those traits as the days and weeks go by.

As a result, youll become more successful in school.

The Top 10 Straightforward Money Tips For College Students

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

Youre young and you have a bright future ahead of you if you learn to manage your money the smart way, that is.

You should start making smart choices about your money now in order to set up a solid financial foundation for the future.

Also Check: Study.com Transfer Credits

Spend Less Than You Earn

One of the most powerful money moves in the history of time is spending less money than you earn. When you have an excess of cash each month you can invest in your future and make purchases without the stress of taking on debt.

If you want to be a millionaire, look at what your typical millionaire does: they spend less than they earn!

Smart Financial Goal For College Students#: Build An Emergency Fund

My next smart financial goal for college students is having a fully stocked emergency fund.

Lets talk about financial catastrophes shall we? Such a cheery subject haha.

What could possibly go wrong? = Famous last words.

Examples of situations you will need an emergency fund are:

- Getting sick and not being able to pay your bills for a month

- Smashing your / someone elses car

- Breaking up with your live-in partner and needing to find your own bond etc

- Your laptop dies

- Flights home for a family emergency

- An opportunity comes up at college that you need extra money for

- Anything you would consider putting on your emergency only credit card

This should be one of your most important financial goals as a college student and your highest priority.

Start by getting $1,000 tucked away, with a longer-term goal of getting at least 3 months basic living expenses saved up.

RELATED POST: How to Budget Your Money with Sinking Funds

Having an emergency fund is so important because it saves you from needing to use debt which costs you a heap in interest and admin charges.

With debt, your agony compounds because you have to repay all this extra money and the longer it takes, the more it will cost you. Nevermind all the paperwork involved applying for loans. Arrgh!

If you have a fully-stocked emergency fund however, you can just pay and move on with your life.

Talk about being financially capable!

No awkward conversations with the parents either. Sweet!

Don’t Miss: Can I Sell My College Books

What Smart Financial Goals For College Students Will You Set

More About Guest Contributor

Creating financially fierce and empowered women.

A personal finance blogger, financial planner and small business consultant, Bethany Holt is extremely passionate about helping women achieve financial independence and gain confidence with their money.

Recently graduating in the top 15% of her university finance class and doing it all as a single mother on a budget, Bethany now helps women rein in their spending and start profitable businesses, so they never have to rely on anyone for financial support. Ever again!

Having worked with small businesses as a consultant for 14 years and teaching accounting for 4 years, Bethany loves sharing her money skills with others.

You Do Your Part Of The Deal And I’ll Do Mine

Posted July 9, 2012

There is a new trend in college teaching, the workshop instructions are clear: connect with students, make the material relevant to their lives, engage them, blah, blah, blah.

Some professors have always done this, but the pressure seems ever growing. Over the course of your college career you will have some teachers who do these things masterfully. Heck, with particularly obscure material, even I will go the extra mile every so often. But not too often. I reject, wholly and completely, that it is my job, as a professor, to do these things.

Why?

Because that is exactly what the student’s job is, and it is what the smart and successful students have always done.

What do the smart kids do?

I know … you are used to thinking that smart kids are smart because of something deep inside of them called “intelligence” or “IQ”. Well, you are wrong. Sure, some people have things like brain injuries, literally inside their heads, that make it much more difficult for them to learn things. But people do not have “intelligence” stuffed somewhere inside their head making it easy for them to learn things. For most people, the difference between excelling and failing is almost entirely determined by what world you live in, and how you act in that world.

Here are five important behaviors characteristic of smart kids:

At this point, you might fairly ask “Well then, what the heck is your part, oh great professor?”

You May Like: How Much Are College Classes

By Step Financial Goal Planning For College Students

Step #1: Write It All Down

At the beginning of the year, I would review my current financial situation and write it down on paper.

I wrote down my current financial assets and the income they generated, I recorded all my income sources and any I hoped to develop in the next 3 months.

I also recorded any debts I had, how much they were and my repayments.

This was my starting point.

Step #2: Calculate Your Budget

I calculated my barebones budget. The absolute minimum I had to make in order to meet all my obligations and keep the lights on. I looked at the income I already had and calculated my shortfall.

Step #3: Figure Out How Much You Can Work

Then I looked at my study load to see how much time I had available for working. I would be realistic about how much work I could possibly fit in.

Yes, I obviously wanted to earn as much as I could, but not at the expense of my health. But, I am a single mother as well, so I had to account for the time my daughter required from me too.

Step #4 Find Ways to Earn the Most Money

Next, I looked at all the skills I had and assessed which ones would bring in the most money for the small amount of time I had available.

I also looked long term here, and considered skills that were aligned with my major and would look impressive to future employers. I settled on casual teaching at the local community college.

RELATED POST: Best Side Hustles for College Students

Step #5 Create a 12-Month Financial Plan