Course Material Average Spending

College students have spent less on textbooks and digital course materials over the years. Students now have more available options to purchase course material such as print or digital material and choose to rent or purchase them. The choice to rent and use digital material has likely caused a sudden decrease in college course material compared to years prior.

- At 4-year public institutions, college students pay roughly $1,334 yearly on books and supplies.

- For private, nonprofit institutions, students pay about $1,308.

- For private for-profit institutions, students pay about $1,194 for books and supplies.

- At 2-year public institutions, students pay $1,585 annually on average for books and supplies.

- Students pay $1,061 on average at private nonprofit institutions, and for 2-year for-profit colleges, students pay about $1,393.

How Much Will College Cost Your Family

There is no doubt that college is expensive, but it doesnt have to be unaffordable. The sticker price of a college is also not always what you pay for college. Instead, take a look at a colleges estimated net costs so you can determine how your financial situation influences what youll pay.

Want to know how your college profile will influence your chances of admission? Check out our free chancing calculator! This tool can help you determine colleges that are a great fit for you based on your chances of acceptance, location, and other criteria.

If youre curious to find out what kind of financial aid you would receive from the schools on your college list, look at our free financial aid calculator. This tool will help you gauge how much different schools will cost based on your financial situation.

How Much Should I Save For College

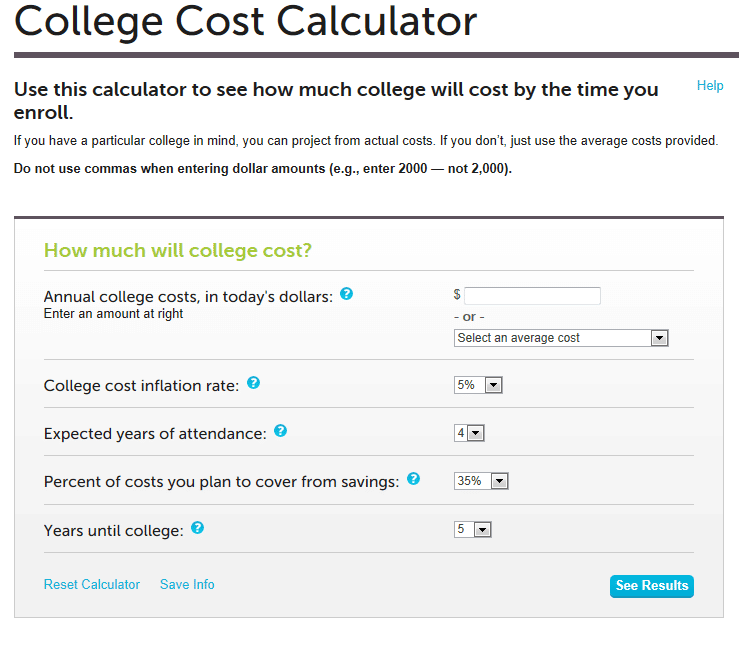

If college is still a few years away, using a college cost calculator can help you figure out how much your total cost of college will be, including a 5% increase in costs each year. If youre looking at a schools annual cost this year, add in the number of years until you or your student goes to college and how long you expect to be in college to find out just how much it may cost.

If college is in your near future, youre probably already looking at different schools. Once youve decided on some that youd like to apply to, its likely time to file the FAFSA®, which opens up on October 1 for the next academic year. This is the gateway to $150 billion in federal aid. By filing the FAFSA®, you could potentially unlock free money for college , and the opportunity to work on campus in exchange for a paycheck you can apply toward tuition or expenses . Plus, you can see if youre eligible for subsidized or unsubsidized federal student loans. All these details will be a part of the financial aid offer letters youll receive from the schools that have accepted you for admission.

Once you have your financial aid offer letters in hand, you can start comparing your options. Use a spreadsheet to understand the best financial aid offer, which will be determined by the total amount of expenses against the aid you can secure .

Don’t Miss: How To Pay For College With No Money

How Much Are Tuition Fees In The Us

The US is one of the worlds most popular destinations for higher education and also one of the most expensive. Although the initial pricing may cause a sharp intake of breath, it is worth exploring all avenues of funding and financial aid before ruling the country out.

Tuition fees range from $5,000 to $50,000 per year. Most undergraduate degrees last four years.

American universities differentiate between in-state and out-of-state students when calculating tuition fees. A typical four-year public college charged in-state students $10,200 per year while out-of-state students were charged $26,290 . There are private non-profit colleges too, which charge $35,800 on average. These include universities such as Harvard, Stanford and Yale.

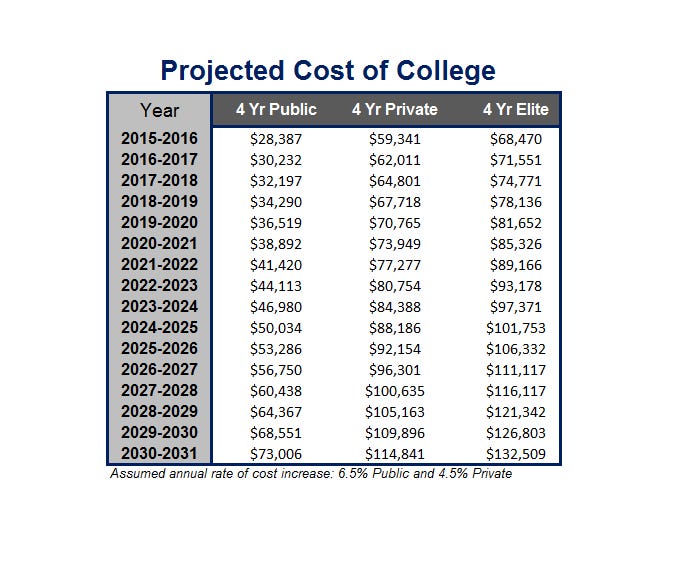

Average Cost Of College Tuition: How Much Do You Have To Save

Theres no denying the cost of getting a college degree.

As a parent, maybe you want to shield your child from the burden of student debt.

It can take graduates 10, 20, or 30 years to pay off what they owe. Student debt also makes it harder for grads to buy a house or save for retirement.

For this reason, some parents begin saving for their childs education early. But even if you know the importance of saving early, you might not know how much to save.

Let’s face it:

The cost of college will dramatically increase over the next five, 10, or 20 years.

Knowing the average cost of college tuition today can help you plan for the future.

Recommended Reading: What Is An Undergraduate College

Most Expensive Colleges In The Us

While the least expensive four-year colleges are typically state schools, the most expensive are nearly all private institutions. The highest-priced college in the US is Columbia University with tuition and fees totaling $64,380 for the 2020-2021 academic year.

The listof the countrys 10 most expensive schools draws heavily from elite universities such as Brown, Amherst College, Tufts, and Duke. Most of these schools are located in the northeast the most expensive region in the country for higher education, including the 10th most expensive college on the list: Boston College at $60,202 per year.

However, dont immediately succumb to sticker shock when considering applying to schools such as these. A universitys published price for tuition and fees can often be significantly reduced through offers of need-based grants and scholarships, which makes the actual price you pay a great deal less than advertised. This brings us to the next important consideration when determining your higher education costs.

What Does College Really Cost

While college education has become more expensive, the costs that are often reported in the financial media don’t tell the whole story. For instance, because they are based on national published averages, they do not reflect regional differences or the fact that the net price many students pay to attend college is often significantly lower than the published price.

Each year, the College Board publishes a detailed analysis of the cost of attending college, based on an annual survey of US schools.

For the 2021-2022 academic year, the average cost at a private, nonprofit 4-year college was $55,800 .2 While that amount is high enough to cause sticker shock among even relatively affluent families, a closer look reveals that many students do not pay the full sticker price. For example, the average total published price for tuition and fees, not including room and board, was $38,070 in 2021-2022, for private nonprofit colleges, but the estimated average net price was only $14,990.2

Students who attend public colleges typically pay less than those at private colleges, provided they qualify for in-state tuition rates. The average cost per year for a public 4-year in-state college was $27,330 in 2021-2022.2 Keep in mind that all of the College Board’s numbers are based on national averages, so depending on where you live, the cost of attending a public college could be higher or lower.

Don’t Miss: How To Send Your Final Transcript To College

Religious And Military Schools

A number of schools also offer free tuition, room, and board in exchange for service, such as Christian and military colleges. If one of these schools offers the kind of program youre looking for and you meet the sometimes highly selective admissions criteria you can graduate debt-free with solid preparation for your future career.

Open A 529 Saving Plan

A 529 is a state-sponsored educational savings plan. Funds in the account can be used to pay for tuition, books, fees, and other educational expenses.

You can open an account for your own child, a grandchild, a relative, and even a friend. Depending on the plan, youre allowed to contribute a maximum of $300,000 to $400,000 per beneficiary.

As a bonus, deposits up to $15,000 per year per beneficiary qualify for the annual gift tax exclusion. For a couple, this limit is $30,000.

The best part:

A 529 savings plan grows tax-free.

Youll also benefit from tax-free withdrawals when you use the money for qualified educational expenses.

Abiding by the rules set by the IRS, qualified education expenses include:

- Computer software for education purposes

You May Like: How To Find The Perfect College For You

What Is The Cost Of Room And Board

The cost of room and board depends on the campus housing and food plans you choose. Living at home with parents will reduce your costs. For the 2022-2023 academic year, average room and board costs are

- $14,030 at private colleges

- $12,310 at public colleges

Some colleges provide room and board estimates for living off-campus. At public colleges, room and board costs are usually the same for in-state and out-of-state residents.

Source: College Board, Trends in College Pricing and Student Aid, 2022.

Average College Tuition By Region

The cost of college tuition varies widely depending on the region of the country where the school resides. According to data provided by The College Board, the New England region has the highest in-district and in-state average tuition costs for both 2-year and 4-year schools.

In contrast, the South had the lowest tuition for a 4-year education at around $9,000. The West region had the lowest 2-year tuition coming in at around $2,000

Editorial Listing ShortCode:

Another thing to keep in mind is the projected increase over the next 10 years. The College Board data states that the West region had the highest increase of 62% for 4-year schools and 60% for 2-year schools.

Recommended Reading: What Colleges Have The Best Teaching Programs

How Much Will College Really Cost You

2 min read

https://money.com/how-much-will-college-cost/

Chances are you wont pay the full sticker price for a college degree. At private schools, 75% of students qualify for at least some institutional aid at four-year publics, 60% do. So when youre shopping for a college, what you really want to know is your net price, or what youll likely pay after factoring in scholarships and grants awarded by the school.

This College Abacus tool will help you estimate the net price for one year at more than 5,000 colleges, based on your personal financial and academic circumstances and the schools aid policies. You can compare options from multiple colleges in one place, rather than having to visit each schools website individually and re-enter your information.

Information You Can Trust

For over 30 years, My College Guide has been producing an annual magazine chock full of expert advice to aid you in your college selection process. Getting into college isn’t just about who picks you, it’s also about who YOU pick. We can help walk you through factors ranging from cost of education and the strength of various majors to faculty ratio and accreditation.

Read Also: What To Write On College Graduation Announcement

Average College Tuition In

- In 2019-2020, the average cost of a year of out-of-state student tuition and required fees at a 4-year public school was $27,023 versus $9,349 that an in-state student would pay.

- That was a difference of $17,674 more that an out-of-state student would pay compared to an in-state student, on average, for a year of public college education at a 4-year college.

- In 2019-2020, out-of-state tuition and required fees for a year at a public 2-year college, on average, nationwide, was $8,126 versus only $3,377 for an in-state student.

- The difference between the nationwide average for in-state and out-of-state tuition at a public 2-year college for the 2019-2020 school year was $4,749.

- There was no noted difference between the average in-state versus out-of-state cost for private 4-year colleges.

How Much Should I Save For College Monthly

You should save as much as you can afford for your childs education, without hurting your quality of life. Ideally, you should save at least $250 per month if you anticipate your child attending an in-state college , $450 per month for an out-of-state public four-year college, and $550 per month for a private non-profit four-year college, from birth to college enrollment.

Also Check: How Much Is Animal Behavior College

Not Paying Sticker Price

Its also important to keep in mind that many of the more-expensive colleges have ways to reduce the cost of attendance for most, if not all, of their students. This is especially true for private schools, which make up most of the pricier colleges. This list shows you the schools that offer the biggest discounts between the advertised cost of attendance and what most students actually pay. If a school youre interested in isnt on this list, talk with their financial aid office, and ask about the average financial aid award. A school that first seemed out of reach might suddenly be within your budget.

Another tool that can help you plan your college budget is the net price calculator. Many students dont know about the discounts colleges offer, and since so many colleges offer them, the US government now requires every college to put a net price calculator on their website. This makes it easy for families to obtain some basic information and get a general idea of what they would be expected to pay for college. Just as important, most net price calculators give an indication of how large a loan the student or parents would have to take out each year.

Cost Of Ivy League And Other Elite Colleges

Some of the nation’s most selective and esteemed institutions, such as Ivy League and other elite schools, have the highest tuition rates. At the same time, these schools often provide large financial aid packages.

| Ivy League School |

|---|

Source: NCES College Navigator Database

Recommended Reading: How To Recruit College Students

Financial Aid Scholarships And Loans

There are a variety of financial aid options available to help students pay for college. Federal and state governments offer financial aid programs, while employers may offer tuition reimbursement programs.

Private organizations also offer scholarships to eligible students. Loans are another option for financing college, although they must be repaid with interest. Financial aid can significantly reduce the cost of college, making it more affordable for students.

Scholarships and loans can also help students cover the cost of college, although loans must be repaid with interest. By carefully researching all of the colleges with financial aid available, students can choose the best option for their needs and budget.

To qualify, be sure to fill out the Free Application for Federal Student Aid , regardless of your enrollment status or income. This will help financial aid offices determine what kind of aid you might be eligible for.

How Much Does College Tuition Cost

The price of college has soared across the board for all institution types. Out-of-state tuition and in-state tuition differ significantly and are important to consider when applying for college. Schools with the highest tuition are typically located in the Northeast.

The amount to be paid for tuition will not be uniform across different types of institutions. There are several things to consider when determining how much tuition will be. Tuition is a charge for instruction from a university or college it is not considered the total price of college it is simply the price a student pays for teaching or instruction. Depending upon the program of study and the location of the school of choice, college tuition can be more or less expensive.

Factoring in student loan debt and interest is significant when considering college enrollment. Students pay interest on federal loans, including unsubsidized student loans. This interest can accrue while a student is in college, so it is important to exhaust your financial assistance to lessen the amount of tuition and debt.

Check out How to Apply for Scholarships to learn more about earning scholarship awards from Bold.org to lessen tuition and educational expenses.

Read Also: What Does Phd Stand For In College

What You Can Do To Prepare

While there are real differences in costs among various schools, restricting your college choices based on cost may not be as prudent as it appears. It can be hard to predict where your student may be admitted, and which school might be the best fit. The cheapest option may not be the best. And even if it is, college will still likely be a significant expense for most families.

Getting an early start on college savings is one thing you can do to help yourself. The earlier you start saving, the more time your college savings portfolio will have to potentially grow. With money set aside, your child can make their college choice based on where theyre most likely to thrive, rather than on financial considerations only.

Starting early can also help you to minimize your child’s student loan burden. Fidelitys Planning & Guidance Center offers tools to help you set goals for how much to save now and set expectations for how much you might have by the time you need the money.

Even if starting early isnt an option, its never too late to start saving for college. Any amount you can set aside now will reduce your borrowing needs and your overall cost of college.

If youre closer to the time when tuition checks need to be written, consider the importance of discussing the situation with your student. Clear communication is part of setting realistic expectations and can help you avoid surprises later.

Why Are Colleges So Expensive

The cost of college has been increasing for years, and there are no signs of it slowing down. One reason for this is that colleges are becoming more and more competitive, which means they need to spend more money on things like top-notch faculty, updated facilities, and scholarships.

Additionally, the number of students going to college has increased, while the amount of funding colleges receive from state governments has decreased. This has put even more pressure on colleges to raise tuition prices. Finally, many colleges are facing rising costs for things like health insurance and utility bills. All of these factors combine to make college an increasingly expensive endeavor.

Also Check: What Are Good Colleges For Fashion Design