Average Monthly Payment For Student Loans

The average student loan debt for 2016 college graduates who borrowed to get through school was $37,172.

If a 2016 graduate took the standard repayment plan for the $37,172 borrowed 10 years, at 4.29% interest rate they would be paying $382 a month for the next decade. Experts estimate that you will need a starting salary of $47,000 to afford to pay off the loan if you remain single. If you marry, that number goes up to $52,000.

In all, you will pay $8,607 in interest and a total of $45,779 for the privilege of earning a college degree.

If $382 a month is too much and you decide to use one of the alternative repayment programs like Income-Based Repayment or Pay As You Earn to stretch payments out over 20 years, the monthly payment drops to $231. Unfortunately, that means that the interest you pay jumps from 122% to $18,262 and your total payback leaps to $55,434.

Those numbers go up or down based on how much you actually have to borrow to get through college, but with more than 30% of graduates leaving school with more than $30,000 in debt, its worth figuring out whether borrowing is the right direction to pay for college.

How Much Debt Does The Average College Graduate Have

The average college graduate has about $66,000 in debt when they graduate. This doesnt include the undergraduate debt, which takes the total to more than $71,000 in debt when everything is said and done.

Key Statistics:

- On average, graduate students leave college with $66,000 in student debt

- Only 36% of student borrowers, still current on their loan, had reduced their balance over the last 12 months of 2019.

- $71,000 was the average student loan debt for the class of 2015 – 2016.

- The average graduate student is looking at about $949 per month for their monthly loan payments.

- Graduates that obtain their masters degree usually leave school owing $64,800 in debt.

- Doctors who go for more specialized programs that last longer can owe around $183,200 in debt.

What This Means For Your Student Loans

Will your student loans get cancelled? There doesnt appear to be a clear path to wide-scale student loan forgiveness. While Biden could cancel everyones student loans, its less likely to happen. The Education Department has been focused instead on targeted student loan cancellation for specific student loan borrowers. Biden has now cancelled $11.5 billion of student loans this year. This include student loan cancellation for public servants, borrowers misled by their college or university, and borrowers with a total and permanent disability. The Education Department recently announced $2 billion of student loans will be cancelled within weeks. While more student debt will be forgiven, it likely wont happen before temporary student loan forbearance expires on January 31. Opponents of student loan forgiveness want policymakers to consider both the policy goals and impact of mass student loan forgiveness before any decision is made. As Washington debates the future of student loan forgiveness, the best thing you can do is have a strategy for student loan repayment. Understand all your options. Here are some popular ways to pay off student loans faster:

Read Also: How To Make Money Over The Summer College Student

Community College Transfer To Four Year Programs

Earning an associate degree in two years and then transferring to a four-year program could save students tens of thousands of dollars. Two-year schools are significantly less expensive, and they allow students the opportunity to complete nearly all degree prerequisites. Just 17% of community college students take out federal student loans, compared to 48% of students at four-year public institutions who use loans to finance their education.

The Donts Of Credit Cards

Overall, one can say that parents and college students have similar opinions regarding which credit card habits are the worst. For instance, 44.4% of parents and 40.3% of college students believed that missing a payment is the worst of all credit card habits. This slight difference between the two groups persisted for most of the categories presented, such as habitually paying late .

Aside from bad habit perceptions, actions speak more to the reality of which of these bad habits are actually practiced by both parents and students. Specifically, although more parent respondents believed that only making the minimum payment on their credit cards was a bigger deal than students did, the reality is that more parents have actually made this mistake. Specifically, 47.6% of parent respondents reported having only paid the minimum payment on their credit cards, while 44.7% of students did the same.

Also Check: How To Get College Discount On Apple Music

How Many College Students Are In Debt

Were here to help! First and foremost, SoFi Learn strives to be a beneficial resource to you as you navigate your financial journey.Read moreWe develop content that covers a variety of financial topics. Sometimes, that content may include information about products, features, or services that SoFi does not provide.We aim to break down complicated concepts, loop you in on the latest trends, and keep you up-to-date on the stuff you can use to help get your money right.Read less

American students and their parents continue to take out student loans to pay for their undergraduate and graduate degrees.

People who are attending college are paying for tuition, room and board, books, and other necessities by taking out student loans or using credit cards.

The Federal Reserve said in a report that over half of adults who are under the age of 30 took on some debt to pay for their education in 2019. The survey in the report showed that the typical amount of debt reported in the survey was between $20,000 and $24,999.

The good news was that most borrowers were current on their payments or had successfully paid off their loans, according to the Federal Reserve report.

About 45 million have taken out over $1.6 trillion in student loans to pay for their degrees.

One alarming trend is that 23% of people surveyed who had debt from taking college or university classes said they paid for classes and other expenses from a .

Q Is College Worth The Money Even If One Has To Borrow For It Or Is Borrowing For College A Mistake

A. It depends. On average, an associate degree or a bachelors degree pays off handsomely in the job market borrowing to earn a degree can make economic sense. Over the course of a career, the typical worker with a bachelors degree earns nearly $1 million more than an otherwise similar worker with just a high school diploma if both work fulltime, year-round from age 25. A similar worker with an associate degree earns $360,000 more than a high school grad. And individuals with college degrees experience lower unemployment rates and increased odds of moving up the economic ladder. The payoff is not so great for students who borrow and dont get a degree or those who pay a lot for a certificate or degree that employers dont value, a problem that has been particularly acute among for-profit schools. Indeed, the variation in outcomes across colleges and across individual academic programs within a college can be enormousso students should choose carefully.

You May Like: How Can I Sell My College Books

These Five Charts Show How Bad The Student Loan Debt Situation Is

One in five adult Americans carry student loan debt. The issue returned to the headlines this week, when Democratic presidential candidate Sen. Elizabeth Warren of Massachusetts proposed canceling this debt for more than 40 million Americans. Here’s a look at the landscape.

As many as 44.7 million Americans have student loan debt, according to a 2018 report by the Federal Reserve Bank of New York. The total amount of student loan debt is $1.47 trillion as of the end of 2018 more than credit cards or auto loans.

Most Americans with student debt are young. But adults 60 and older who either struggled to pay off their own loans or took on debt for their children or grandchildren are the fastest-growing age cohort among student loan borrowers.

Persis Yu, an attorney at the nonprofit National Consumer Law Center, said seniors are a sizable portion of the clients she sees. “The number of seniors with student loan debt has exploded,” Yu said. “We’re not just talking about kids and millennials. It impacts a large swath of our population.”

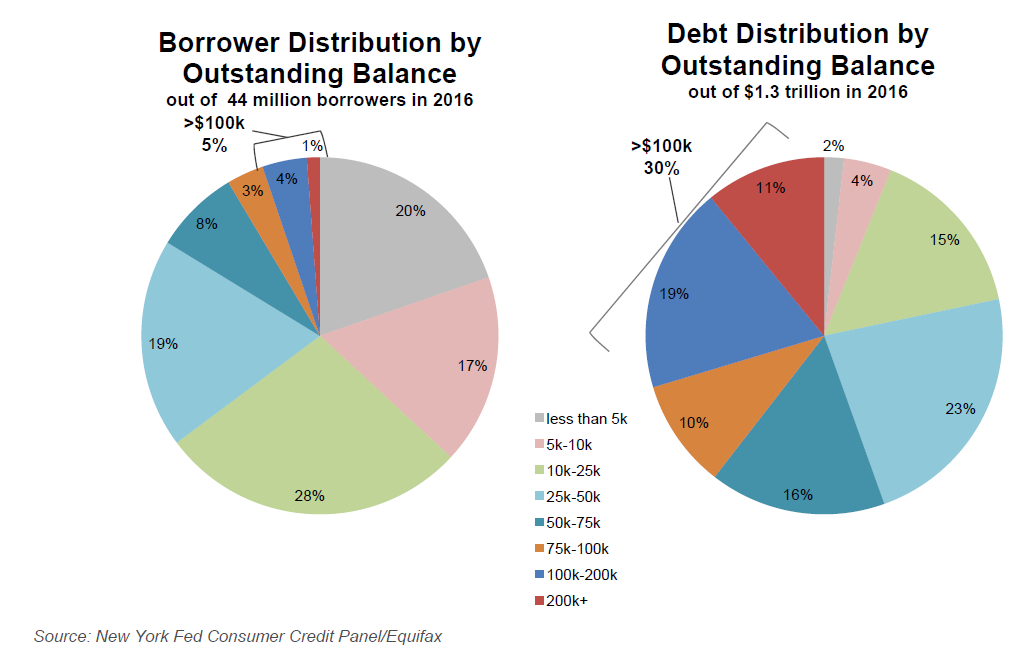

More than three out of four borrowers owe less than $50,000. The Warren proposal would wipe out the first $50,000 of debt of anyone with a household income below $100,000 a year.

Experts say that borrowers with low balances are the most likely to default.

Defaulting has serious consequences.

The Rising Cost Of College

Between 1988 and 2018, tuition rose more than 200% at four-year public colleges, and almost 130% at private nonprofit colleges.

There is a big difference, though, between the shockingly high sticker prices and the amount most students end up paying, after accounting for scholarships and grants.

If you look at Americas private colleges, and you dont look at the list price, you dont look at the sticker price in the catalog, but you look at the price the average student pays, the net price? Its barely budged since 1990, said David Feldman, co-author of the book Why Does College Cost So Much? and economics professor at the College of William and Mary. People just react in shock when I tell them that.

Where the price paid by the average student has gone up much more significantly is at public colleges, which most Americans attend.

Since the mid-1980s, the level of state appropriations for public higher education has fallen by about 30%, said Feldman, who described this as the driving engine of price increases to average families.

People often want to look at higher education in isolation, as though its some sort of a special case industry But its embedded in the American economy.

Recommended Reading: Getting Accepted Into College

Most People Dont Have Student Loans

Student loans are not as popular as headlines suggest. There are approximately 250 million adult Americans. Of this group, only 45 million people have student loans. That means approximately 80% of adult Americans dont have student loans, didnt go to college, or already paid them off. So, any plan to cancel student loans wouldnt directly benefit most Americans. Instead, student loan cancellation would be targeted at roughly 20% of the adult population. .

Student Debt Hits Middle Class Students Hard

Overall, we know that students from low-income backgrounds still face the greatest struggle when it comes to earning college degrees. Unstable home lives, lower-quality high schools and other frequent corollaries of low-income neighborhoods present plenty of obstacles even before loan debt becomes an issue.

For students from middle-class backgrounds, the road to a degree seems easier. Their families often have money saved their schools and support systems tend to prepare them well for the next step. Nevertheless, weve learned in the past year that middle-class students actually shoulder more student loan debt than anyone after graduating. According to Dartmouth sociology professor Jason Houles study,

Children from middle-income families make too much money to qualify for student aid packages, but they do not have the financial means to cover the costs of college The study found that students from families earning between $40,000 to $59,000 per year racked up 60 percent more debt than lower-income students and 280 percent more than their peers whose families earned between $100,000 and $149,000 per year. A similar trend held for more affluent middle-income families earning up to $99,000 annually.

Read Also: Study.com Transfer Credits

Rich Or Poor No One Is Immune To Money Problems

The essay by Noelle Schon is an illustration that money problems, like cancer, don’t care if you’re young or old, rich or poor. She grew up in a family that was financially well off, and her parents set up a college fund so her education would be paid for. But then Noelle’s parents split up when she was a teenager and she says her family spent the next seven years in a state of financial crisis while her parents sorted it out. They moved four times and her father lost his job.

Then, just as her mom was getting them financially back on track, a sick grandparent came to live with them. Noelle learned much sooner than other students how important money and a good economy are for the future and that you have to prepare for what happens if both of those things fall apart. Now a junior at Arizona State University, Noelle says she’s learned a lot from how her mom has navigated the family’s financial crisis. But she’s also considering changing her major to something more conducive to her family’s new reality. Something that would allow her more time at home to take a turn helping to care for her grandmother.

“I had no idea taking a semester off would affect my entire life,” Montoya says. “I just hope that other students can look at my story and maybe learn from it and make their lives as college students be a little bit easier.”

“You don’t have to continue that family tradition! You can break it.”

Student Loan Forgiveness Isnt The Best Stimulus

If there is wide-scale student loan forgiveness, student loan borrowers wont get any money. Rather, some or all of their student loans could be repaid. This is a transaction between the federal government and a student loan servicer. The borrower wont receive any money, so there is no direct stimulation. That said, if their student loans are paid off, borrowers would have extra monthly cash flow to spend or invest. Opponents also question whether direct stimulus checks would be a better use of $400 billion or $1 trillion of spending. Similarly, total credit card debt, total auto debt and total mortgage debt are each more than $1 trillion too. Should relief also be available to these borrowers?

Don’t Miss: Colleges That Accept Low Gpa Students

What Is The Current Debate

In a 2020 poll, less than half of millennials surveyed said taking out student loans was worth the cost, compared to two-thirds of baby boomers.

Many experts and policymakers argue that surging student debt is harming younger generations of students by preventing them from reaching their financial goals while exacerbating racial inequality. While older generations were generally able to pay their way through school, or find jobs that enabled them to pay off their debts, that no longer holds true for recent cohorts, they argue. The combination of soaring tuition costs and the recessions caused by the 2008 financial crisis and the COVID-19 pandemic have particularly affected the millennial and subsequent generations. In a 2020 poll, less than half of millennials surveyed said taking out student loans was worth the cost, compared to two-thirds of baby boomers.

However, other observers disagree about the extent of the challenge. The Urban Institutes Sandy Baum says that labeling the current borrowing and debt levels a crisis is misleading, because most individual borrowers are able to pay back their loans. According to Pew, about 20 percent of federal direct and FFEL loans are in default.

Percentage Of College Students That Are In Debt After College

70% of college students are still in debt after college. In 2020 the average graduate left school with around $30,000 in debt. In 2019 the average graduate left school with $29,900 in debt, and in 2018 the average graduate left school with $25,550 in debt.

Key Statistics:

- 70% of college students take out student loans

- 21% of 25 to 39 year old’s with at least a bachelors degree and outstanding student loans works more than one job.

- Only 27% of college graduates with student loans say they are living fine.

- Just 51% of millennials who graduate college with student loans think the benefits of their degree will outweigh its cost.

- In May of 2018 66% of graduates from public colleges had loans with an average debt of $25,550.

- In 2018 75% of graduates from private, nonprofit colleges had loans with an average debt of $32,300.

- 88% of graduates from for-profit colleges took out student loans in 2018 with an average debt of $39,950

- Almost half of student borrowers who go to for-profit colleges default on their student loan within 12 years.

- Only 12% of student borrowers that go to public college default on their student loan

- 14% of students that go to a non-profit college default on their student loan.

You May Like: What College Accepts The Lowest Gpa

What Is The History Of Us Student Lending Programs

The federal government began taking a large role in funding higher education after World War II. The Servicemens Readjustment Act of 1944, commonly known as the GI Bill, provided tuition assistance and many other benefits, including low-interest home loans, to nearly eight million returning veterans. The program continues to pay tuition for hundreds of thousands of servicemembers and veterans each year.

However, federal student lending did not begin until the Cold War. In response to the Soviet Unions launch of Sputnik in 1957, Congress passed the National Defense Education Act, sweeping legislation that created federally funded student loan programs and supported national securityrelated fields, including science, math, and foreign languages. In 1965, the Lyndon B. Johnson administration expanded federal involvement at all levels of education with the Higher Education Act , which laid the foundation for the current system of federal student lending. Since then, Congress has passed laws that expand loan eligibility and allow parents to borrow on behalf of their children.

The federal government also provides need-based aid in the form of Pell grants, which were established in 1972 and students do not have to repay. But funding levels for the program have not kept pace with the rising cost of college, resulting in more students turning to loans.