Fafsa Isnt The Whole Picture

While the FAFSA is a vital tool in determining need-based aid, some families actually put too much emphasis on the document. The fact is, most financial-aid counselors have the authority to use resources as they see fit. The expected family contribution usually plays a big role, but it may not be the only factor theyll consider.

The more an institution values the students skills and experiences, the more likely it is to woo them with an attractive aid package. The key is to look for colleges representing a good fit and reach out to the financial aid office about your childs prospects for grants or federally subsidized loans. This, in addition to its academic reputation, can help families select whether a school is worth pursuing.

Many Students Receive Student Loans

One of the most well-known routes students can take is through a for-profit student loan organization, such as the SLM Corporation, usually known as Sallie Mae. The for-profit Sallie Mae organization was worth $1.8 billion in total equity in 2014. Thats a staggering number for anyone not named Warren Buffet. Sallie Mae, as of the current year, uses a division under the name of Navient to manage their student loans.

Navient directs and provides funds to nearly 12 million students nationwide. On their website, Navient points out that their financial aid program has already been paid off by one out of three customers who used it. They state that students who go through Navient are more than two times more likely to have good credit lines than their peers. Additionally, Navient states that their alumni are 65% more likely to work full time.

Maximizing Your Aid Eligibility

Believe it or not, there are strategies for maximizing your eligibility for need-based student financial aid. These strategies are based on loopholes in the need analysis methodology and are completely legal. We developed these strategies by analyzing the flaws in the Federal Need Analysis Methodology. It is quite possible that Congress will eventually eliminate many of these loopholes. Until this happens, we believe that revealing these flaws yields a more level playing field and hence a fairer need analysis process.

In the strategies that follow, the term base year refers to the tax year prior to the award year, where the award year is the academic year for which aid is requested. The need analysis process uses financial information from the base year to estimate the expected family contribution. Many of these strategies are simply methods of minimizing income during the base year. Likewise, the value of assets are determined at the time of application and may have no relation to their value during the award year.

A Word About Honesty

We have not included any strategies that we consider unethical, dishonest, or illegal. For example, although we may describe some strategies for sheltering assets, we do not provide techniques for hiding assets. Likewise, we strongly discourage any family from providing false information on a financial aid

Check out top strategies for maximizing aid eligibility. For more detailed strategies on maximizing your need, click on the topics below.

Recommended Reading: Does Cape Fear Community College Have Dorms

The Fafsa Can Get You More Money If Your Financial Situation Changes

The FAFSA helps you get financial aid before the school year starts, but what if your financial situation changes halfway through?

Whether you get a new sibling or a parent loses their income, you can edit the FAFSA to reflect your new circumstances. In fact, youre expected to do so if something major changes in your household.

You should also get in touch with your schools financial aid office to alert them of the changes. If you find yourself needing more support during the year than when you started, the FAFSA can help you gain more financial aid.

The Amount You Get Isnt Enough To Cover All The Expenses File An Appeal With Donotpay

If the offer from your dream college isnt as satisfying as you expected, DoNotPay gives you a chance to send an appeal letter to the institution quickly and efficiently! Instead of writing it yourself, give us the basic info, and we will compose and send it on your behalf in only a few taps!

Heres what you need to do:

Our learning base features many practical guides that will teach you everything about the financial aid application for many well-known universities, including:

Read Also: Eagle Express Tuition Plan

It’s Okay To Negotiate

You dont have to accept all the financial aid listed in your offer.

Lets say youre offered work-study in your financial aid package but you know youre going to be too busy with schoolwork. Or the amount of the federal loan youre qualified for is more than you want to take out. You can say “no” to all or part of a financial aid offer, or ask your schools financial aid office to review your financial situation. Just be sure that you wont need to borrow money for costs that you could have covered with free money.

Whether you decide to accept or decline your financial aid package, youll need to respond to the financial aid offer. Each school sets a deadline for a response, so dont miss out, whether its mailing back a signed form or answering online. If you do decide to request more financial aid from a school, talk to your financial aid office. There might be a written process to request a review of your financial situation.

Remember, bigger isnt always better. Dont rely only on the total dollar amount of a schools financial aid offer. For instance, you might receive a smaller total award that offers more scholarships and grants than a larger award consisting mostly of loans. Or, despite a generous financial aid package, School A will still cost a lot more than School B, which is offering less financial aid.

Confirm Your Dependency Status

Your eligibility for financial aid is closely linked to whether youre considered a dependent or an independent student. If youre an independent student, you dont have to include parent information, such as parent income or assets, when you apply for financial aid. Independent students may qualify for more need-based financial aid they also have higher loan limits when borrowing federal unsubsidized loans as undergraduates.

The federal government determines dependency status based on certain specific factors. Youre automatically an independent student if youre:

- 24 years old or over

- Pursuing a masters or doctoral degree

- A parent who provides more than half of your childrens financial support

- Living with non-child or -spouse dependents and you provide more than half of their financial support

- An active-duty or veteran member of the U.S. armed forces

- An emancipated minor, or youre in a legal guardianship

- An unaccompanied young person either homeless or at risk of homelessness

- In foster care, a ward of the court or both of your parents have died

If none of these situations apply to you, then youre a dependent student and you must add your parents information to the FAFSA, meaning their income and assets will affect your financial aid. For some students, this feels inappropriate because they do not have contact with their parents, or their parents refuse to provide their information.

You May Like: What College Has The Best Dorms

Know The Types Of Aid Available

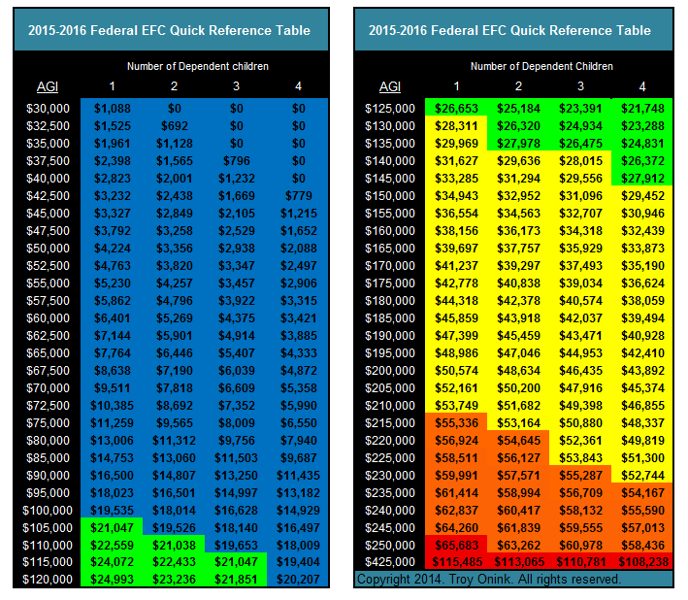

Based on your EFCand potentially other information gathered from additional financial aid forms, like the CSS Profileyour school will provide a financial aid award letter when youve been accepted.

Youll be offered need-based and/or non-need-based financial aid. Youll receive need-based aid if your EFC leads to a determination that you have enough financial need. Need-based aid includes federal subsidized loanswhich dont charge you interest during certain periodsthe Pell Grant and work-study. Non-need-based aid includes federal unsubsidized loans and PLUS loans. Merit aid is given out in the form of college-specific grants or scholarships.

Not all types of aid listed on your award letter are truly awards. Some types, like loans, youll have to pay back, and some loans come with less generous terms and interest rates than others.

To make up for a gap between your need-based and merit aid and the cost of attendance, for instance, some schools may suggest your parents take out a federal parent PLUS loan, which is a form of non-need-based aid that carries higher interest rates and fees than other federal loan types.

Youre not required to take out all the loans offered in your financial aid package. When considering how to pay for college, look carefully at the financial aid youve been given and understand clearly the total amount it will cost to attend schoolwhich means taking into account any loans interest rates and repayment terms.

How Much Financial Aid Can You Get For College

To get an idea of the approximate financial aid amount you can receive, you must consider two crucial factors:

| TEACH Grant | $4,000 |

Also Check: Central Texas College Culinary Arts Program

How Will I Get Financial Aid For College

If you meet all the standards proposed by the Federal Student Aid , you can start the financial aid application process.

The first step is to fill out a special form called the Free Application for Federal Student Aid . Its purpose is to provide complete information about your financial situation and help institutions decide if you are eligible for college or graduate school support. You must fill it out every year to keep getting the necessary financial help.

Before you proceed with completing the form, make sure you:

- Check the application deadlines for the current year, as they may vary from state to state or from college to college

- Prepare the necessary documentation since you will have to complete the form by entering details from your ID, Social Security Card, or bank statements

The FAFSA form contains more than 100 questions and covers your personal details, household information, annual income, and tax return details. Make sure you answer the questions carefully since even the slightest mistake can cause difficulties in your application procedure.

Once the form is filled out, you can submit it:

- Online, via your FSA accountyou must create it before completing your FAFSA form and receive your unique FSA ID number to be able to sign the document electronically

- Via myStudentAid app

Common Income Counted In The Fafsa Formula

Colleges using the Free Application for Federal Student Aid allocate 50 percent of eligible student income to cover the upcoming year of college expenses, and between 22 47 percent of eligible parent income. If parents are divorced, the FAFSA asks for financial information about the parent with whom the student lived most of the time. Here are the most common sources of income counted by the FAFSA.

- Income from work, except work-study income

- Proceeds from asset sales, dividends, and capital gains

- Retirement fund withdrawals

- Untaxed income, such as elective retirement fund contributions and money spent by non-parents on the student’s behalf

Read Also: Where Does Arielle Charnas Live

Whats In A Financial Aid Offer

Financial aid offers usually contain this information:

- Cost of attendance , an estimate of what you can expect to pay for one year of school. This includes tuition and fees, room and board, books and supplies, transportation, and even personal expenses.1 If the COA isnt included in your offer, check the schools website or call the financial aid office.

- a number that your school uses to determine how much financial aid youre eligible for. Its not how much your family will have to pay for college.2

- are typically need-based and can be given by state or federal governments.

- can be need-, merit-, or interest-based and are awarded by a school, company, or private organization.

- is a program, implemented by the school, where you work to earn your financial aid.

- let you borrow money directly from the federal government you pay this financial aid back with interest. A financial aid offer may also list the amount you can borrow with a credit-based loan .

Next Steps To Determine How Much Financial Aid You Can Get

Once you have an idea of how much financial aid you can expect, you can better determine your debt load to pay for college.

A good rule of thumb is to borrow no more than 10% of projected after-tax monthly income in your first year out of school. For example, if you expect to make $40,000 in your first year out of college, borrow less than $21,000 to keep your payment affordable. Use a student loan affordability calculator to figure out how much to borrow.

Recommended Reading: What Colleges Are Still Accepting Applications For Fall 2021

There Are Also Federal Aid Programs

While Navient is not connected directly to the US government, Washington also runs its own federal aid program to help out students in need. For example, things like the need-based Perkins Loan Program and the subsidized Pell Grants. The most common source of financial aid provided by the government is the Free Application for Federal Student Aid, also known as the FAFSA program. FAFSA provides over 13 million students with nearly $150 billion for aid and rosters well over a thousand employees nationwide. Most students, no matter their economic background, should fill out the FAFSA form to see if they qualify for government assistance.

Other Sources Of College Funding

There are many more forms of aid available through programs and careful planning. Specialized scholarship and loan programs, such as loans specifically for students studying abroad, help thousands of students attend school each year.

Aid for Military Families

Many types of student aid are available to military personnel, veterans, and their families. There are also reserve training programs and scholarships available through most branches of the military.

- Over 1,000 colleges participate in Reserve OFficers Training Corps programs.

- Army, Air Force, Navy, and Marine ROTC programs all offer scholarships.

- The Department of Veterans Affairs GI Bill offers education benefits for vets, their dependents, and widows.

- Children of Iraq and Afghanistan service vets who died in combat after September 11, 2001 qualify for multiple additional education benefits.

- Low-interest and no-interest educational loans are also available to military personnel and their families.

Education Tax Benefits

The IRS offers student expense relief in the form of tax credits. If a student is required to pay taxes, they may reduce the amount of their taxable income using these credits. The IRS also offers deductions on student loan interest and special savings accounts for educational expenses.

Aid for Foster Care Youth

Recommended Reading: Ashworth College Reputation

Federal Direct Subsidized Loans

These loans are subsidized by the government, which means that will not be required to pay interest on them while you are in school and for a grace period of six months after you graduate. Loan amounts that can be subsidized range from $3,500 to $12,500 per year, depending on your year in school and whether you are considered a dependent or independent student as defined by the office of Federal Student Aid. These subsidized loans are not available for graduate study.

How Is The Amount Of Aid You Get Determined

You need to file the FAFSA to figure out your eligibility for federal and college aid. The form takes about 30 minutes to complete and will require various financial documents, such as bank statements and tax returns.

The amount of money you can get depends on your financial need, which is determined by your college’s cost of attendance minus your Expected Family Contribution .

Your EFC is how much your family is expected to put toward your education in a given year, and you’ll get that number after you fill out the FAFSA. The EFC is calculated according to a formula established by the Federal Student Aid office and will take into account your family’s assets and income. If your need is great enough, you could theoretically get a federal aid package that covers the entire cost of your college, though that isn’t likely.

Popular Articles

Your college’s financial aid office will determine your financial aid package, which includes both federal and institutional assistance. Each state has its own process for distributing aid. Some only require the FAFSA to be completed, while others require separate applications to qualify.

The more financial need you have, the higher likelihood you have to qualify for more financial aid. Additionally, the earlier you file your FAFSA, the more likely it is you will be eligible for first-come, first-served aid like grants and scholarships. These forms of aid do not need to be paid back.

Recommended Reading: Are Summer Classes Worth It

Financial Aid Holds: What To Do If There Is A Financial Aid Delay

If you log into your student portals financial aid section and see that there is a hold on your financial aid, dont panic!

There are several possible reasons for this, and all of them have solutions.

First, make sure you are taking the correct amount of credits. Federal aid is only eligible for full-time students. If you arent taking enough credits, you will either need to forgo aid for the term, or rearrange and add to your schedule.

Another reason there may be a hold is unpaid balance on a previous bill. Go back through your student bills and make sure all balances are paid for you to be able to receive the new aid.