Fill Out The Free Application For Federal Student Aid

The important first step parents and students should take is to complete the FAFSA as soon as the application opens each year in October.

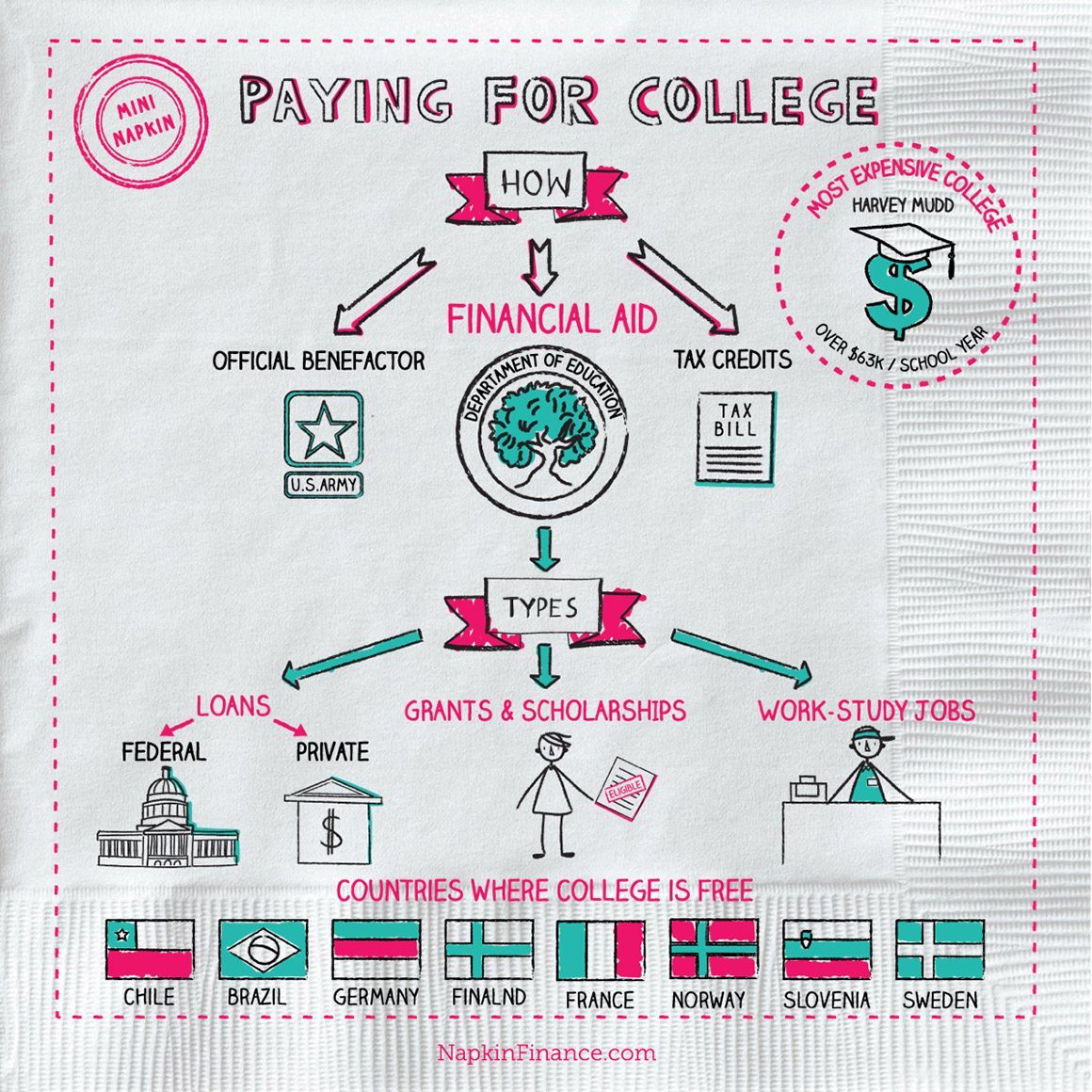

The FAFSA determines your eligibility for financial assistance and puts you in the running to receive financial aid including federal grants, work-study opportunities, student loans, and even state and school-based aid.

The form can be easily submitted online and, after completing the FAFSA, you have a better idea of your options on how to pay for collegeso its the perfect place to begin. Additionally, remember to fill out a FAFSA every year you are attending college to apply for continuing federal aid.

First How Much Does College Cost

The first step in understanding how to pay for college is having a good understanding of what your expenses will be.

For the 2014-2015 academic year, the average cost of tuition and fees for one year was:

- $31,231 at private colleges

- $9,139 for state residents at public colleges

- $22,958 for out-of-state residents at public colleges

This is the cost that people typically consider when they think of college expenses. Unfortunately, theres a lot more to the picture than just tuition costs – there are also hidden or implicit expenses associated with spending a year at college.

These other annual expenses include:

- Room and board – averages $11,188 at private colleges, $8,804 at public colleges

- College textbooks – average cost is about $1,200

- Travel costs – these will vary widely based on the student

- Lab fees and supplies – these will come to about $50 per class if they’re not already rolled into fees

- Personalexpenses – most students budget about $2,000/year to cover personal costs like toiletries and entertainment

Lumping together all of these expenses will give you a schools real sticker price – the Cost of Attendance. Its pretty easy to get an estimate of a schools CoA- just google cost of attendance.

Go To Community College First

All over America, including your hometown, we have these wonderful schools known as community colleges. And I love them. Want to know why? Because they allow people to get valuable college credits on their way to a degree at much cheaper rates than if theyd enrolled in a four-year school right out of high school. They can knock out the basics at a community college for two years, then transfer to a school that offers bachelors degrees for years three and four.

And while Im on the subject, let me deal with a myth I run into all the time. A lot of people seem to think doing their first two years at a community college will hurt them when they go to interview for jobs after graduation. The truth is that few employers even notice it when applicants only attended two years at the school they graduate from. The main thing theyre looking at is whether you have a degree, and after that, what you studied.

Also Check: How To Fix Your Gpa In College

Keep Track Of How You’re Using Student Loans

It’s certainly possible to use student loans to pay for college housing, but stay vigilant of how much of the loans you’re using for living expenses, since many of your loans will charge interest. Be just as careful about spending money via student loans as you would be about spending money on credit cards.

Even though credit card interest rates are typically higher than student loans, it’s still a slippery slope when it comes to racking up debt. Take a look at this scenario:

|

Expense |

|

|---|---|

|

$50,000 |

$200,000 |

If you had the cost of living covered by taking on a job, you’d have $120,000 to repay vs $200,000. Be vigilant about using loans to pay for living expenses and it may be helpful to write down what you’re using the funds for.

When you see scenarios of individuals with over $100,000 in student loans, living expenses are a big driver of this!

Attend A Work College

A work college is another way to get a free or substantially discounted college education. These schools, which are generally four-year liberal arts institutions, provide educational opportunities as well as valuable work experience.

Be aware that all students must participate in a comprehensive work-learning service for all four years of enrollment. In other words, all resident students have jobs. Often the jobs are located on campus, but off-campus jobs are also possible. Specific program details vary by college.

All participating work colleges are approved and supervised by the U.S. Department of Education and are required to meet specific federal standards.

Read Also: How To Get Into College At Age 12

Borrow Through The Federal Direct Loan Program

The Direct Loan, which is designed exclusively for students, is the safest loan to use and has built-in safety nets if you graduate without a well-paying job. Provided by the U.S. Department of Education, the Direct Loan is currently available in four options: Direct Subsidized Loans, Direct Unsubsidized Loans, Direct PLUS Loans, and Direct Consolidation Loans.

Direct Subsidized Loans

These loans are only available to undergraduate students with demonstrable financial aid . These loans do not accrue interest while students are in school or for the first sixth months after school is finished.

Direct Unsubsidized Loans

This loan type is available to eligible undergraduate, graduate, and professional students. Demonstrable financial need is not required to earn these loans, though the amount you borrow is determined by your cost of college attendance and the amount of financial aid youre currently receiving. Direct Unsubsidized Loans accrue interest the moment they take effect.

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

How is this page expert verified?

At Bankrate, we take the accuracy of our content seriously.

Expert verified means that our Financial Review Board thoroughly evaluated the article for accuracy and clarity. The Review Board comprises a panel of financial experts whose objective is to ensure that our content is always objective and balanced.

Their reviews hold us accountable for publishing high-quality and trustworthy content.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners. Here’s an explanation for how we make money

You May Like: What College Is Best For Computer Science

Ways To Pay For College: A Parents Guide

Paying for college has never been more expensive. It can quickly become overwhelming to calculate and, with the variety of schooling optionsand price pointsits difficult to plan ahead. Plus, everyones financial situation is different.

Attending college is no small financial decision for students and parents alike, but dont let the initial sticker shock stamp out you or your childs excitement over that coveted acceptance letter.

There are a myriad of scholarships, resources, funds, and financial aid options available for your child to achieve their higher education goals.

This article will discuss six ways to pay for college that are available to parents and their children.

How To Pay For College

College financial aid offices help students determine how they will pay for school. Because schools expect students to need financial help to pay for college, most schools offer free financial counseling services for current and prospective students.

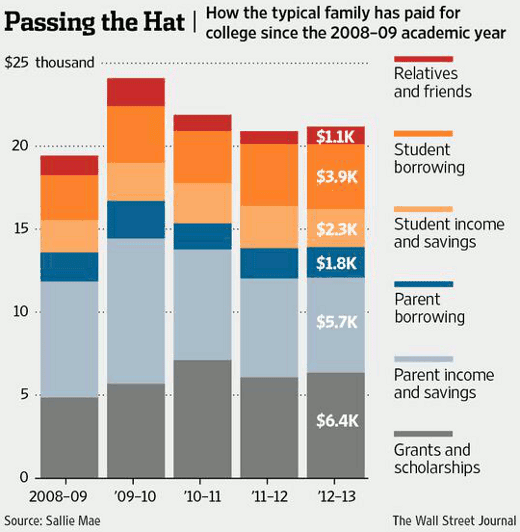

- 84% of students receive some form of financial aid.

- Scholarships and grants cover $7,500 of annual academic costs per student.

- For federal and state government aid, the average award per student is $13,100.

- Students who attend nonprofit private schools receive the most federal and state government aid.

- Parental support accounts for the greatest financial contribution to most students educations.

- Parental income and savings, parental borrowing, and college savings accounts cover over half of students educational expenses.

- Excluding college savings plans, $11,900 is roughly how much parents pay for one academic year of their childrens education.

- Long-term, high-yield savings accounts and property mortgages are common strategies parents use to pay for college education.

Also Check: What Are Good Jobs For College Students

How To Pay For College Without Student Loans

13 Min Read | Oct 31, 2022

Are you worried about how youre going to afford to send your kids to college? Youre in some very good company.

I talk with parents all the time who dream of providing their children with the best higher education possible. But with the cost of college rising every year, financial concerns usually dominate the conversation. And thats totally understandable. After all, look at these average price tags for yearly tuition and fees:

- Public two-year college for in-district students: $3,770

- Public four-year college for in-state students: $10,560

- Public four-year college for out-of-state students: $27,020

- Private four-year college: $37,6501

No matter which college route you choose, its expensive. And paying for it has become one of the biggest economic problems in America today. Do you compromise on the dream of helping your child go to college and maybe limit their future prospects? Or do you do the “normal” thing and take out student loans to ensure they have a shot at a great career?

Student Loan Rates Are Rising

Apply for a private student loan and lock in your rate before rates get any higher.

College must be paid for before you attend school or when you are attending. Paying college tuition on time is essential, as many colleges will not allow you to register for classes until your tuition has been paid and many colleges will drop you from courses if your tuition is late.

You May Like: What Is The Average College Tuition

We Put People And Communityfirst

Our editorial team does rigorous research and testing so you dont have to. We generate helpful, honest, and accurate information to match you with companies that are best for your specific situation so you can find what you need, when you need it.

We review hundreds of products and services, and often times the categories we cover are purchases that are important, complex or difficult to research. We hope the brands and experiences you choose will improve your life today, tomorrow, and for the future.

When Do I Start Applying For Scholarships

You can start applying for scholarships as early as your high school years, with many students beginning their scholarship search in their junior or senior year. Applying for scholarships should be a regular practice throughout your college education, too. Consider applying to scholarships after submitting your annual Free Application for Federal Student Aid completing a FAFSA can be an eligibility requirement for some scholarships.

Also Check: Does Ashworth College Credits Transfer

Attend A Community College With A Free Tuition Program

There are many community colleges that now offer free tuition programs Tennessee, Oregon, California, New York and Washington are all examples of states that have implemented some version of free community college.

For many states, you have to graduate from an in-state high school and enroll full time to qualify for the free tuition program. You may also have to commit to staying in the state for several years after graduation. Even though tuition will be free, you may still have to pay for textbooks, supplies and room and board.

Education Tax Benefits Living In Uk

The United Kingdom has some tax advantages for those who choose to pursue higher learning.

One example is the student loan repayment deduction.

This allows eligible taxpayers to deduct certain amounts they spend on qualified educational expenses from taxable income.

Qualified educational expenses include tuition, books, supplies, room and board, transportation costs, and miscellaneous items like parking passes.

Taxpayers must itemize deductions on Schedule A to claim these deductions. They also cannot use their standard deduction instead of claiming the deduction.

Another benefit is the Lifetime Learning Credit.

Eligible students can receive a credit equal to 100% of qualifying tuition paid over four years.

To qualify, students must enroll in courses leading toward a foundation degree or certificate program.

Courses taken solely for personal enrichment will not count towards eligibility.

Finally, the U.K. offers several types of tax breaks for graduate students. For instance, graduates can take advantage of the Graduate Entrepreneurship Allowance.

They can apply for this allowance once every three years beginning five years following graduation.

Graduates must meet two conditions: first, they must work less than 30 hours per week second, they must earn less than $30,000 annually.

Those who fail to meet either condition forfeit all GEA payments.

Recommended Reading: Is It Possible To Go To Two Colleges At Once

How Much Can You Borrow As A Graduate Student

The amount that you can borrow for graduate school generally depends on the loan most of our graduate student loans let you borrow from $1,000 up to 100% of the school-certified Cost of Attendance .2

The COA, generally listed in your financial aid award letter, is an estimate of what you’ll pay for the following costs: tuition and fees, room and board, books and supplies, and personal expenses.

Consider Going To Community College Or Trade School First

- Potential savings: Varies

You might want to consider going to a community college or trade school before attending a public university. For starters, you can take general education courses that will transfer over, allowing you to pay less for courses that you might take at a larger college. Also, trade schools typically cost less and take less time than a traditional four-year college degree.

Recommended Reading: Is There Scholarships For Community College

Loan Forgiveness Program Statistics

Every year, thousands of indebted borrowers become eligible for loan forgiveness but never apply. Some applicants submit a request for loan forgiveness multiple times before it is finally accepted. Additionally, acceptance rates vary by program.

- Over 3 million student loan borrowers are eligible or nearly eligible for student loan forgiveness.

- Just 6.7% of graduates eligible for loan forgiveness actually apply.

- 11% of applicants benefit from full or partial loan forgiveness.

- Some loan forgiveness programs have an acceptance rate of less than 1%.

- At one point, the PSLF program accepted 0.03% of applicants.

- In recent months, however, PSLF has decreased its rejection rate by 250%.

Get A Job To Pay For Living Expenses

There are a lot of good reasons to get a job while you’re in school. While your first priority should be your school work, it doesn’t mean you can’t also earn money when you’re not studying or attending classes.

While you probably won’t work 40 hours a week, even a part-time, on-campus job can help reduce the amount of loans you need to take out. A job can also improve your work ethic and time management skills for college and in your adult life.

Don’t Miss: When Does The New Semester Start For College

Paying For Study Abroad

When youre studying abroad, youve likely got your room and board covered by your grants, scholarships, or student loans that were already paying your tuition at your home school.

But once youve reached your destination, youre going to want to spend some time exploring. If youve built up a strong enough credit history, you can use travel rewards cards to fund your excursions whether youre taking a flight or booking a train.

How To Build Credit As A College Student

If youre a college student trying to build your credit history up from zero, there are usually two main paths available to you: get added as an authorized user on your parents card or get a secured card.

If your parent or anyone else adds you as an authorized user, make sure youre doing your part to pay for your own expenses. Its not just a jerk move to leave them holding the bill if they cant afford to pay it, this will negatively impact both your credit and their credit.

A secured card is like a credit card on training wheels. Instead of borrowing against the banks money, youll pay the bank a deposit. Say, $500. Then youll borrow against your own $500.

As long as youre making on-time payments every month and the bank reports your payments to the credit bureau, this tool can help you build a positive credit history. Eventually, you could get approved for a full-fledged credit card.

TIP: Credit cards arent the only way to build your credit. In fact, they shouldnt be the only way youre building your credit. Your credit mix is a big part of your credit score, and it requires both revolving debt like credit cards and term loans like car notes.

You May Like: What Is The Best College In Missouri

Incoming Students Need To Fill Out The Fafsa

The availability of different types of financial aid depends on a variety of factors, and application requirements vary. One critical step for incoming students is to fill out the FAFSAthe Free Application for Federal Student Aidat fafsa.gov. Filling out the FAFSA as early as possible lets families determine the types and amount of financial aid they are eligible for from the federal government. Colleges often have their own processes for determining financial aid, and private scholarships also have their own application processes. The FAFSA must be completed each year and is the foundation of critical sources of financial aid.

- StartHereGetThere.org provides tips and tools for completing the FAFSA.

Can You Pay University Fees Monthly

You should be allowed to pay the tuition fee in instalments, however you should double check this with your university. I say this because student finance usually pays the university in 2 equal instalments one around December/January and another around April/May/June.

Don’t Miss: How Many Credits Transfer From Community College To University