How To Apply For Merit Scholarships

Start searching for scholarships as soon as possible. The sooner you start searching for scholarships, the fewer deadlines you will miss.

- There are scholarships you can win in younger grades, not just during your senior year in high school.

- Some scholarships have deadlines in the fall, not just during the spring.

- Continue searching for scholarships even after you enroll in college, as there are some scholarships that are open only to current college students.

Search for scholarships on free scholarship matching sites. The best scholarship databases are free.

- Dont pay a fee to search for scholarships or to apply for scholarships.

- If you have to pay money to get money, its probably a scam.

To increase your chances of winning a scholarship, apply to every scholarship for which you are eligible.

What Happens After Submitting Fafsa When Applying For Financial Aid

Upon sending the application, you will receive a Student Aid Report by mail or email if you provided your email address in the form. This is a document that summarizes all the disclosed information from your FAFSA, including:

- Estimated Family Contribution

- Estimated eligibility for the desired student loans or other types of aid

- Whether your application has been eligible for verification

SAR should reach your inbox or home address within three to 21 days, depending on the application submission method.

Once you receive it, you should revise the reported details and see if the form requires any corrections. If everything is alright, keep the document for your records. In case of any mistakes, you must update the application with the correct details and resubmit it. When its done, all you should do is wait for the institutions to make their offers.

Irs Data Retrieval Tool

Use the IRS Data Retrieval Tool within the FAFSA to transfer income and tax information from your federal income tax return to the FAFSA. This will simplify the FAFSA application, letting you skip some questions. It will also reduce the chances that your FAFSA is selected for verification, saving you time and hassle.

Also Check: Do Credits Expire

My Fafsa Has Been Selected For Verification What Does That Mean

If your FAFSA is selected for verification it means that you need to provide additional documentation to verify that the information you provided on your FAFSA is correct. This is perfectly normal. Approximately half of the financial aid applicants at Quincy College are selected for verification either by the Federal Government or by the college.

Applying For Financial Aid

Applying for financial aid is a process that should be started as soon as possible. We ask that ALL degree and certificate seeking students apply for financial aid, even if you think you aren’t eligible because of income, etc. There are BILLIONS of dollars in federal grant money left unclaimed each year by those who were eligible to apply for it, but did not apply. You can work on your financial aid file at the same time as you are completing other College application requirements.

There’s an app for that! The FAFSA can now be completed on your mobile device using the U.S. Department of Education’s myStudentAid application. on how to complete the FAFSA using your mobile app.

Before you apply for financial aid:

- New students and those who have not attended within the last two years are required to complete an admission application. Admission is free, and the application can be completed online here: Online Admissions Application

- Make sure the College has you signed up for the correct degree or certificate you intend to complete. If you need assistance, please call Enrollment Services/Pirate Central at 417-6340.

- Meet the Federal financial aid requirements for eligibility for the FAFSA, or meet the State financial aid requirements for eligibility for the WASFA.

Also Check: Wcws All Session Tickets

Debunking Financial Aid Myths

Myth: My family’s income is too high to qualify for federal financial aid.Fact: Student and family income isnt the only factor that the government uses to decide if a student qualifies for federal financial aid. The only way to know for sure if youll qualify is to fill out the FAFSA.3

Myth: My family has money saved for college so we won’t get any federal financial aid.Fact: Savings might not be a major factor when a school decides if a student qualifies for Federal Direct Unsubsidized Loans. There are allowances for savings and assets.4

Myth: My sibling wasn’t eligible for much federal financial aid last year, so I won’t be eligible when I enter college.Fact: Actually, the number of family members in college might have a favorable impact on your financial aid eligibility.5

Myth: Im only attending college part-time, so I won’t be eligible for federal financial aid.Fact: Financial aid is available for part-time students. Talk to the financial aid offices of the colleges youre interested in attending about aid for part-time students.6

“There are kids who think, Oh, Im not gonna get anything from FAFSA. Just fill it out!”

Bryana B., Bridging the Dream 16 scholarship winner

Get matched with college scholarships

Our free Scholarship Search helps you find scholarships as unique as you are.

Access to 6 million+ scholarship opps Email alerts for new matches

Youre Our First Priorityevery Time

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You May Like: Ashworth College Legit

Welcome To The Oxnard College Financial Aid

We offer programs and services to help meet some of your educational costs. Financial aid applications are accepted throughout the academic year but we encourage you to apply as soon as possible.

The Financial Aid Office is comprised of dedicated financial aid professionals committed to serving students and provide them information to secure the necessary financial resources to meet their educational objectives. Financial aid awards are subject to availability of funds, eligibility for funds, enrollment status and financial need.

If you need help paying your enrollment fees or other expenses, financial aid in the form of grants and federal work-study is available to eligible students. The California College Promise Grant is available to California residents. View the VCCCD Code of Conduct/Conflict of Interest Policy here.

Changes and updated to financial aid status will be displayed on the student portal and in portal e-mail. Financial aid requirements can be viewed by logging in to your my.vcccd.edu student portal.

Financial Aid Goals and Objectives :

- Provide student centered service, information, and identify financing options to students seeking financial assistance

- Maintain efforts to minimize the student loan default rate

- Identify, outreach to, and increase both financial aid participation and student access to locally defined un-served and underserved student populations

- Increase awareness on campus and at local high schools of financial aid

Students will :

Review Your Financial Aid Status

After we have reviewed your financial aid file and awarded aid, you will be able to view your financial aid awards in your ctcLink student account in the “Financial Aid” tile. If you were not found eligible for aid, you will be immediately notified by the Financial Aid Office via email, and given instructions on how you may regain eligibility if possible.

For those who are awarded financial aid, please note:

- All financial aid funds will be applied towards tuition and fees first any leftover funds will be issued as a refund to you through BankMobile if the is refundable to the student.

- The amount of grant aid you are awarded may decrease if you are enrolled less than full-time See the “Adding/Dropping Classes” webpage for more info.

- Loans require a separate application form, available here. Loans can only be awarded after your financial aid file is completed and reviewed for aid eligibility. You must be in 6 or more credits to be eligible for loans. For more info on loans, please visit the “Student Loans” webpage.

Read Also: Brandon Charnas Instagram

How To Apply For Financial Aid

Now that you understand the general types of financial aid, its time to start the application process.

Depending on the type of financial aid youre trying to receive, the steps of this process will vary. If youre trying to get scholarships, for instance, you may need to write essays, complete interviews, or attend tryouts.

But regardless of the financial aid you seek, it all starts with filling out the Free Application for Federal Student Aid . This is the document that determines your eligibility for federal, state, and college student aid.

Filling it out is free and shouldnt take long .

The small amount of time and paperwork is trivial in comparison to the financial benefits you could receive. So dont skip filling it out because you dont have time or dont think youll qualify. It can only help you.

But how do you fill out the FAFSA, exactly? Heres an overview:

How Does Financial Need Impact Admissions

This depends on the type of school you are applying to and the intricacies of their financial aid office policies.

- Need-blind schools: These aid packages are based on the familys financial needs and controlled by the financial aid office. They do not impact a students admissions prospects or process! However, most need-blind schools are need-aware for international students.

- Need-aware schools: Aid packages are offered based on your profile and controlled by the admissions office. This doesnt mean you are hindered from acceptance if you are middle or lower class, rather you are more likely to receive an acceptance without aid than outright rejection. If you fall under the average range for the admissions criteria at one of these schools, then it is safer to not apply for financial aid to be admitted, if you can afford it.

Just remember, no school is fully need-blind. Admissions officers can see if you applied for aid on the Common App, but dont let that scare you! If you require need-based financial aid, make sure you apply without fear of it impacting your admission.

Don’t Miss: Cfcc Housing

Paying For Financial Aid Help Isnt Worth It

No matter how confusing filling out the FAFSA or CSS Profile is, you dont need to pay a company to help you, says Kent Rinehart, dean of undergraduate admission at Marist College in Poughkeepsie, New York. Plenty of free resources are available that will get you to the same result.

If youre applying for financial aid, you probably want to save as much money as possible, he says.

When applying for financial aid, start by talking with your high school counselor. If you still have questions, call the financial aid office at one of the colleges where youre applying. Finally, look for a financial aid completion event near you many schools and local organizations host free workshops with experts on hand to answer your questions as you fill out the FAFSA.

» MORE:How many colleges should I apply to, by cost of application

The Financial Aid Award Letter

After you’ve been admitted to a college, the school will put together a financial aid award letterif you noted that you want financial aid, that is. You will not have to accept or reject any offer of admission until you’ve been able to go over a school’s financial aid package. You can use the award amounts to calculate your net cost, or what you have to pay out of pocket to attend that school.

If there are loans offered on your financial aid letter, you don’t have to accept any that you’re not comfortable with. You tell your financial aid office what awards you want to take and what awards you don’t.

Calculating Your Net Cost

- Figure out the school’s CoA . This figure includes tuition, fees, books, transportation, room, and board. If it’s not listed on the financial aid letter, turn to Google or the financial aid office. Learn more about expenses in our guide on what college really costs.

- Subtract any grants and scholarships listed on the financial aid package from your CoA. This is free money that your school and/or government is awarding you.

- The figure you have right now is your out-of-pocket cost. If this isn’t affordable, this isn’t necessarily what you have to pay right now to attend this school.

- Subtract any federal loans offered from the out-of-pocket cost. These loans tend to have low-interest rates and good repayment terms.

Don’t Miss: Buzzfeed College

The Css/financial Aid Profile

The CSS/Financial Aid PROFILE is an application for nonfederal financial aid used by almost 400 different colleges and scholarship programs. Even if you don’t think you’ll apply to one of these colleges or programs, it may be wise to fill it out, so you don’t preemptively limit your funding options. Check out the list of participating programs before deciding not to complete ityou might find a program or school you’re interested in!

If you’re applying to any of the participating schools , they’ll have their own deadlines for submitting the PROFILE. It’s very important that you meet this deadline if you want to be considered eligible for institutional financial aid. Some schools may ask for it around the time college apps are due.

Submitting the PROFILE

If you plan on completing the PROFILE, you’ll need to enter detailed student and parent financial information. Gather the following paperwork for both you and your parents to expedite the application process:

- Current and previous years’ tax returns

- W-2 forms and other records of current year income

- Records of untaxed income and benefits for current and previous tax years

- Current bank statements

- Records of savings, stocks, bonds, trusts, etc.

There are fees associated with this applicationone fee to actually submit it , and a $25 fee to generate reports for additional schools. There are fee waivers available for low-income students.

The FAFSA: Perhaps the most important part of the financial aid process.

- W-2 forms

California Dream Act Application

Also Check: Berkeley College Nyc Dorms

Financial Aid And Awards

The Financial Aid and Awards office is here to assist you in exploring the financial options available to you as a post-secondary student.

Financial Aid and Awards administers a range of financial aid programs geared to assist you in realizing your educational goals. Providing you with access to financial literacy education helps to expand your financial knowledge and develop confidence in dealing with your finances. Here’s how to get in touch with us.

Applying For Financial Aid For College

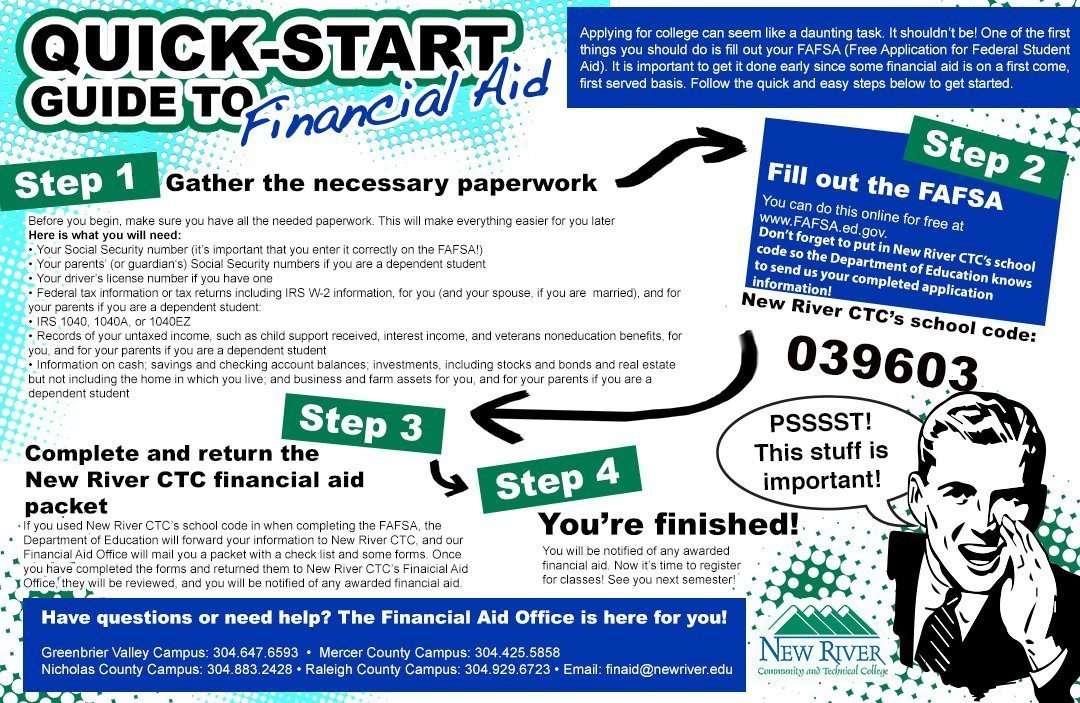

All students who wish to apply for federal financial aid must fill out the Free Application for Federal Student Aid . It is a general application that will allow you to qualify for the different types of financial aid available for college education. The process of application goes about as follows

1. First and foremost, a student has to apply for admission to a particular college before the deadline. In any case, this application should be made at the earliest.

2. This application has a deadline. The best time to put forth the application is when a student is in the senior year, after the 1st of January, but as early as possible. This is because the amount of financial aid available is limited, and how much will be provided is decided as soon as a student gains admission into the college. This means, if you are late for the process, you are likely to miss out on the funds awarded.

3. After your application has been received, the financial aid office of the college you have applied to will review it to see if you deserve the aid, and how much you deserve. You will be judged in five aspectsthe cost of your course, the income of your family, the size of your family, the number of family members who are also in college at the same time, and the assets owned by your family.

4. After all these aspects have been approved, you will be granted aid depending on your requirement as well as the amount available.

Don’t Miss: How To Get Grammarly For Free As A Student

Financial Aid Apply Every Year

Financial aid can be a complicated and mysterious process. If you were offered only loans last year, then there is hope that this will not happen again! Financial aid formulas are very complex and often depend on family circumstances or changes in these circumstances.

For example, if the students assets have been depleted from attending college for a while now while their parents assets remain strong they may become eligible to receive more assistance through financial scholarships available exclusively to students already enrolled in school.

How To Apply For Financial Aid For College: 10 Steps

How Student Loan Hero Gets Paid

Student Loan Hero is compensated by companies on this site and this compensation may impact how and where offers appear on this site . Student Loan Hero does not include all lenders, savings products, or loan options available in the marketplace.

Student Loan Hero Advertiser Disclosure

Student Loan Hero is an advertising-supported comparison service. The site features products from our partners as well as institutions which are not advertising partners. While we make an effort to include the best deals available to the general public, we make no warranty that such information represents all available products.

Editorial Note: This content is not provided or commissioned by any financial institution. Any opinions, analyses, reviews or recommendations expressed in this article are those of the authors alone, and may not have been reviewed, approved or otherwise endorsed by the financial institution.

Weve got your back! Student Loan Hero is a completely free website 100% focused on helping student loan borrowers get the answers they need. Read more

How do we make money? Its actually pretty simple. If you choose to check out and become a customer of any of the loan providers featured on our site, we get compensated for sending you their way. This helps pay for our amazing staff of writers .

* * *

Also Check: How To Get 15 College Credits